Eclipse Re Ltd., the Horseshoe managed private syndicated collateralised reinsurance note, private catastrophe bond issuance and reinsurance transformer platform, has issued four more private cat bond series of notes, together totalling $277 million, which now take private cat bond issuance above $1 billion so far in 2021.It’s turned into another busy year for private catastrophe bonds and the Eclipse Re structure managed by Artex’s Horseshoe is the major contributor in 2021.Including these four new series of notes, which are all now listed in our extensive , the Eclipse Re Ltd.

structure has issued $411 million of private cat bonds so far in 2021, way up on the 2020 total of just $107 million and still up on 2019’s almost $300 million of ILS deals issued through the structure.This vigorous activity from the Eclipse Re platform has now helped to drive the issuance of private catastrophe bonds, or cat bond lites as they’re also know, to a new record high and for the first time annual issuance of private cat bonds has now surpassed $1 billion.It’s a meaningful figure and shows that two trends continue to gather pace in the reinsurance and insurance-linked securities (ILS) market.

One, sponsors continue to look to efficient and lower-cost ways to securitize their risks and transfer them to the capital markets, hence these private cat bond platforms like Eclipse Re offer a good way of achieving that, without needing to go down the full 144A issuance route.Two, ILS fund managers continue to leverage private cat bond issuance platforms to make securitized reinsurance and retrocession a more liquid and therefore investable asset for their cat bond fund strategies.With cat bond fund strategies having grown so much in 2021, this second factor could be as big a driver of this private issuance market growth at this time, as ILS fund managers look to transform assets to fit their cat bond fund mandates allowing them to bring in new investor funds to match with them.

So, onto the details of the four new Eclipse Re Ltd.private cat bonds we’ve added to our today.The four new Eclipse Re cat bond deals only came to light last night, so it is possible that they could have been issued earlier this year and we’ve only now been made aware of them.

Totalling almost $277 million, the four vary in size and also in duration, with some matching up with the due dates of previous Eclipse Re private cat bonds issued this year, but one having what appears to be a two year term (which is notable).As background, Eclipse Re Ltd.is a Bermuda domiciled special purpose insurer (SPI) and segregated account company that is managed by insurance-linked securities (ILS) market facilitator and service provider Horseshoe, part of Artex.

Eclipse Re is typically used to enable issuance of insurance-linked securities (ILS) notes, via the transformation, securitisation and ultimately transfer to one, or syndication to a group of investors, of reinsurance or retrocession arrangements.So its main use-cases are the issuance of privately syndicated collateralised reinsurance notes, or private catastrophe bond notes, with an ability to cover a range of underlying structures and perils, or lines of business.The structure is also used as a transformer for ILS fund managers, to help them securitize a risk and make it investable for a catastrophe bond strategy, so not all issues from Eclipse Re are syndicated to investors.

In fact, quite a few of the Eclipse Re issuances of recent years have been for the sole benefit of specialist, cat bond focused ILS fund manager Fermat Capital Management, acting as the investor for the benefit of its funds.We do also know that the California Earthquake Authority (CEA) has been a recipient of reinsurance protection through Eclipse Re deals in the past.The $277 million of new Eclipse Re issuances we have listed, along with their sizes and due dates are below: – $19.72 million – due May 31st 2022.

– $55 million – Eclipse Re Ltd.(Series 2021-04A) due May 31st 2022.– $127.5 million – due June 30th 2022.

– $75 million – Eclipse Re Ltd.(Series 2021-11A) due September 30th 2023.These are quite sizeable deals for private catastrophe bonds and the due date of the Series 2021-11A issuance is particularly notable, being roughly a two year duration (long for a private cat bond).

As ever, we assume these all represent property catastrophe risk-linked notes, providing an unnamed protection buyer, or fund, with reinsurance or retrocession protection.The proceeds from the sale of the roughly $277 million of private catastrophe bond notes across each series will have been used as collateral to underpin linked reinsurance or retrocession contracts, and the cash will be held in a trust.ILS and reinsurance market service provider and facilitator Horseshoe, part of Artex, will have led the issuances as the manager for these Eclipse Re Ltd.

