Due to the extensive tornado, hail, and wind damage across the central and eastern United States, global insurance and reinsurance broker Aon has indicated that a recent outbreak could be among the most expensive severe weather events in U.S.history on an inflation-adjusted basis.In its latest report, Aon analysed the meteorological causes and damages of two major severe weather outbreaks that impacted the central and eastern U.S.between May 14-17 and May 18-20.

Aon highlighted the May 14-17 outbreak as particularly devastating.The report noted the extensive tornado and hail damage, especially in the Ohio River Valley and Midwest, with 30 fatalities reported.One of the most destructive events was an EF-3 tornado that caused severe damage in St.

Louis, Missouri, impacting thousands of buildings.Aon estimates that the economic and insured losses from this severe weather outbreak could reach well into the single-digit billions USD.“A large portion of this loss will likely come from the St.

Louis tornado alone as city officials initially estimate around $1.6 billion in total damages.Moreover, as more assessments are completed in the coming weeks, the May 14-17 event may even potentially rank among the costliest severe weather outbreaks in U.S.history on a price-inflated basis,” Aon stated.

In addition to the damage caused by the St.Louis tornado, the May 14-17 event also saw multiple tornadoes that ravaged parts of Kentucky, Missouri, Arkansas, Illinois, Michigan, New Jersey, and Wisconsin.Particularly hard-hit areas included Laurel County, Kentucky, where several fatalities occurred, and St.

Louis, where over 5,000 buildings were reported damaged.Aon also noted that the severe weather outbreak from May 18-20, while not resulting in fatalities as of the latest reports, caused significant damage across Oklahoma, Kansas, and Arkansas.The storms reportedly left over 100,000 people without power and damaged or destroyed numerous homes and structures.

The second event, which included powerful EF-3 tornadoes in Kansas and other severe weather impacts in Oklahoma, Arkansas, and Alabama, caused widespread destruction.In Oklahoma, over 130 homes were damaged or destroyed, with significant impacts in Muskogee County.Meanwhile, in Kansas, the towns of Plevna and Grinnell were heavily impacted by two separate EF-3 tornadoes.

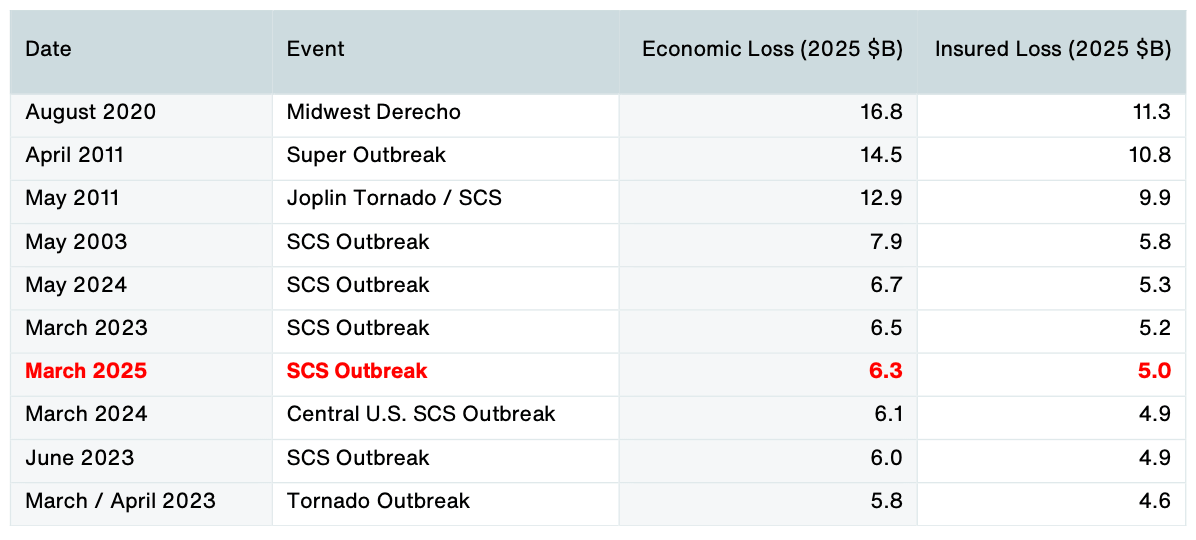

“Additionally, due to multiple significant tornadoes and widespread wind impacts, total economic and insured losses from the May 18-20 severe weather outbreak may also reach into the billions USD.As a result, both outbreaks over the past week are already among the costliest severe weather events thus far in 2025,” Aon added.For context, the March 14–16 outbreak earlier this year is already ranked as the seventh costliest severe weather event in U.S.

history, based on loss data from Aon’s Catastrophe Insight platform, as shown in the table below.Andrew Siffert, Senior Meteorologist at BMS Group, He explained that an omega block had previously limited severe weather across much of the Central and Northern Plains, raising concerns about wildfires.However, as the omega block broke down, the severe weather season reignited, resulting in these damaging outbreaks.

“Over the last few weeks, an omega block has controlled much of the weather pattern across the U.S., which has limited severe weather across much of the Central and Northern Plains, increasing the wildfire concern over the region,” Siffert said.“With the breakdown of this omega block, the severe weather season is back.There will likely be three weeks of heightened severe weather, with a series of storm systems adding to the insurance industry’s losses in 2025.” Siffert also highlighted the ongoing nature of the severe weather season, suggesting that the May 14-17 outbreak could become the most costly event of 2025.

“After a relatively quiet few weeks of severe weather across the U.S., severe weather is back with what is likely the most significant outbreak of severe weather that will cost the insurance industry over $5B+ in damages, making it likely the most costly severe weather event so far in 2025 after more severe weather damages occur today as severe weather moves over an even more populated area along the Mid-Atlantic and Ohio River Valley,” Siffert added.With significant losses already accumulating from the severe weather outbreaks, insurers and the wider industry will be closely monitoring further developments.As more assessments are completed, the total impact of these two events may continue to rise, with the May 14-17 outbreak already positioning itself as one of the costliest severe weather outbreaks in U.S.

history.It’s also worth highlighting, that many aggregate reinsurance, retrocession contracts, and catastrophe bonds have their annual risk periods reset at the mid-year renewals.As a result, these recent losses could affect some of those arrangements, increasing the likelihood of impacts for both traditional and alternative risk capital providers.

Several aggregate catastrophe bonds are already considered at risk of attaching, or have partially attached.So this recent severe weather could further erode aggregate deductibles or deepen losses on exposed positions in the coming weeks..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis