Broking powerhouse Aon has warned that the industry faces a multi-billion loss from the US tornadoes that struck at the weekend, but notes that at this stage it only anticipates a “limited portion” of the losses being ceded to reinsurance.Perhaps more notable though, is the fact that Aon highlights the top five severe convective storm loss events for comparison to the tornadoes, which range from a $3.9 billion insurance and reinsurance market loss, right up to almost $10 billion with the US Derecho from 2020 ($9.6bn adjusted).The calculation of losses from the severe convective storm and tornado outbreak is expected to take some time, given the wide area impacted.

Aon explained, “The widespread scope of the damage footprint from the severe thunderstorm outbreak on December 10- 11 will require a prolonged period of assessment to gain a full view of the event.“However, given the substantial nature of damage across a high volume of residential properties and some major commercial facilities, there is an expectation that the total economic loss will reach into the billions of dollars (USD).” Because most of the wind and any hail related damages are expected to be covered by insurance, Aon said it is expected, “there will be a multi-billion-dollar loss for the insurance industry.” Aon’s Impact Forecasting team went on to say that severe convective storms are an increasing source of loss for the insurance and reinsurance industry.“The severe convective storm (SCS) peril has become an increasingly expensive peril for the insurance industry, governmental agencies, and humanitarian aid groups.

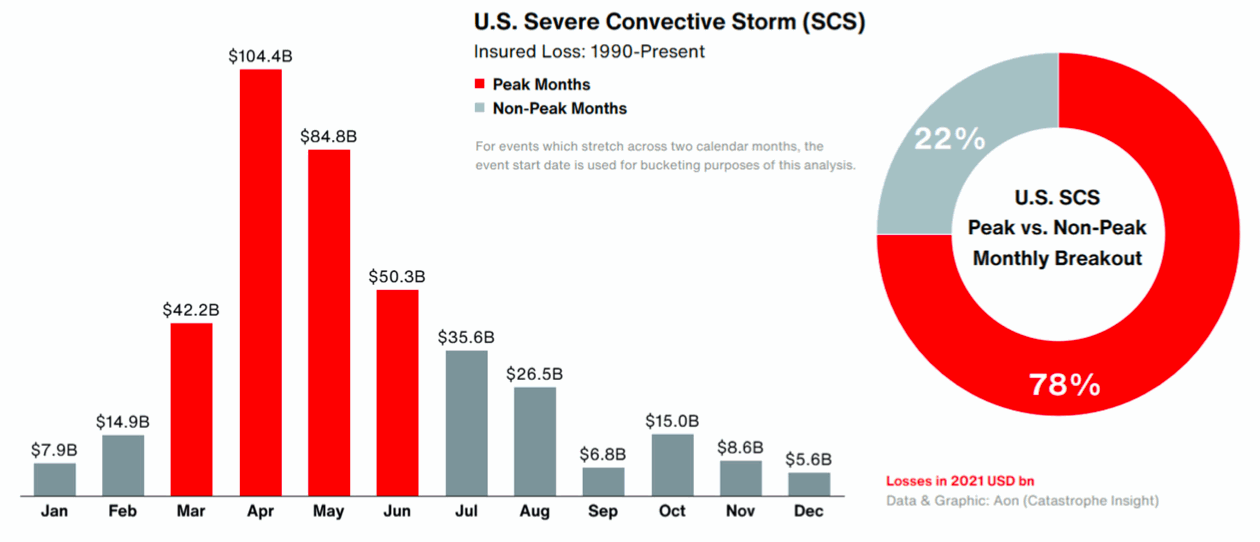

While peak SCS events tend to be much less expensive than the largest tropical cyclone or earthquake events, the annual aggregate of the SCS peril has become a dominant driver of industry payouts.The frequency of USD500 million or USD1 billion SCS events has notably grown in the past 10 to 15 years,” the company said.This specific December 10th and 11th 2021 convective storm and tornado loss event is now expected to become the first billion dollar December severe storm event, so the costliest such event on record for December.

“Nearly 80 percent of SCS insured losses since 1990 have occurred during the peak months of March, April, May, and June.However, if conditions are right, costly SCS events can occur at any time of year.Prior to the Dec 10-11, 2021 event, the month of December had been the quietest for the industry,” Aon said.

The broker also highlighted that since 1990, all severe convective storm losses in December only aggregate to $5.6 billion.Which means that this recent event could perhaps even eclipse all previous December severe convective storm losses with a single outbreak.Despite the clear severity and deadly nature of this tornado and convective storm event, Aon does not believe it will be a particularly significant event for reinsurance capital, at this stage.

“Despite the elevated expected loss for insurers, the total is likely to represent a manageable number for the overall industry,” the broker said.Adding that, “At this time, only a limited portion of the loss is expected to be ceded to reinsurance.” – – – – – ———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis