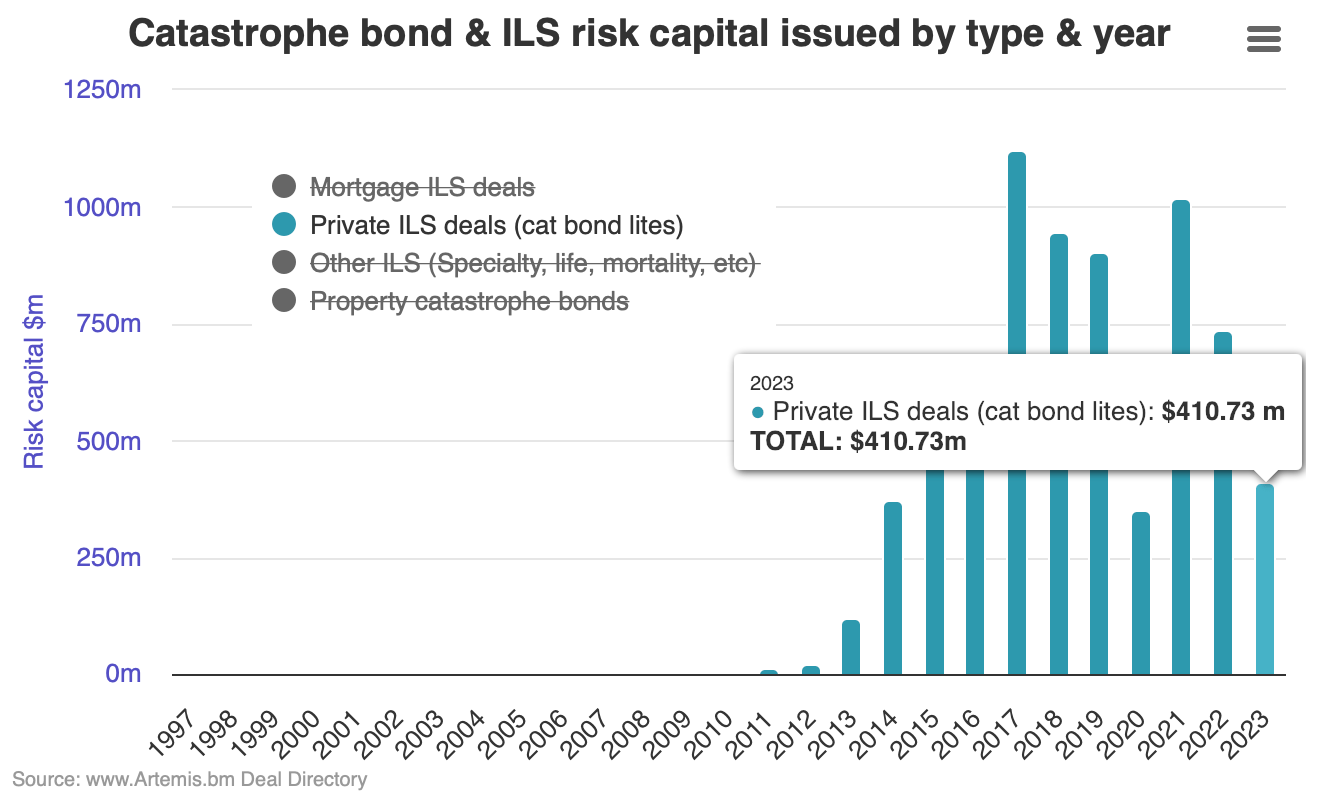

Privately placed, or cat bond lite transactions continue to contribute to total catastrophe bond issuance, although so far in 2023, the total value of deals issued is below the 10-year average, according to .As highlighted in the Artemis Q3 2023 cat bond and related insurance-linked securities (ILS) market report, after the first nine months of 2023, approximately $396 million of new risk capital from 13 privately placed cat bonds featured, accounting for around 4% of total issuance for the period.Since the end of September, eight more cat bond lite transactions have been issued with a combined value of roughly $142 million, taking 2023 private cat bond issuance to approximately .

Analyse issuance by type of transaction (144A property catastrophe bonds, other cat bonds featuring life and specialty line risks, private cat bonds, and mortgage ILS) using : The first privately placed cat bond transactions came to market in 2011, and since 2013, these types of deals have contributed at least $350 million to annual issuance levels.The most active year for cat bond lite issuance was 2017, when more than $1.1 billion of risk capital was issued via these structures.Annual cat bond lite issuance also exceeded $1 billion in 2021, but fell to around $738 million in 2022.

Currently, 2023 is the seventh most active year for cat bond lite issuance.During the 10-year period 2013-2022, annual cat bond lite issuance has averaged $660 million, meaning that as things stand, 2023 is on track to be a below average year for these types of deals.However, there is still some time before year-end and with both new and repeat sponsors taking advantage of market conditions, there’s every chance more private deals come to light before January 1st, 2024.

It would take another $120 million of private cat bond issuance for 2023 to be in line with the previous 10-year average, and more than $580 million of issuance, which seems unlikely, for 2023 to be a record year for the cat bond lite sub-sector..You can ..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis