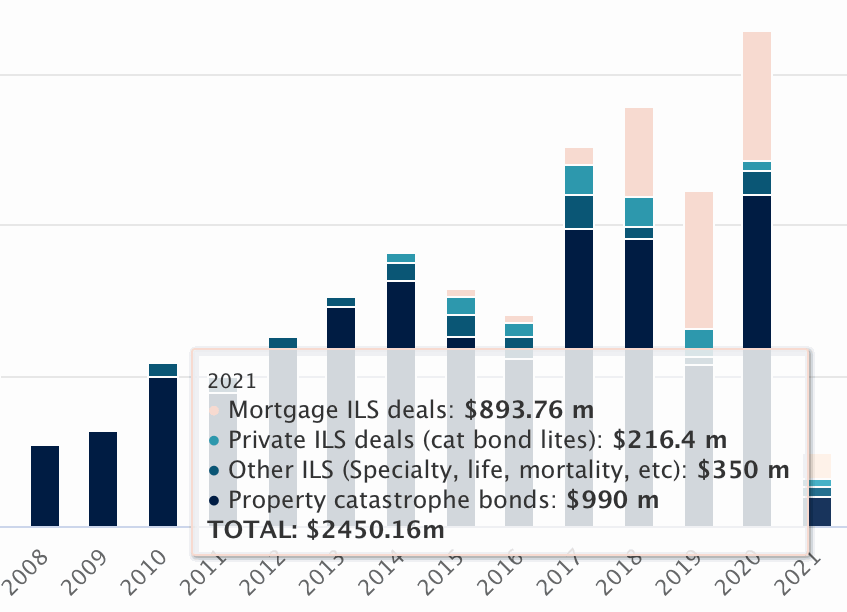

Catastrophe bond and related insurance-linked securities (ILS) issuance has already surpassed the ten-year average for the first-quarter in 2021, with total issuance recorded in the now at almost $2.5 billion.The ten-year average for first-quarter issuance of cat bonds and related ILS deals tracked within our Deal Directory is just slightly over $2.4 billion.With the completion of the California Earthquake Authority’s (CEA) latest catastrophe bond this week, the total for first-quarter 2021 issuance has already passed that and is nearing on $2.5 billion.

There are still five new catastrophe bond issues in the market, all of which are currently slated to be first-quarter deals.At the moment, the target for these five new cat bond deals totals another $750 million of risk capital issues, which suggests we should see a Q1 issuance figure of at least $3.25 billion.Of course more new cat bonds could hit the market stretching the total even higher by the end of March.

Although it should also be noted that, if any of these cat bonds take a little longer than expected to place, they could potentially fall into Q2.These figures include every deal tracked so far in 2021 within our , the most extensive publicly available source of information on catastrophe bonds and other similar insurance-linked securities (ILS).As a result, it includes the 144A property catastrophe bonds, private cat bonds, cat bonds covering other lines of business (financial guarantee and health risks), as well as mortgage insurance-linked securities (ILS) deals.

You can break the total down and At the moment, pure property catastrophe bonds structured as 144A issuances make up almost $1 billion of the first-quarter issuance, a figure that currently looks set to rise to almost $1.75 billion if the remaining five deals all close within the period.The next largest chunk of Q1 2021 ILS deals we’ve tracked are the mortgage ILS, at almost $894 million, followed by other cat bond structured ILS covering health and financial guarantee risks at $350 million, and finally the private cat bonds or cat bond lites at just over $216 million..

According to , the 10-year average for Q1 property cat bond issuance is $1.85 billion and if you include private property cat bonds it reaches almost $1.95 billion.So that suggests that in order for Q1 2021 to surpass the 10-year average for property catastrophe bond issuance, we will need to see some upsizing of .At this stage of the quarter .

By the end of Q1 2021 though, this should return to outright growth, although that may not be held for long as there are a significant amount of maturities due in the second-quarter of this year.In fact, there is a huge $5.2 billion of maturing cat bonds and ILS set to roll out of the market in Q2 2021, meaning the pace of issuance is going to have to approach record levels to sustain outstanding market growth.As we explained yesterday, .

But it will need a number of other large issuers to come back to market if market growth is to keep pace, especially in the pure property cat bond segment.Stay tuned to Artemis for all the and details of related ILS transactions that come to market, as well as news and data on other ILS market structures, including reinsurance sidecars.You can view information on every catastrophe bond issued so far in 2021 and all prior years, totalling more than 700 issues, in the .

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the , designed to be a simple and effective tool providing key on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis