The insurance and reinsurance industry loss from the three major European windstorms that struck in series over a few days during the month of February 2022 has been preliminarily estimated at close to EUR 3.3 billion by data aggregator PERILS AG.PERILS estimate covers three separate European windstorms that impacted the United Kingdom and continental Europe between February 16th and 21st.This series of storms were named Ylenia, Zeynep and Antonia by the Free University of Berlin, and Dudley, Eunice and Franklin by the UK Met Office.Given the duration of the series, across five days, PERILS is estimating them together given the challenges in identifying which storm caused property damage.

The company said that based on claims data collected from affected insurance companies, its initial estimate of the insured property market loss for the storm series is EUR 3.289 billion (approx.US $3.67bn).PERILS estimate is at the lower-end of expectations, given it had been thought the industry loss from these three storms may rise , while RMS had said Eunice alone could be as high as EUR 3.5 billion, while combined with Dudley losses could reach EUR 4.5 billion, and .

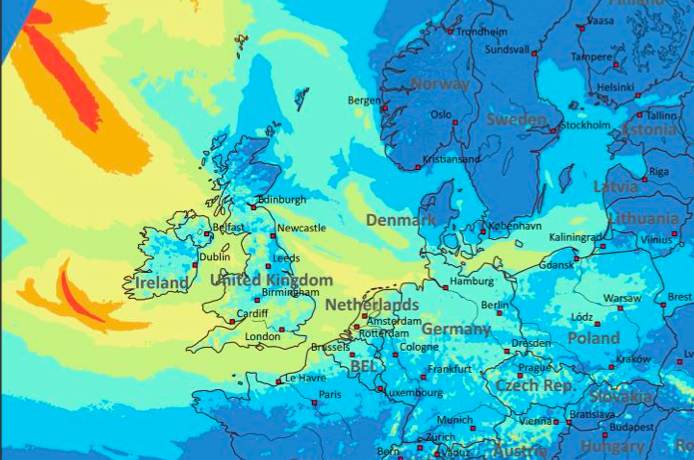

But PERILS estimate is always going to undercount the actual insurance and reinsurance industry impact, given the company does not collect loss data in certain countries.PERILS said the majority of losses were from Germany, followed by the Benelux states, the United Kingdom and France.A modest amount of losses also came from Austria, while Denmark and Switzerland saw limited impacts.

But neither Poland or the Czech Republic are covered by PERILS, so claims from those two are not included.These extratropical windstorms were driven by a strong jet stream that “acted as a conveyor belt for low-pressure systems from the North Atlantic across the British Isles and on into Europe,” PERILS explained.Adding that, “This clustering phenomena is not uncommon for European extratropical cyclones but poses a challenge for the insurance sector as it makes it difficult to precisely allocate insurance claims to a specific storm given that the three events occurred within a short space of time and impacted similar areas.” PERILS also noted that event definitions for reinsurance purposes in Europe can include meteorological conditions plus loss aggregation periods ranging from 72 hours up to 168 hours.

As a result, the company is reporting on these three windstorms as a single event.In total, these three European windstorms drove roughly 1.8 million individual insurance claims.The vast majority were for non-structural damage and PERILS said they had a moderate average claim size.

But, the significant number of claims drove the insurance industry loss of EUR 3.289 billion, representing the largest European windstorm loss since Kyrill in January 2007.PERILS had previously ..

...

..———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis