Among the data points we track during the timeline of each catastrophe bond issuance, are , as well as any changes in the size of a cat bond offering from the initially targeted amount.We’ve created two new charts to help you analyse these two catastrophe bond market data points, averaged across issuance by quarter, which can help in visualising cat bond offering execution over time, investor demand related factors, as well as providing signals for overall market conditions.When a new catastrophe bond is first offered to investors it tends to come with price guidance for the eventual spread it will pay set in an initial range.

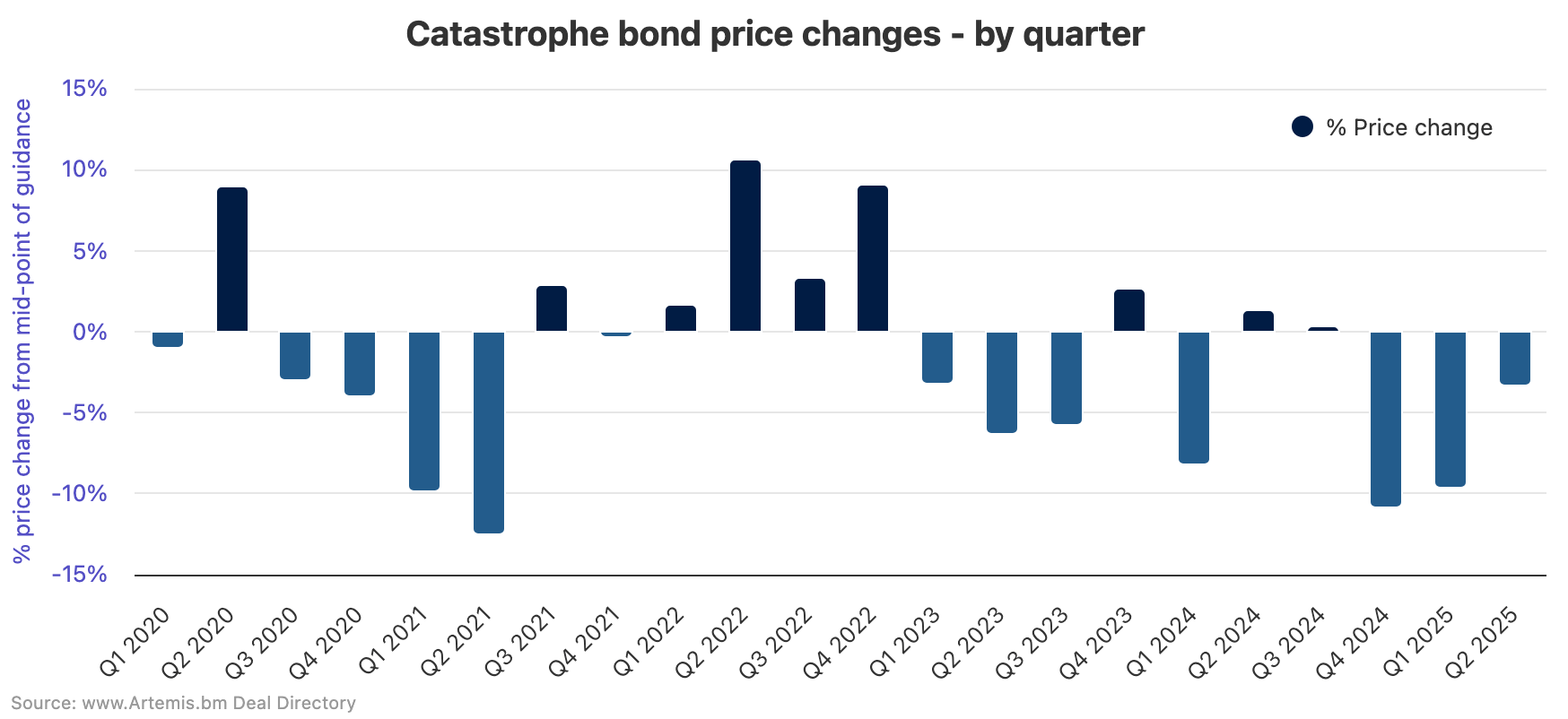

The offering is then circulated and explained to the catastrophe bond investor base, after which the broker or banker marketing the deal will assess appetites and sometimes narrow, or adjust the price guidance before finalising it at a level that delivers what is seen as the best price execution for the cat bond offering.We track how the prices move, where we have the information, so .Based on data from the Artemis , this first new chart enables you to view and analyse the average percentage price change from the initial mid-point of price guidance to the final risk interest spread at issuance, across tranches from: pure 144a catastrophe bond deals; other cat bond like deals featuring specialty, life, mortality risk, etc; and private cat bond lites or private ILS deals where we have pricing details.

You can analyse this data and the historical trend in cat bond offering price changes by quarter and year in .The second of our new charts is focused on catastrophe bond issuance size and how that changes during the offering process.When a new cat bond is launched and marketing to investors begins, it tends to come with an initial size for each tranche, which we take to be the initial target for how much in reinsurance or protection the sponsor would like to secure.

Over the course of the offering period for a cat bond the size of tranches can fluctuate and be changed in response to investor demand.This typically results in more deals increasing in size (or upsizing) than decreasing, so the average percentage size change across a quarter is almost always a positive figure, which is also one reflection of investor demand for cat bonds.So .

Based on data from the Artemis , this chart enables you to view and analyse the average offering size change from the initial target to the final confirmed cat bond size at issuance, across tranches from: pure 144a catastrophe bond deals; other cat bond like deals featuring specialty, life, mortality risk, etc; and private cat bond lites or private ILS deals where we have initial and final size information.You can analyse this data and the historical trend in cat bond offering size changes by quarter and year in .Both of these new charts are helpful additional interactive visualisations that provide signals of market conditions and investor appetite for offerings in the catastrophe bond market.

Of course there is also an element of execution precision involved as well, given the more accurately investor appetite, demand and capital availability are assessed, the less movement there can be in these metrics at certain times in the market cycle.We hope you find these new charts displaying and are a useful addition.As with all of our charts, we updates these as new cat bonds come to market once we have the final details for the pricing and size of any offerings we have the necessary details for.

, .(use the key of months at the bottom to include and exclude any from your analysis).The lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s.

The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list..We track , the most prolific sponsors in the market, most active , which risk modellers feature in cat bonds most frequently, plus much .

, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.All of these are updated as soon as a new cat bond issuance is completed, or as older issuances mature..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis