Property catastrophe reinsurance rates and pricing rose by 10.8% year-on-year at the January 2022 reinsurance renewals, which broker Guy Carpenter explained saw a market that bifurcated between loss-affected and non-loss affected programs.Overall, the January 2022 reinsurance renewals saw a “healthy but bifurcated” market, with reinsurers responding to the challenges posed throughout the year and by loss activity.Guy Carpenter explained today that reinsurers have been seen to adjust their risk appetite and pricing thresholds for certain parts of the market, in response to the challenges faced.

However, the broker said that reinsurance placements were generally orderly, once terms were issued and market participants “effectively traded” through a dynamic environment.However, the lateness of the renewals cannot be avoided and Guy Carpenter said some are as much as fourteen days late, in terms of how much they have lagged behind what is more typical.“The changing nature of risk fundamentally influences reinsurers’ view of pricing and capacity allocations,” Dean Klisura, President and CEO, Guy Carpenter explained.

“It is clear from the January 1 renewals that strategies are adjusting to account for these factors.Cedents’ views, supported by portfolio data, will continue to drive renewal outcomes.This emerging reality further emphasizes the critical nature of our advisory role.

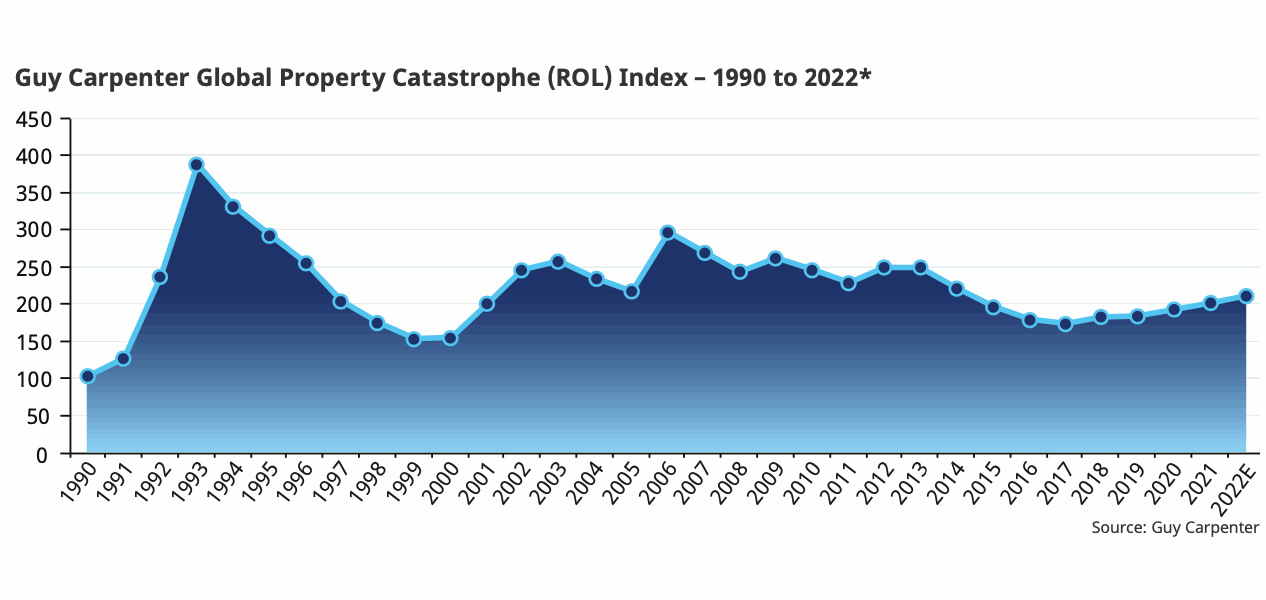

We will continue working closely with our clients to help them manage this shifting environment effectively.” Of particular note for insurance-linked securities (ILS) markets, is the fact property catastrophe reinsurance rates were seen to rise significantly at the January renewal season.Guy Carpenter has recorded a 10.8% year-on-year rise in global property catastrophe rates, according to its , as seen below.That’s more than double the 4.5% increase reported at the January reinsurance renewals a year ago, reflecting steeper increases now achieved in Europe this year, which make up a significant contributor to this Index at the January 1st renewals.

It is .The broker explained that, where rates and pricing moved higher in property catastrophe reinsurance risks, structure adjustments, especially on retentions, were most prevalent in the heavier loss-impacted sectors.In fact, while pricing movements spanned a wide range, on a risk-adjusted basis, non-loss-impacted property reinsurance renewals were generally flat to up 7%, while loss-impacted rose by between 10% to more than 30%.

For those reinsurance markets able to capitalise on this, including ILS funds, the opportunity to construct more performant portfolios of catastrophe reinsurance is clear, putting some in a position to deliver enhanced returns, or to have dialled down the risk level in their funds and structures.David Priebe, Chairman, Guy Carpenter, commented on the renewal outcome, saying, “The reinsurance market is evaluating a broad spectrum of forces, including climate change, cyber threats, core inflation, social inflation, and the continued evolution of frequency and severity of catastrophe losses.While reinsurers reassessed underwriting strategies, resulting in a late and varied price discovery process, outcomes were successful, and Guy Carpenter was able to support its clients in what has proved to be a very dynamic marketplace.” Guy Carpenter further explained that there was ample capacity in the global property reinsurance market to complete programs, but market appetite was greater for non-loss-impacted upper layers of towers.

Capacity was seen to be more constrained for the lower layers of reinsurance towers, as well as for structures such as aggregates, multi-year and per risk, particularly if loss impacted.In retrocession, Guy Carpenter said that capacity was also constrained for renewals, as well as frequency exposed contracts.Reinsurers and ILS funds continue to differentiate strongly based on performance and the bifurcation of renewal pricing based on losses and profitability is a prudent way to deal with recent market challenges.

It’s likely to continue at future renewals and we expect similar market conditions may prevail through much of 2022, absent a major influx of new capital to dampen pricing.———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis