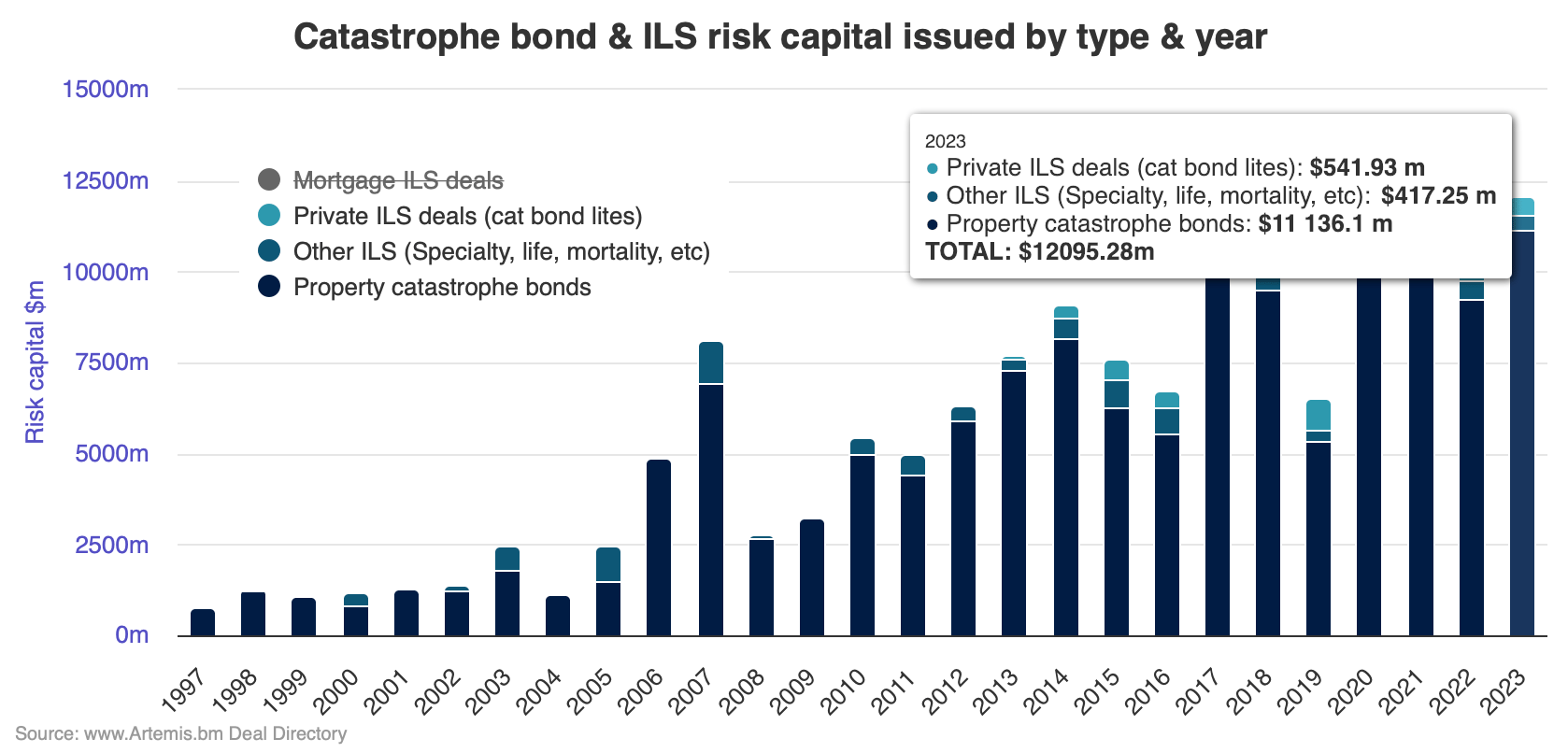

According to Artemis’ data, which tracks issuances of catastrophe bonds and related insurance-linked securities, overall issuance year-to-date has already reached $12.5 billion, while issuance of Rule 144A property cat bonds alone is now above $11.5 billion in 2023.With another $400 million of notes from the North Carolina Farm Bureau’s Blue Ridge Re 2023-1 cat bond having settled this week, which have now been incorporated into , we can say that 2023 is already officially the second most active year ever for the cat bond market.Full-year 2021, when the record was set, saw $12.5 billion of property cat bonds issued and just under $14 billion of issuance across the deals we track, which are 144A property cat bonds, 144A catastrophe bonds that cover other lines of business (life, specialty etc), and private cat bonds with secondary transferability features.

2023 is well on-track to eclipse those figures and set a new annual issuance record, .In fact, our forecast for full-year issuance has risen since that article, thanks to .Including that new Mystic Re IV deal, our full-year 2023 projection based on all issuances closing at the sizes they are today (remember, it will likely rise as no doubt at least a handful will upsize), would be almost $14.9 billion for cat bonds and the related issuances, or an impressive almost $13.8 billion for 144A property cat bonds alone.

With some upsizing, there is every chance we eclipse $15 billion across the three types of deals and $14 billion for property catastrophe bonds only, setting a new higher bar and helping to expand the market even further this year.You can analyse issuance by year and type of transaction using this chart ( or on the image below for an interactive version where you can use the key to include, or exclude, types of deals): as we move through the final weeks of the year for as it prices and settles, as well as news on any new cat bonds that come to light, which could raise these forecasts for year-end totals even higher.The lists all catastrophe bond and related transactions completed since the market’s first deal in the late 1990’s.

The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list..We track , the most prolific sponsors in the market, most active , which risk modellers feature in cat bonds most frequently, plus much .

, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.All of these are updated as soon as a new cat bond issuance is completed, or as older issuances mature..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis