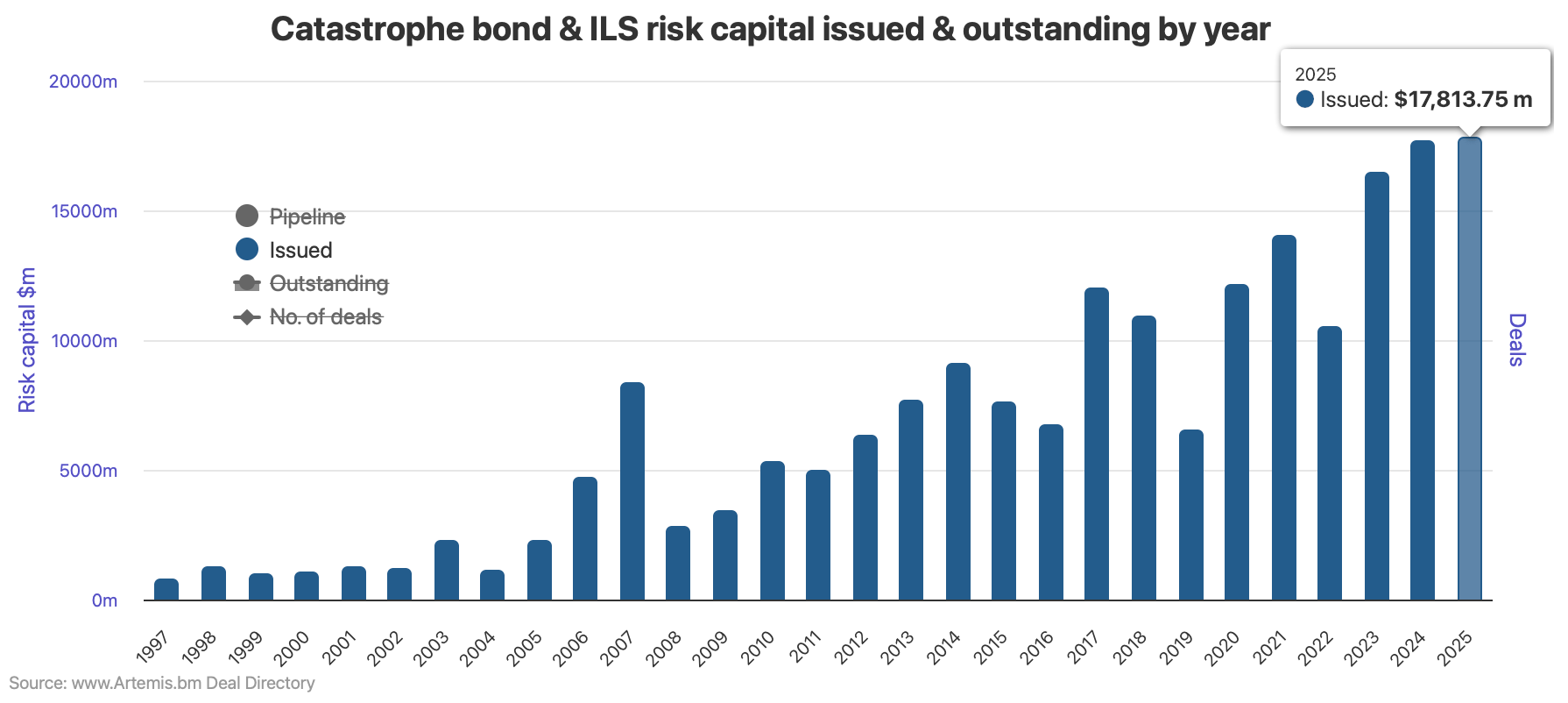

Catastrophe bond issuance has already beaten the headline annual record in 2025, as new deals have taken the figure to over $17.8 billion, beating last year’s record and putting the $20 billion milestone clearly in sight, according to .The record for annual catastrophe bond issuance, by Artemis’ data, fell at the start of July with the settlement of Ariel Re’s latest Titania cat bond deal.That took Artemis’ total for issuance across all Rule 144A catastrophe bonds and private cat bonds we’ve tracked in 2025 so far to just over $17.71 billion.Our total rose a little further with that we reported on yesterday, now standing at over $17.813 billion as of this week.

The previous cat bond annual issuance record was set in 2024 and stood at just over $17.69 billion.With a further $315 million of new cat bonds still in the market pipeline to settle soon, Artemis’ annual catastrophe bond issuance total for 2025 will reach $18.13 billion, or perhaps higher if the remaining deal yet to price upsizes, within just a couple of weeks.: , the annual record for 144A catastrophe bond issuance had already been broken just before the end of the first-half of the year, a notable milestone already.

But readers know that at Artemis we also track as many private catastrophe bonds as we can, which tends to make our headline annual issuance figure a little higher than are seen in broker reports.But now the annual record for total issuance tracked by Artemis has also been broken in 2025, with over $17.8 billion now the most cat bond and related private deal issuance activity we’ve recorded in our more than twenty-six years of tracking the insurance-linked securities (ILS) market.As of this time, the outstanding market for 144A catastrophe bonds and private deals stands at close to the $57 billion of risk capital level.

Impressively, risk capital outstanding in the cat bond market (by Artemis’ metric) has now increased by almost $7.5 billion, or around 15%, just since the end of 2024.These new record figures are testament to the hard work and discipline of the ILS and catastrophe bond community, in particular the investment managers, end-investors, sponsors, broker-dealers, risk modellers, law firms and raft of other service providers that help issuance flow smoothly and have contributed to this market’s success.We now look forward to seeing the $20 billion issuance milestone being reached for the first-time in the catastrophe bond market’s history.

It seems inevitable, with the only eventualities that could derail the cat bond market from achieving such heights this year likely a really meaningful market dislocation, or a series of major catastrophe loss events.It’s also impressive to note that the annual record for catastrophe bond issuance, of over $17.8 billion, has been set with so far .Last year’s record level of issuance was set by 95 cat bond transactions, which shows that not only is issuance rising but average deal sizes are too this year.

The average deal size for 2024 cat bond issuance stood at $190.26 million.But in 2025 so far, the average deal size has risen by a significant almost 27% to $240.73 million.Finally, you can also .

This chart shows that since the inception of the cat bond market Artemis has now tracked over $197.2 billion of transactions and this could surpass $200 billion before the end of 2025.For full details of second-quarter and first-half 2025 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.For copies of all our catastrophe bond market reports, ..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis