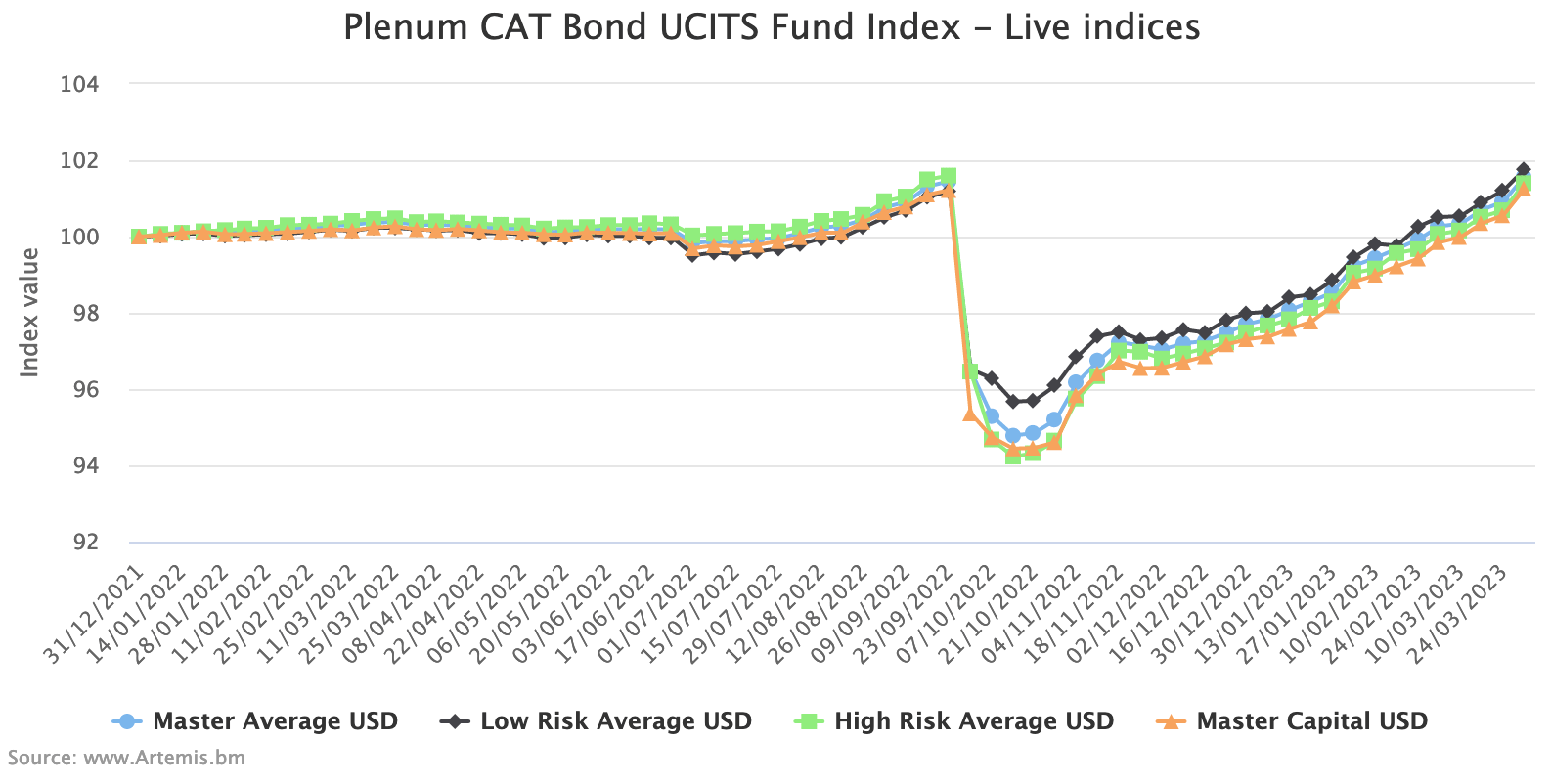

Catastrophe bond funds in the UCITS format have reported a record start to the year, delivering almost 4% in returns on average in the first-quarter of 2023, according to the latest data from the .The Master Average cat bond Index return reached 3.95% for the first-quarter of 2023, while the lower-risk UCITS cat bond funds averaged 3.85%, higher-risk 4.01% and the Master Capital Index return was 4.06%.It’s a very impressive start to the year for catastrophe bond fund returns, far eclipsing any previous first-quarter recorded by this UCITS cat bond fund index, which tracks cat bond fund performance data back to 2011.

As we , the lower-risk cohort of UCITS catastrophe bond funds had recovered back to a level last seen before hurricane Ian recently.Now, the Master Average and Master Capital Indices of UCITS cat bond funds has also achieved this, while the higher-risk cohort of cat bond fund strategies is very close to surpassing the level seen prior to hurricane Ian, a testament to the cat bond market recovery following that major insurance and reinsurance market loss event.Since hurricane Ian, which is really a half-year performance for these Indices, the Master Average UCITS cat bond fund Index has now returned 5.28%, while the Master Capital UCITS cat bond fund Index is now up by 6.19% since the end of September 2022.

That’s a very strong half-year performance for cat bond funds and while a significant proportion of this was from recoveries in value of positions that got heavily marked down after hurricane Ian, on a go-forward basis the higher spreads of new issues should begin to deliver an equally impressive return for the months to come.Overall, the are now back at an all-time high, having recovered back to the levels last seen prior to Ian.Over a rolling-12 months period to the end of Q1 2023, the Master Average UCITS cat bond fund Index is now up 1.26%, but it is the lower-risk UCITS cat bond fund strategies that have performed the best, with that Index up an impressive 1.57% for the last 12-months, despite the spread widening seen in 2022 and the impact of hurricane Ian.

A very impressive performance.As we also reported recently, .These , calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a useful source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum..Get a ticket soon to ensure you can attend.

Publisher: Artemis