Catastrophe bond funds in a UCITS format only fell to a -2.3% negative annual return for 2022, according to the average weighted index of the .Despite the negative performance for the full-year, this cat bond fund index shows a strong recovery since hurricane Ian, as well as a reasonable level of performance before that major storm wiped out the gains from earlier in the year.Performance of catastrophe bonds had been muted somewhat through the first almost three-quarter of 2022, as pricing pressures and spread widening depressed returns, largely on the back of macro-economic factors.

In fact, these had fallen by July 1st, as spread widening related price pressure built to a crescendo.After that, the UCITS cat bond funds tracked within this Index performed better as some seasonality returned, alongside some recovery on the price side of certain positions.Just before hurricane Ian came along in the second-half of September, these UCITS cat bond fund indices were up by 1.45%, according to the average weighted index.

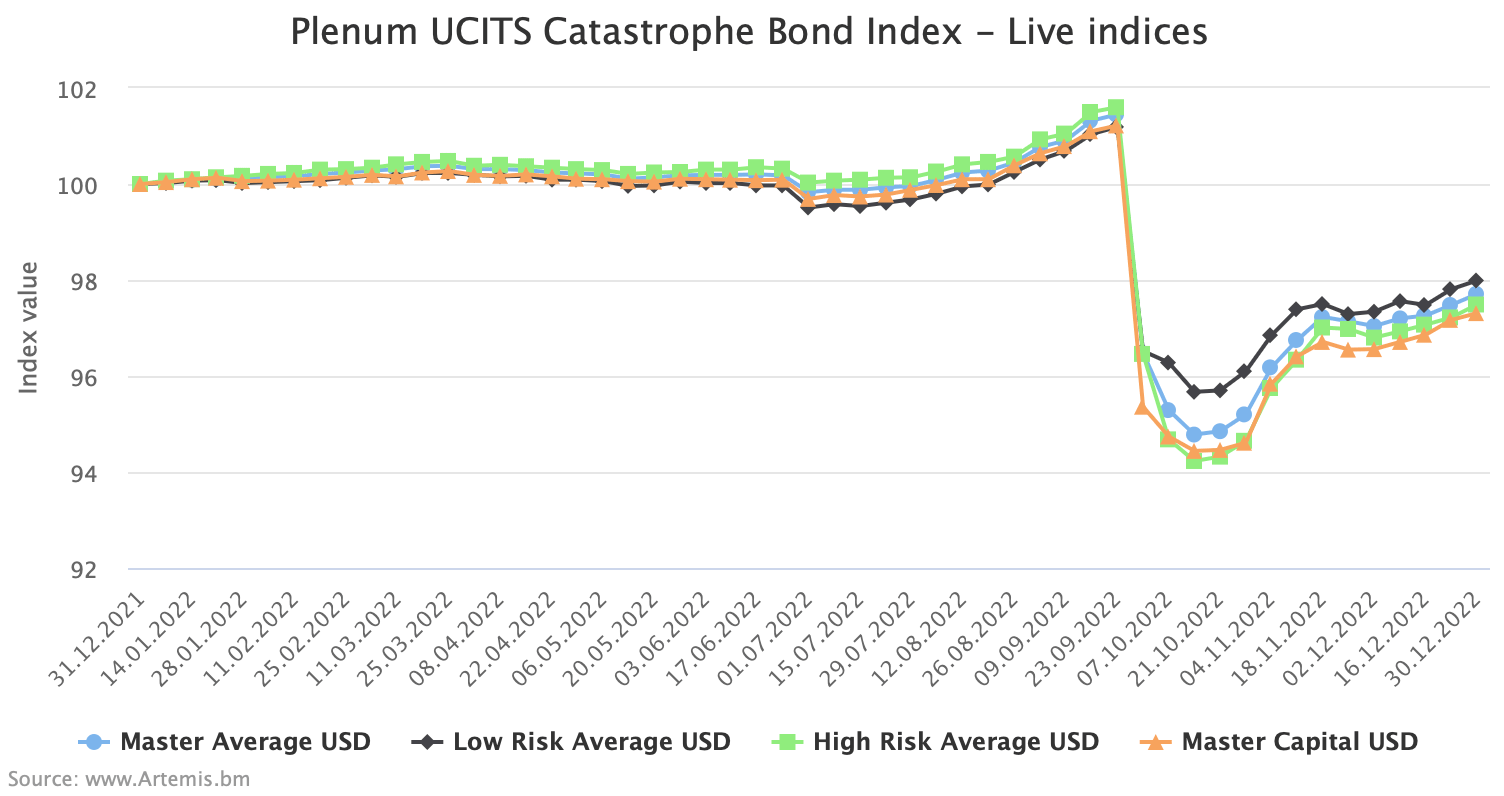

Hurricane Ian then severely dented performance, wiping out those gains.The average weighted cat bond fund index experienced a -4.9% decline on hurricane Ian, while the low-risk index fell by -4.6% and the higher-risk strategies saw a -5.06% fall.You can clearly see this trend in the chart below, the sluggish returns through the first-half, the dip around mid-year as price pressure took hold, then the stronger performance through until the major hit from hurricane Ian (click on the chart for an interactive version).

Also clearly visible in the interactive charts of the is the strong recovery experienced after hurricane Ian’s initial hit to the market.So, on average, the UCITS cat bond fund indices were down almost 5% immediately after hurricane Ian struck Florida in September.The average decline since hurricane Ian is now just under -3.7%, so roughly one-third of the hurricane Ian hit has already been recovered.

By the end of the year the full-year 2022 returns across these UCITS cat bond funds averaged -2.3%, according to the indices.Given 2022 saw hurricane Ian hit Florida, ground-zero for the insurance-linked securities (ILS) and catastrophe bond market, the full-year performance of these dedicated UCITS cat bond funds is impressive.Ian was the most expensive US hurricane loss in over a decade and the second most costly US hurricane loss the insurance and reinsurance market has ever experienced, after hurricane Katrina.

For these investment funds, that often specialise, or hold much of their exposure, in Florida and coastal US property catastrophe reinsurance risks, to only be down -2.3% for the full-year is testament to the robustness of the cat bond asset class, as well as to manager risk selection and portfolio management expertise.Not everyone fared the same, of course, with a relatively wide-dispersion across the UCITS catastrophe bond funds.But that also reflects the broad range of risk and return strategies employed.

While the ILS market has been challenged to raise money in recent years, the performance of catastrophe bond funds in 2022, under the shadow of the one of the largest relevant catastrophe losses ever, should go some way to rebuilding investor confidence in these assets and help to drive future investor flows.These , calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a useful source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

.Get a ticket soon to ensure you can attend.

Publisher: Artemis