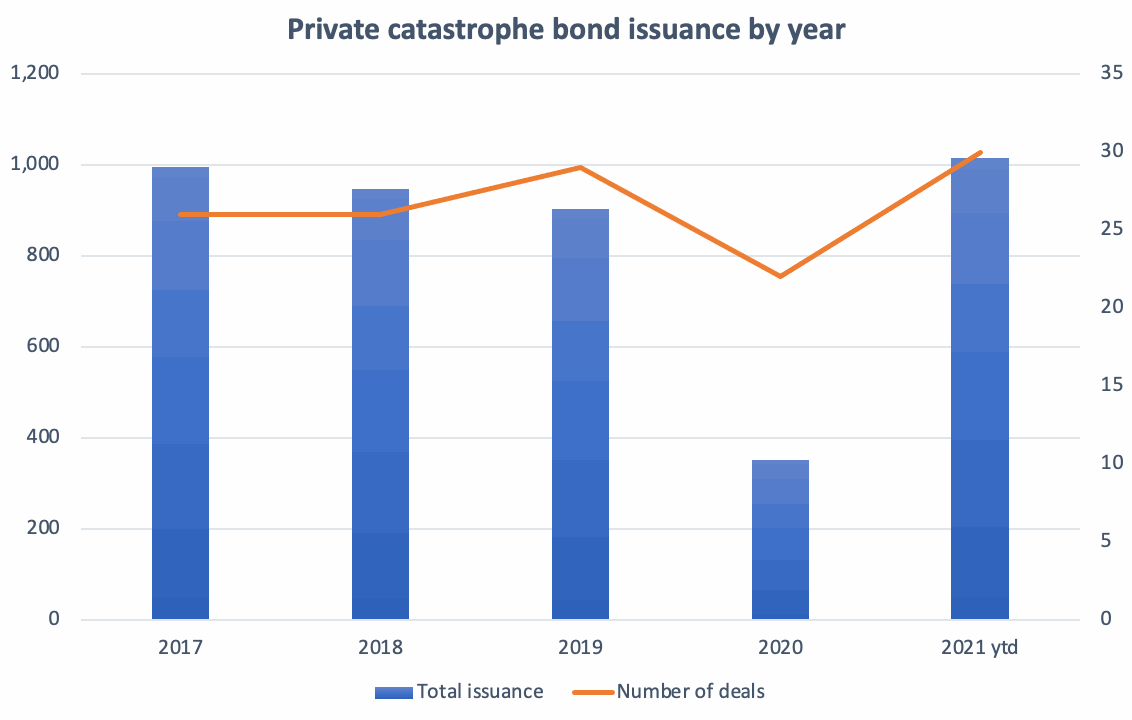

transactions, with this special purpose vehicle a key offering to its clients.The notes have all been placed with qualified institutional investors and been admitted to the Bermuda Stock Exchange (BSX) as insurance-related securities for their listings, with Horseshoe also acting as listing sponsor through its Horseshoe Corporate Services Limited unit.New private cat bond market record in 2021 So, thanks to the very active issuance year for Eclipse Re, we now have almost $1.017 billion of private cat bonds listed in our Deal Directory, with 30 transactions issued in 2021.

That’s a new annual record for private cat bond issuance and 2021 is the first time we’ve tracked more than $1 billion of these deals..It’s also a record for the number of separate issues we’ve tracked as well.

The previous record was 2017 when 26 deals issued just under $1 billion of notes, while the previous record for number of deals was 2019 with 29.Private catastrophe bonds (cat bond lites) and similarly privately placed insurance-linked securities (ILS) remain an effective way for ILS fund managers to transform risk into a securitized note format, or for cedants to access the capital markets in a more efficient manner than in a full-blown 144a catastrophe bond issue.Until the costs of issuing a full Rule 144a catastrophe bond can be reduced somewhat, these private cat bond platforms will continue to play a vital role in the market.

Perhaps more so than ever now, when investor appetite for catastrophe bonds is running higher than even the record-setting pace of 144a issuance can satisfy.As a result, we expect to see more private cat bonds before year-end and a strong contribution to the overall market from them again in 2022.You can read about issued in our extensive Artemis catastrophe bond Deal Directory.———————————————————————.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis