One of the imperatives for growth of the catastrophe bond market has always been the onboarding of new first time cat bond sponsors into the market and Artemis’ data indicates over 40 have been added to in just over three years.Right now there are ., detailing the dollar value across their outstanding cat bond issues, as well as the number of issues and tranches included.This leaderboard has expanded considerably over the last few years, as .

We took a look back at how the sponsor-base of the catastrophe bond market has grown and can see that in the fourth-quarter of 2021 we had just 70 named sponsors listed.As a few new sponsors came to the market in that quarter as well, it suggests the sponsor-base actually grew by more than 40 over the following period, which means the catastrophe bond sponsor-base has expanded by an impressive 57% in just over three years.Over that period, .

The number of names in our catastrophe bond sponsor leaderboard was lower at just over 60 around the middle of 2020, but had stood at 68 around the middle of 2019.Calendar years 2021 through 2024 actually saw 51 first time cat bond sponsors come to market during that period, but a number have seen their first deals mature without any renewal or further issuances, so far.This period and the new sponsors that have been brought to the cat bond market for the first time has been a critical factor in the growth we’ve seen in .

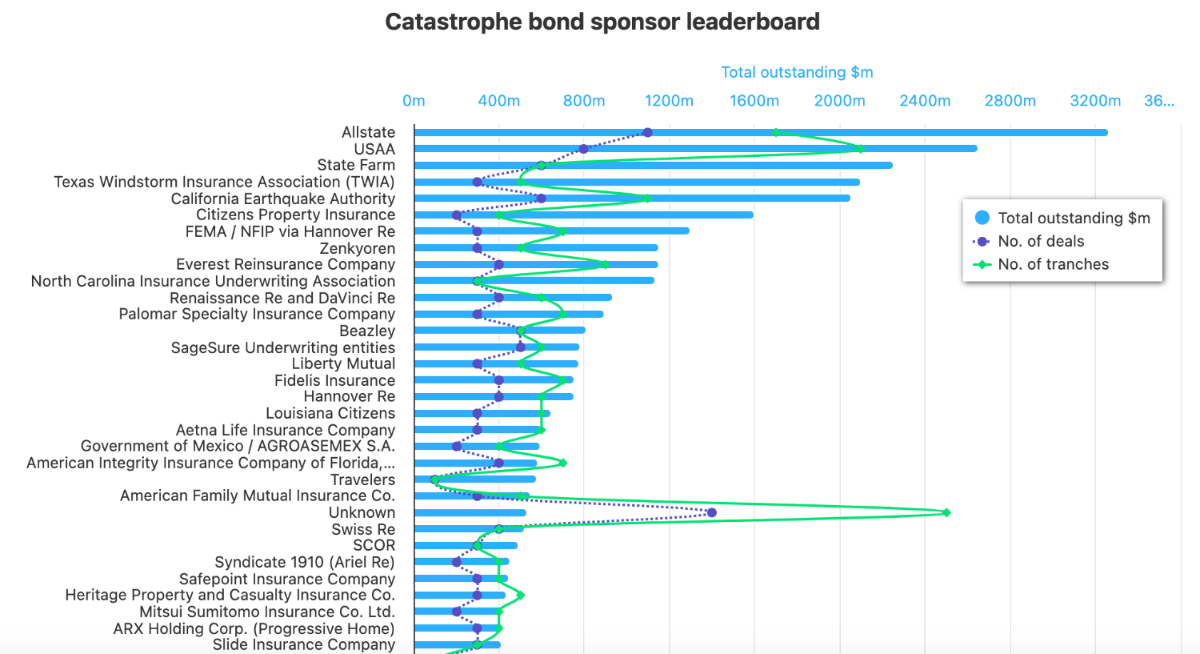

Of course, alongside these new and first time cat bond sponsors, the repeat sponsors that bring new cat bonds to market regularly, renewing the reinsurance coverage they provide in most cases, are of course a key driver for market growth alongside the introduction of new firms.With these long-standing and repeat catastrophe bond sponsors in mind, it is no surprise that the top names in our cat bond sponsor leaderboard are all prolific buyers of cat bond protection (click the image below to see ).Topping at this time is US insurer Allstate, with just over $3.26 billion of risk capital across its outstanding Sanders Re catastrophe bonds.

Second in our list is USAA with $2.65 billion of Residential Re deals outstanding and third State Farm with $2.25 billion of Merna Re cat bonds.In fourth is the Texas Windstorm Association (TWIA) with $2.1 billion of Alamo Re cat bonds, followed by the California Earthquake Authority (CEA) with $2.055 billion of Ursa Re and Sutter Re issuance.The CEA is likely to jump higher up the list soon, as it has in the market at this time.

is a great way to stay up to date on who the most prolific sponsors of cat bonds are, as well as the increasing depth of the market and its sponsor-base.The growth in the cat bond sponsor-base is testament to the increasing acceptance of cat bonds as an alternative sources of risk transfer and reinsurance capital, as well as the work of the broking and ILS manager communities in promoting catastrophe bonds to insurers, reinsurers and other sponsor types..

We track , the most prolific sponsors in the market, most active , which risk modellers feature in cat bonds most frequently, plus much ., or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.All of these are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis