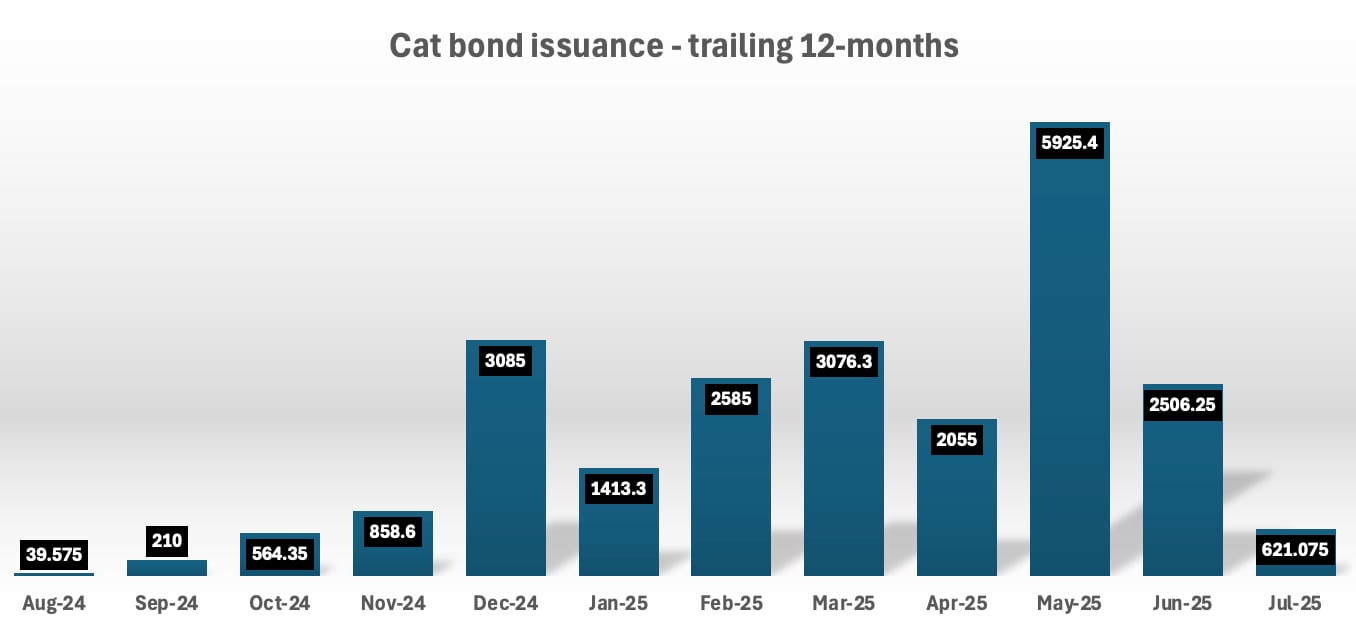

The catastrophe bond market has just had its busiest 12-month period on record, as issuance between August 2024 and July 2025 has now reached just slightly under $23 billion, marking a landmark stretch of activity for this segment of the insurance-linked securities (ILS) market.Readers will know that records have fallen just in the current year 2025 so far, with and more recently a new annual record for total catastrophe bond issuance tracked by Artemis.Issuance in 2025 , based on Artemis’ data on 144A catastrophe bonds as well as the private cat bond transactions we have reported on.

But, our extensive range of also features a way for you to analyse cat bond issuance by month each year.Tracking month-by-month issuance from that dataset shows that the latest 12-month stretch is the busiest in catastrophe bond market history.The total issuance over the trailing twelve months now stands at precisely $22.94 billion (close enough to call it $23bn), based on all of the cat bonds tracked in the Artemis database.

During this 12-month stretch of accelerated catastrophe bond market activity, we saw the biggest single month in the market’s history.That was May 2025, at almost $5.93 billion.There is no other 12-month stretch in the market’s history that gets this close to $23 billion, although there are some other periods that get above the $20 billion mark, one stretch that gets over $22 billion and a number of others that break the previous calendar year record from 2024 (which has fallen in 2025).

It is the accelerated level of cat bond activity in 2025 that has driven all of the $20 billion plus 12-month stretches of cat bond issuance though.One other notable fact from the latest trailing 12-months of catastrophe bond market activity, is that this almost $23 billion of issuance came from just 106 deals that we have listed in our .Which makes the average deal size for this 12-month period since August 2024 an impressive $216.4 million.

However, as we explained recently, , setting another high-bar.The catastrophe bond market will now be much quieter through the peak of the hurricane season, but we’ll keep you updated here on Artemis as soon as the cat bond market pipeline reopens.For full details of second-quarter and first-half 2025 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

For copies of all our catastrophe bond market reports, ..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis