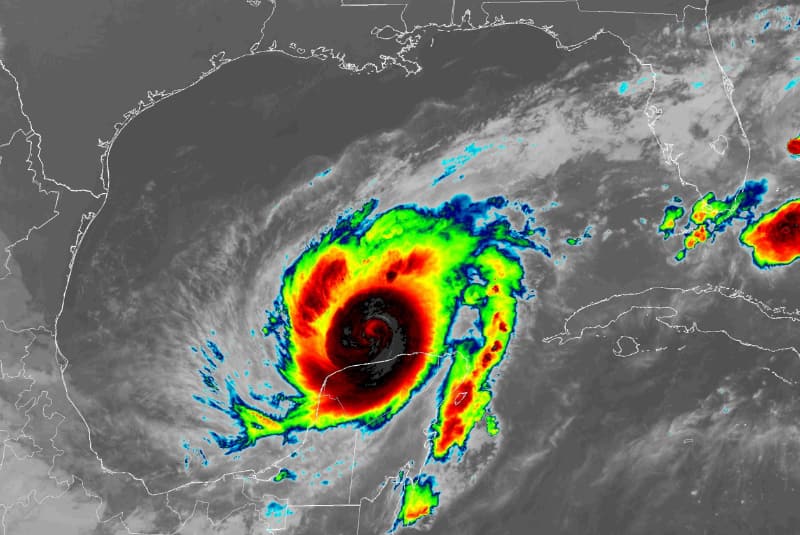

If hurricane Milton remains locked onto the Tampa Bay area for landfall, then it could be a huge test for the entire insurance and reinsurance market, according to analysts at Evercore ISI.A huge test for insurance and reinsurance markets would likely be equally testing for insurance-linked securities (ILS), given a share of reinsured losses and any retrocessional claims would almost certainly have ramifications for catastrophe bonds and other ILS instruments., hurricane Milton remains on course for a landfall on the west coast of the Florida Peninsula some time late on Wednesday.Hurricane Milton remains a major hurricane, at Category 4, with sustained wind speeds of 155 mph and a central pressure of 924mb.

and so projections for a potentially meaningful loss event remain in play.Commenting on the storm yesterday, analysts at Evercore ISI explained on Milton, “The storm is a turn of events following a generally lower than expected Hurricane season and has the potential to be a major insurance loss event.” They continue, “Reinsurers are more at risk and will likely retain 1-2% of insured losses with RNR having a larger share if the storm losses are more severe even with the incremental retro coverage.Despite retro purchases, RNR shaped its book more towards higher layer risks which has the potential to be impacted as Hurricane Milton approaches.

“ACGL did not grow its exposure at midyear and had a 1:250 PML at ~7% of equity at 7/1 ($1.4b).We think EG wrote more lower layer risk as it indicated it had prop cat rates up at 6/1 which we believe implies it moved down the towers as risk adjusted rates were down -5%.EG’s net 1:250 PML was ~11.5% of equity ($1.7b) after it grew the most at 6/1 among our coverage.” Bottom line, the Evercore ISI analysts state, “A category 4 into Tampa Bay is a huge test for the entire (re)insurance market after reunderwriting over the last few years, with RNR, EG and ACGL likely to be most impacted among our coverage.” But they also add that, “While Hurricane Milton is a negative, we think the offshoot of this is potentially less negative or even positive property cat rates at 1/1 depending on how much damage the storm causes.

It also could help instill more discipline into the primary market where property rate increases are moderating.” Reflecting this extreme test, reinsurance company share prices tumbled yesterday with some Bermudians like RenaissanceRe falling close to 10%.Some analysts now suggest a historic buying opportunity for those brave enough to buy in while Milton approaches landfall, while estimating that the share price decline seen could indicate the market expects an industry loss of above $50 billion.– .

– .– .– .

– .– .– ..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis