Munich Re has renewed its retrocessional reinsurance program arrangements to provide $1.55 billion in protection for 2025, utilising both traditional retro and capital markets through its sidecars and catastrophe bonds at a stable level with the prior year.Munich Re’s collateralised reinsurance sidecar structures have been renewed at $650 million in size for 2025, the reinsurance firm said today.That is the same volume of capital raised for .

The company said that the sidecar program features, “Quota share cessions of certain lines of business collateralised by US$ 650m in 2025.” As we’d reported in January, .In addition, as we reported last October, investor PGGM had .The target allocation range for Munich Re’s Leo Re sidecar vehicle, for the PGGM managed allocation for pension PFZW, was doubled to between EUR 500 million and EUR 1 billion, suggesting this vehicle remains the key source of quota share based retrocession partner capital for the reinsurer now.

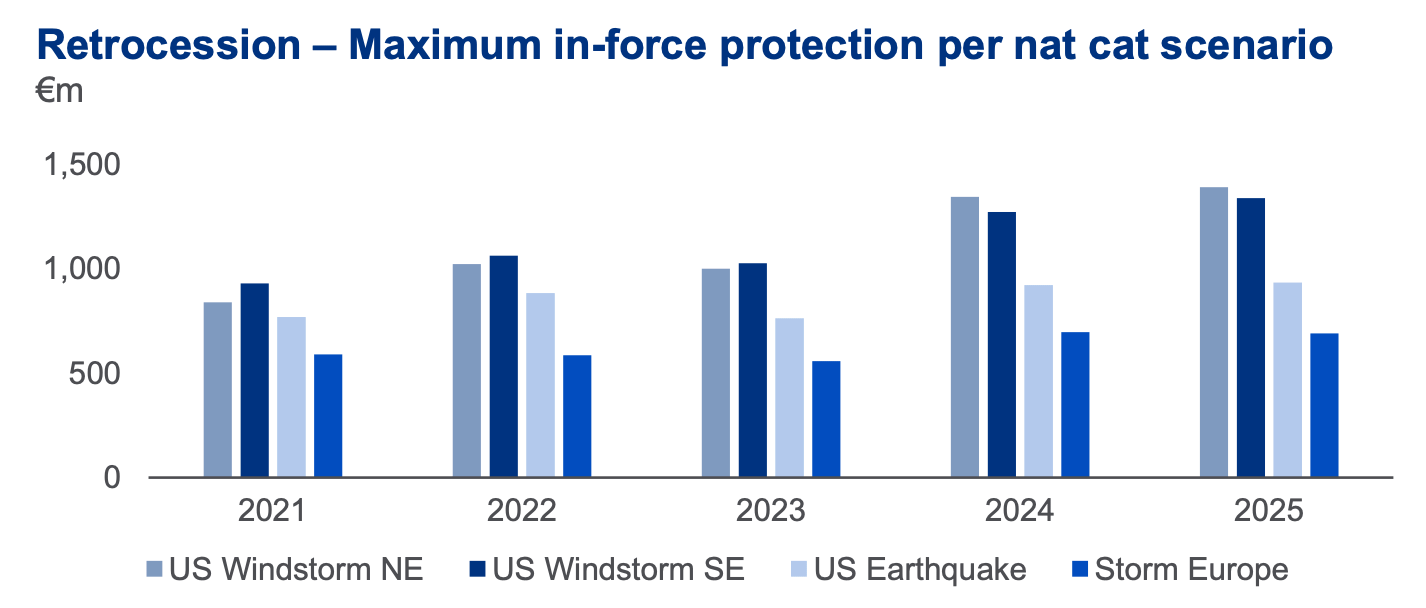

The company also reported that its traditional retrocession placement continued to benefit from a “favourable marketplace,” with $600 million in force still for 2025 (the same as last year) and Munich Re said it was “diligently balancing price and placement volume.” As well as the sidecars and retrocession, Munich Re also benefits from retrocessional natural catastrophe protection from the $300 million catastrophe bond issuance that it sponsored in 2023 and provides US hurricane retro.Last year, the reinsurer noted how it had managed its PML for US hurricane risk with the help of its retrocession program.This year, Munich Re highlights another peak peril, California earthquake risk, with an exposure decrease reinforced by increased external retrocession.

You can see how Munich Re’s retro protection for peak perils has evolved below: Munich Re said that the multi-format retro programme provides it with “material scalability and access to rated-paper capacity, as well as multiple and diverse investment buckets.” The company also uses industry-loss warrants (ILWs) for hurricane risk and has risk swaps in its retro program, as well as indemnity retro, sidecars and cat bonds.Ultimately, the Munich Re retro program has been helping the company manage its PML’s as it has been growing through the harder market years.The retro program is now larger than it was in 2023 and prior, but the stability year-on-year also shows Munich Re’s desire to ensure it is extracting as much profit from its underwriting business while conditions are still attractive to do so..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis