After hurricane Milton skirted the northern Yucatan peninsula of Mexico without making a landfall it is now presumed that the $125 million Class C notes of the catastrophe bond are safe and will not suffer a loss.As hurricane Milton rapidly intensified last night its sustained winds reached 180 mph and its minimum central pressure dipped to 897 mb.At that very low central pressure, which is the second lowest ever recorded in the Atlantic basin after 2005’s Wilma, had hurricane Milton made landfall on the northern Yucatan it would certainly have triggered these catastrophe bond notes.

In fact, we believe that a minimum central pressure of close to that low level would have triggered a 100% loss of principal to the IBRD Mexico Class C notes that are exposed to Atlantic hurricanes on a parametric trigger basis., the $125 million of Class C Mexico IBRD Atlantic hurricane catastrophe bond notes feature a parametric trigger design that requires a storm at or below a certain central pressure to cross into the parametric arrangement for a payout to the Mexican Government to come due.In this case, hurricane Milton tracked roughly east and skirted the Yucatan by only tens of miles, which appears to have avoided a triggering situation for the IBRC Mexico cat bond notes.

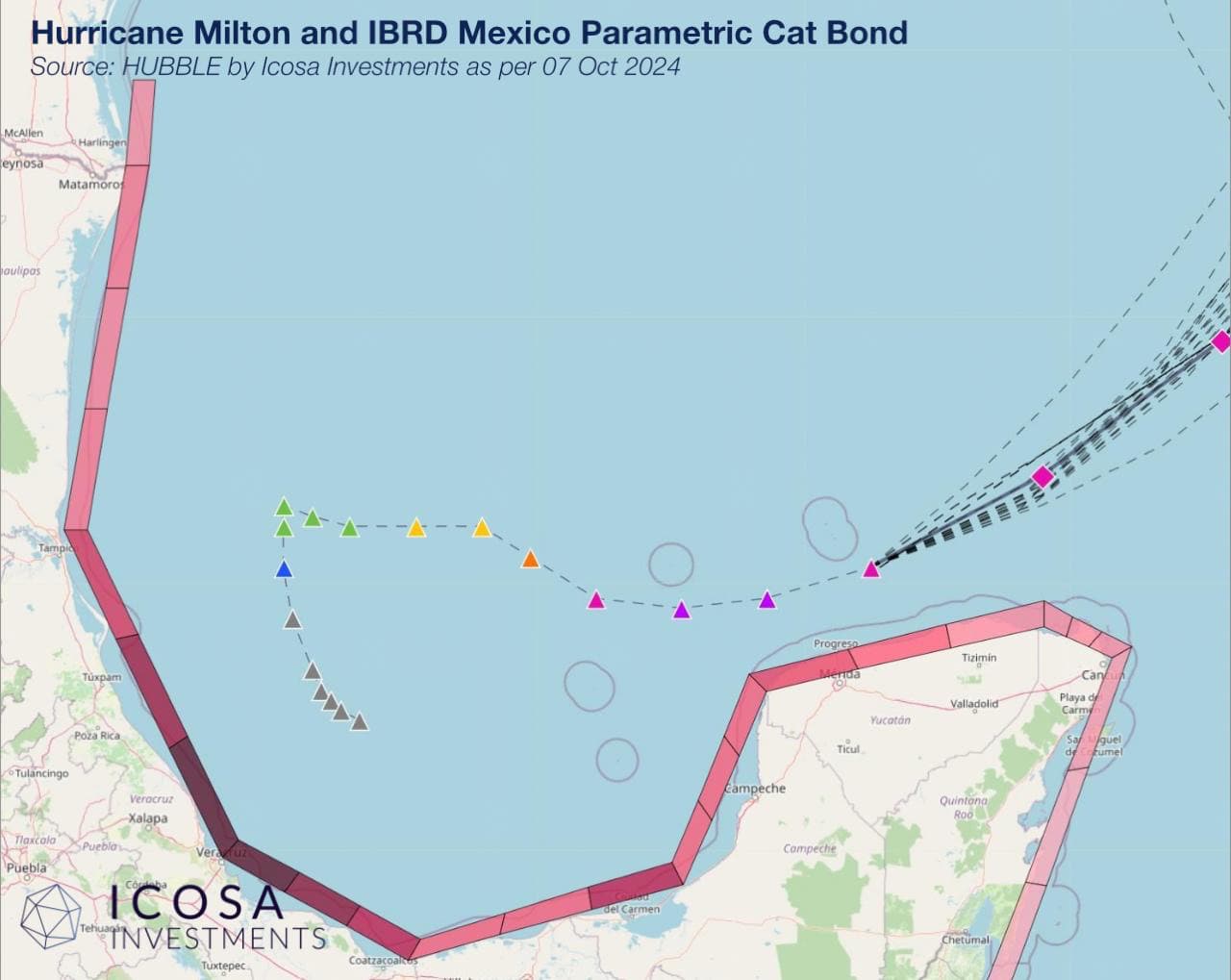

Catastrophe bond investment manager Icosa Investments AG concurred, with its latest analysis of the passage of hurricane Milton passed the Yucatan peninsula of Mexico seen below and showing the storm did not get close enough to breach the trigger gates.It was a relatively close run thing, as just a wobble further south might have taken Milton’s eye up to and over the parametric trigger construction.Of course, having only brushed the Yucatan this land interaction has also not caused any degradation to hurricane Milton’s structure, which could have been a factor that helped reduce the potential impacts in Florida had a closer passage to Mexico occurred.

– .– .– .

– .– .– .

– .– .– ..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis