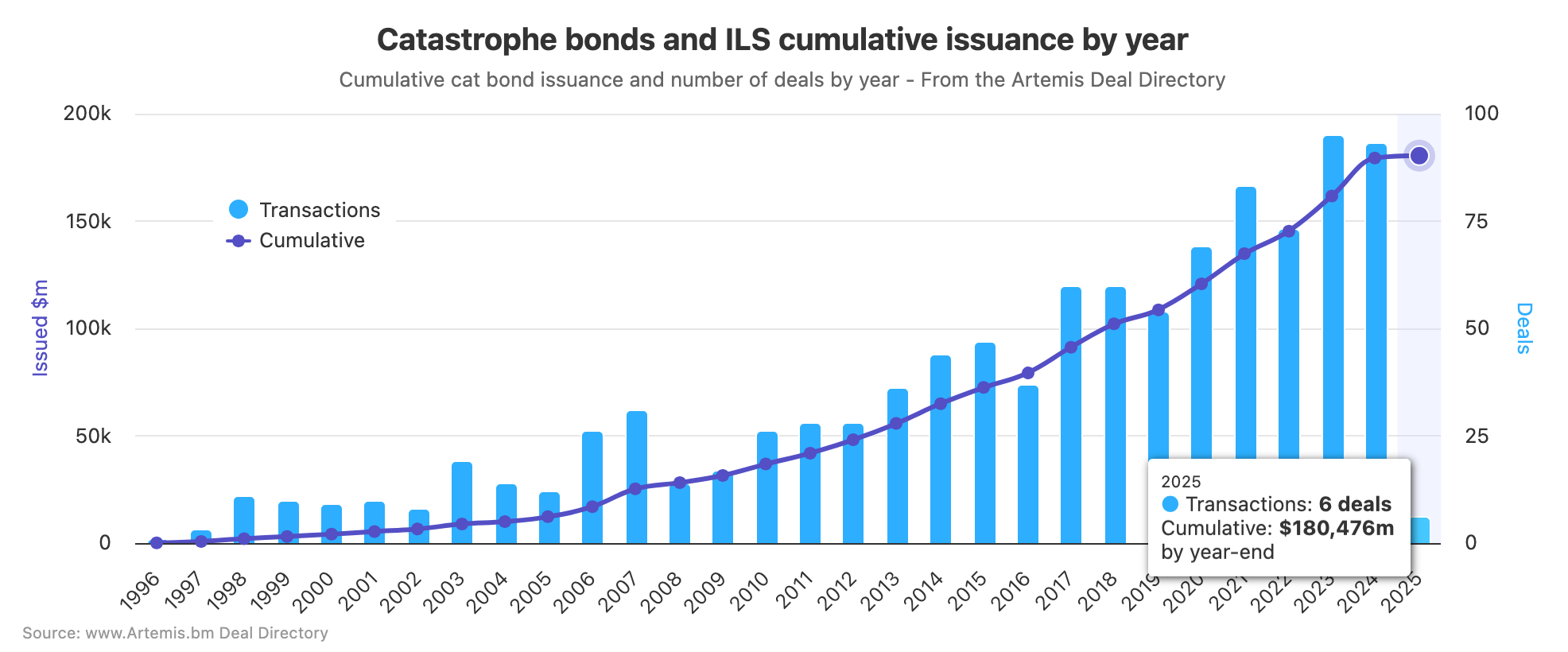

Since the very first deal came to market almost three decades ago, the cumulative value of catastrophe bonds and related insurance-linked securities (ILS) we’ve analysed and tracked has now surpassed $180 billion of issuance, according to our .This is a new milestone for the catastrophe bond and related insurance-linked securities (ILS) market and comes after the second consecutive year of record issuance and a busy start to 2025.Record issuance of $16.4 billion from 95 transactions in 2023 was broken last year as .

In fact, since 2017, cat bond and related ILS issuance has only once failed to breach $10 billion, in 2019 when it totalled $6.5 billion.This impressive growth has seen the market expand considerably.Cumulative issuance only surpassed $100 billion in mid-2018, before jumping to more than $120 billion in 2020 and surpassing the $150 billion mark in 2023.

After a combined more than $34 billion of issuance in 2023 and 2024, cumulative issuance ended last year just shy of $180 billion but has now .The chart above is one of , enabling analysis of the cat bond and ILS sector in greater detail.It shows just how strong market growth has been over the years, notably since 2017.

While much of the growth has come from repeat sponsors, it’s worth highlighting that over the past three years, .So far this year, more than $1 billion of reinsurance or retrocession protection has been secured from the capital markets via cat bond issuances, and this also includes a new sponsor.What’s more, the shows that there’s currently another $1.82 billion in the pipeline scheduled to complete before the end of February, and with the potential for more transactions to appear before the end of Q1, it looks set to be another busy opening quarter for the market.

, cat bond spreads have come down from the highs of 2023, but they clearly remain attractive to investors and also new and old sponsors as activity remains robust and keeps pushing the boundaries of the space.The lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s.The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

.We track , the most prolific sponsors in the market, most active , which risk modellers feature in cat bonds most frequently, plus much ., or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these are updated as soon as a new cat bond issuance is completed, or as older issuances mature..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis