The , which tracks the performance of the insurance-linked securities (ILS) fund sector, has turned positive for the year after April on the back of another strong month of private ILS fund returns.As we reported in , after the first-quarter of 2025 but with not all reporting for the month of March in at that time, the effects of the California wildfires had impacted performance the ILS Advisers Fund Index return for 2025 sat at -0.85%.At that time, March performance was +0.82% for the Index, but once all ILS funds performance data was collected it rose to +1.21%, with private ILS funds experiencing higher returns in that month.As a result, the year-to-date performance for the Index to the end of March 2025 rose to a still negative approximately -0.44%.

April has seen the private ILS fund cohort performing better again, with collateralised reinsurance and retrocession focused strategies beating pure catastrophe bond funds as a group.For April 2025, with some 86% of tracked ILS funds having reported their data so far, the ILS Advisers Fund Index return for the month was +0.49%.Which took the year-to-date performance of the Index for the first four months of 2025 to a positive +0.02%.

No additional major catastrophes were reported in April 2025 that impacted the ILS funds tracked by the Index.“However, higher losses reported by a major U.S.nationwide insurer led to further price declines in multi-peril, annual-aggregating cat bonds,” ILS Advisers explained.

This is likely referring to at the end of the last annual risk period.For the month of April, pure catastrophe bond funds tracked by the Index as a group delivered a +0.36% return for the month.Meanwhile, private ILS fund strategies as a group delivered a +0.67% average return, again outpacing the cat bond strategies in April 2025.

With 32 ILS fund returns having been reported for April at this stage, the majority were positive with just 2 funds reporting a negative performance for the month.Once again, the performance gap from best to worst performing ILS fund was quite wide again in April, ranging from -0.62% to +2.01%.With the ILS Advisers Fund Index only just turning positive for 2025, it shows how meaningful the effects of the California wildfires and aggregate losses have been so far this year.

While the Index now stands at +0.02% for 2025 to April 30th, the performance of the two fund categories differs significantly still.Pure cat bond funds as a group stand at around +1.59% for the first four months of this year, while the private ILS funds as a group stand at -1.53%, still due to the -4.22% average performance for January because of the wildfires.However, take January out of the equation and for February to April the cat bond fund performance stands at +1.48%, while the private ILS fund performance stands at +2.69% for those three months.

It’s worth remembering that there will be a significant dispersion of returns within the private ILS fund group, given the wide range of risk-return strategies on offer in the marketplace.Given the spread effects experienced in recent weeks in cat bonds and now with wind seasonality also likely to become a driver of returns (loss activity allowing), we could see a more sustained and perhaps higher positive performance come through over the next few reports from this Index.Although, as you’d expect, the private ILS funds would be expected to drive the higher returns through the next couple of months of reporting as well.

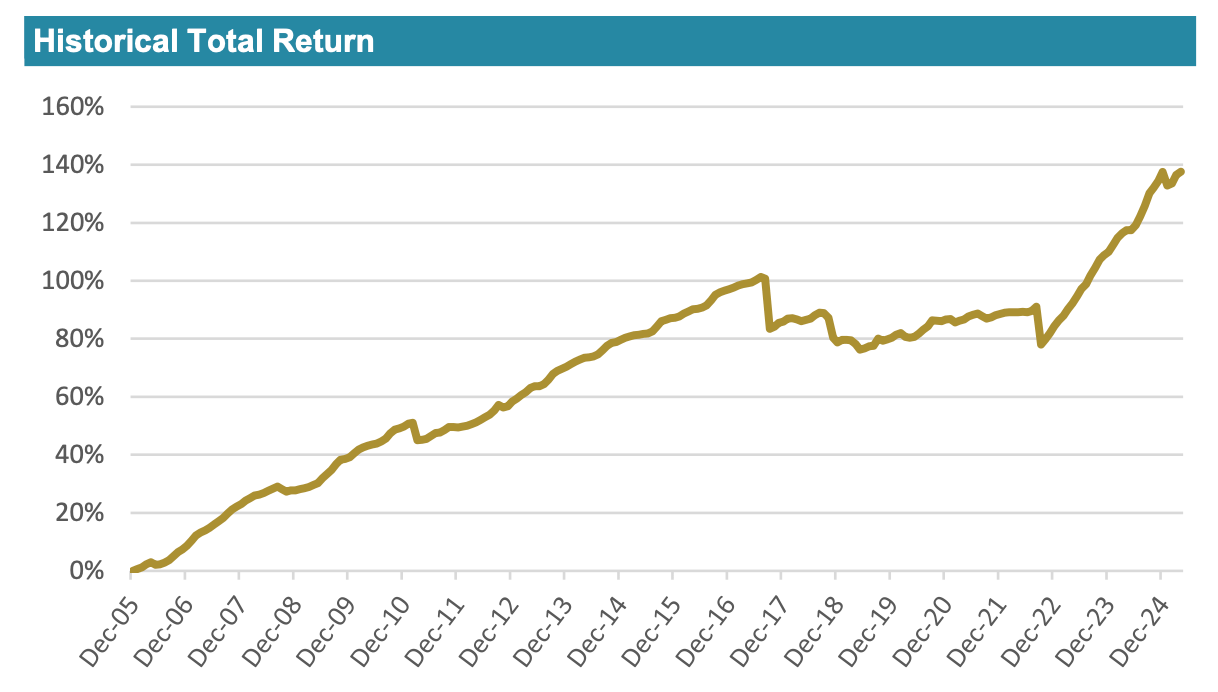

You can track the .It comprises an equally weighted index of 37 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis