We’ve published this article as our earlier piece on UCITS catastrophe bond fund performance was incorrect, there was an error in the data we had received.Based on new data, the average return of UCITS cat bond funds tracked by the was flat at the first pricing in May, but April was a positive month extending return-gains made so far this year.According to the , the average return across the group of UCITS cat bond funds for the period of April 4th up to and including pricing on May 2nd, was a positive 0.28%.

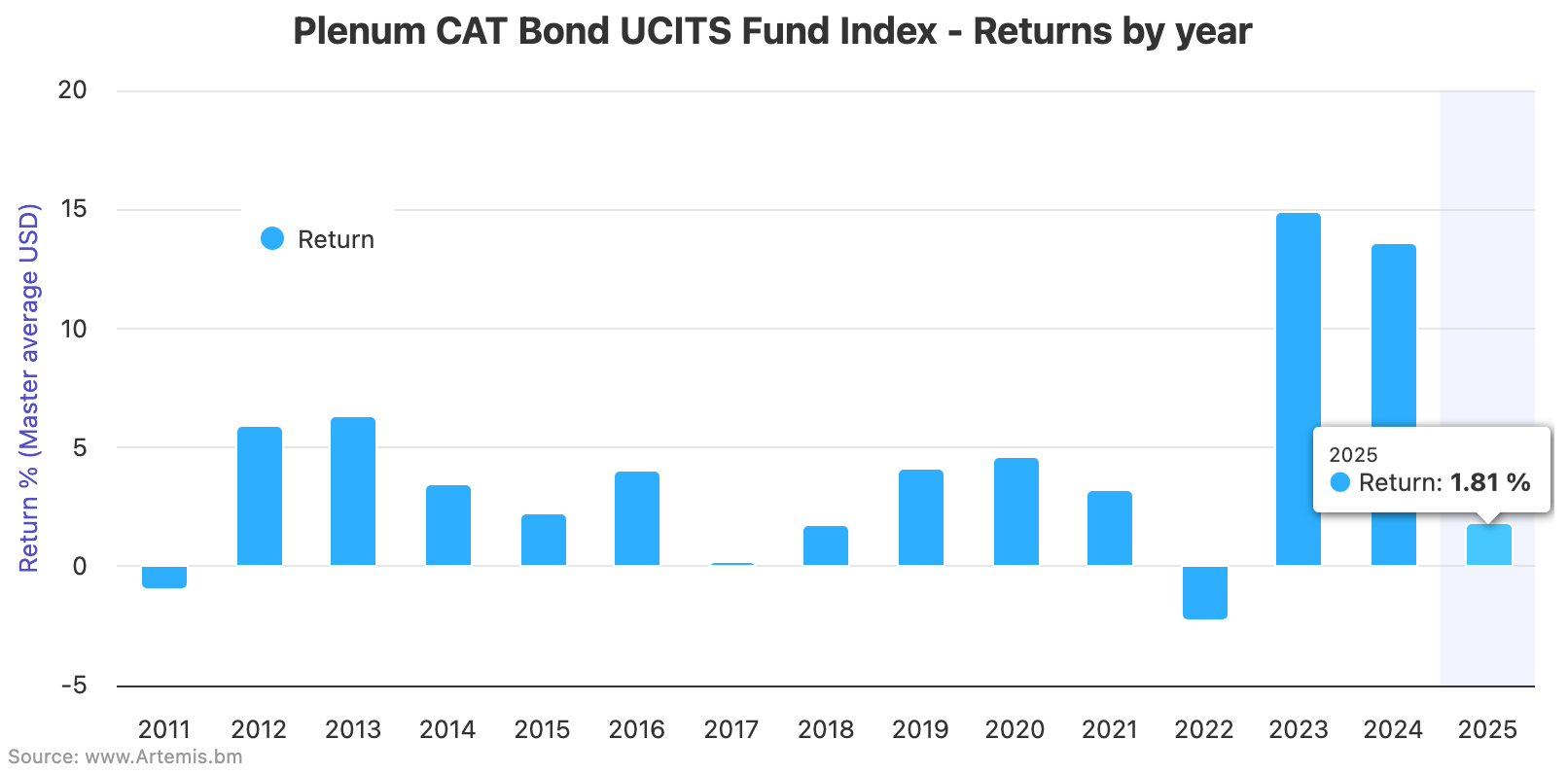

Gains were made through each week in April but it was that last pricing date, of May 2nd, that saw the market affected by loss-related price impacts, with mark-downs to a number of positions, which drove a flat 0.00% average performance for that week across the UCITS cat bond fund group.2025 had started with UCITS cat bond funds as the initial effects of the LA wildfire affected certain cat bond’s pricing, after which performance dropped to an average 0.32% return for the month of February, and then the month of .Adding on the April 4th to May 2nd performance of a 0.28% positive return, takes the average across UCITS catastrophe bond fund strategies to a return of 1.81% for 2025 up to and including that first pricing date in May.

Across the April 4th to May 2nd 2025 period, the lower-risk cohort of UCITS cat bond funds were up 0.26%, while the higher-risk cohort were up by 0.29%.Year-to-date though, it is the lower-risk UCITS cat bond funds that have performed a little better, at a 1.88% return across the group.While higher-risk cat bond strategies in the UCITS format returned 1.74% year-to-date.

On a trailing 12-month basis catastrophe bond fund returns remain very attractive and have demonstrated the asset classes resilience to a number of relatively major catastrophes.The average return for the UCITS cat bond funds for the last 12-months is now 11.18% as of May 2nd 2025, with the lower-risk funds running at a 10.82% return and the higher-risk strategies performing better at 11.44%.Remember that within that 12-month period are events from the 2024 hurricane season, as well as the January 2025 California wildfires and a succession of severe weather events that have impacted certain aggregate positions.

Which makes the rolling 12-month performance particularly impressive at this time.As we also reported recently, ..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis