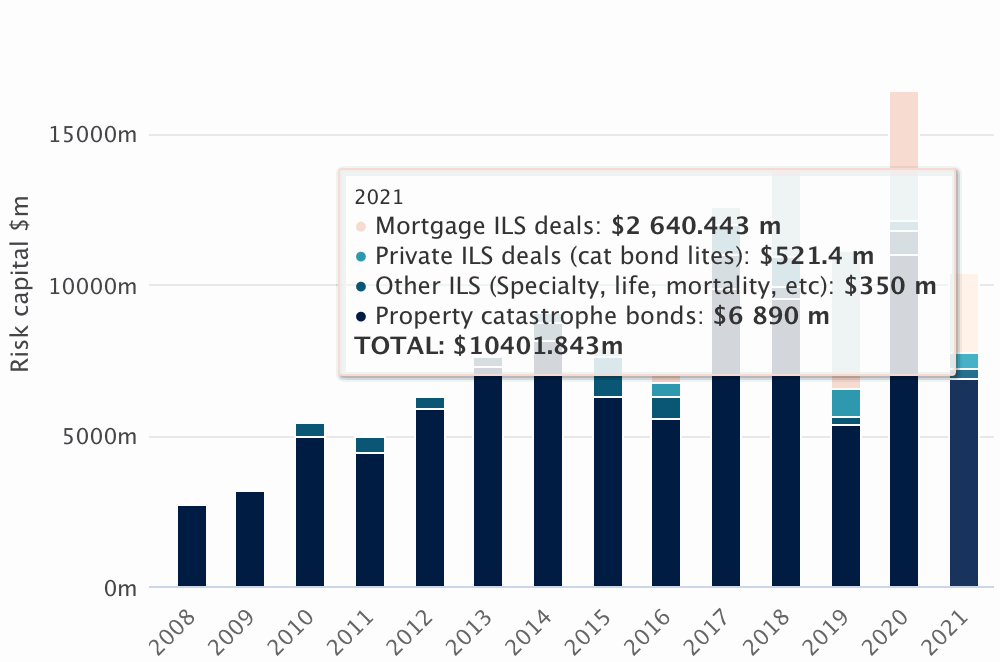

After a flurry of catastrophe bonds launched in recent days, it is now clear that issuance of will break the record for the second-quarter and also the first-half of 2021.We explained back in May that the market for catastrophe bonds and related insurance-linked securities (ILS) is set to break new ground for the first-half of 2021, with over $10 billion of issuance anticipated by us, according to our data on the market at the time.Now, things have accelerated in the catastrophe bond market and total issuance of property catastrophe bonds, other line-of-business cat bonds, private cat bonds and mortgage insurance-linked securities (ILS), has already hit just over $10.4 billion, which is an H1 record for those categories of ILS deals.

The previous record, according to , for first-half issuance of cat bonds, private cat bonds and mortgage ILS stood at $9.76 billion from H1 2017.But, as we said, things have accelerated and right now there are another roughly $1.29 billion of property cat bonds with a chance of settling before the end of this month.That’s from eight new 144A property catastrophe bonds that have all launched in the last fortnight and are currently all slated for settlement before the end of June.

If all of these cat bonds were to settle before the end of June at their current marketed sizes, the total issuance for the first-half of 2021 will reach a stunning almost $11.7 billion.So nearly $2 billion higher than the previous first-half record set in 2017.However, it’s important to note here that mortgage insurance-linked securities (ILS) issuance has been far stronger this year and accounts for the difference.

In fact, pure 144A structured property catastrophe bond issuance will fall a little short of a record without some of the remaining transactions upsizing.Currently, we’re on-track for at least $8.1 billion of pure property cat bond issuance in H1, still a little behind the 2017 record for H1 of $8.5 billion.That said, with eight deals still being marketed and at least five of those still having a chance of upsizing, we could see the first-half property cat bond record being broken if investor demand continues to be as strong as it has been of late.

The roughly $11.7 billion of issuance that we could see by the end of the half would consist of just over $8.1 billion of 144A property cat bonds, $521 million of private cat bonds, $350 million of cat bonds covering non-property risks (so life, health, contingency etc), and $2.6 billion of mortgage ILS.As well as breaking the first-half issuance record, recent high levels of activity in the market also mean the record for Q2 will be broken as well.Currently we’re on-track to record just over $7.02 billion of issuance across the four categories in Q2 2021, just beating the $7 billion from Q2 2017.

Again though, it is mortgage ILS that drive the outperformance this year, with pure property cat bond issuance in Q2 still lagging somewhat behind 2017, at around $5.6 billion versus $6.38 billion.Issuance conditions for catastrophe bonds remain very attractive and sponsors are locking in significant reinsurance and retrocession capacity at keen pricing, on multi-year terms right now.As a result, it’s anticipated that issuance will continue to be brisk through the rest of 2021, although we could see a typical lull during the peak hurricane season months.

That said, we have already heard of some diversifying peril deals that should come to market during the hurricane season, so even Q3 may turn out to be busier than an average year.Execution of recent catastrophe bonds remains strong, with , while the market spread above expected loss has come down significantly.If these issuance conditions persist, we should see a very busy end to 2021 as well, putting full-year records for issuance well in sight, even at this still relatively early stage of the year.

Stay tuned to Artemis for news of and related ILS transaction that comes to market, as well as other structures including .You can view information on every catastrophe bond issued so far in 2020 and all prior years, totalling over 700 issues, in the .Keep up-to-date with the make-up of the catastrophe bond and ILS market using the , designed to be a simple and effective tool providing key on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis