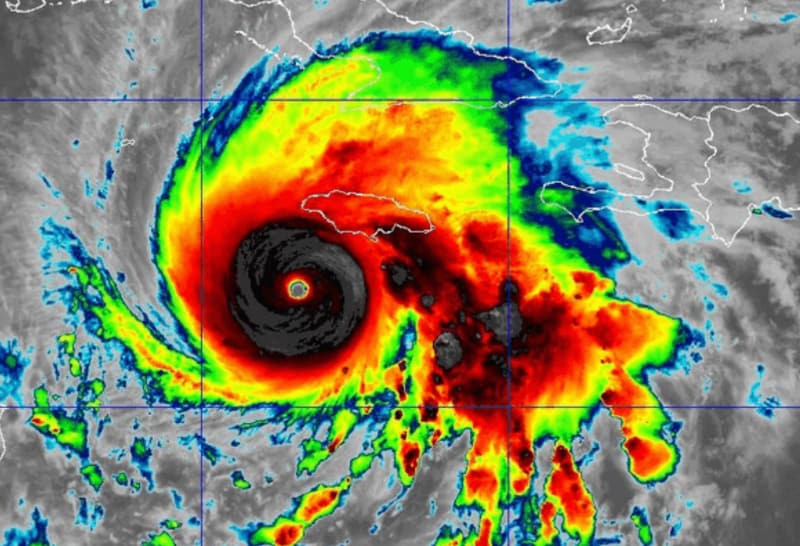

Major reinsurance firms are guiding to triple digit millions of Euros in losses from recent major hurricane Melissa, as these global giants demonstrate that they have meaningful shares of the market’s exposure to catastrophe events in the Caribbean.It’s impossible to say for certain, but any loss in the hundreds of millions could see some retro support.Estimates for insurance industry losses from hurricane Melissa currently average around the US $2.7 billion mark, across the four main catastrophe risk modellers.Recall that, , Verisk said insured industry losses to onshore property in Jamaica will likely range between $2.2 billion and $4.2 billion, Karen Clark & Company (KCC) put , and Moody’s gave a best estimate of $3.5 billion, with a range of between $3 billion and $5 billion.

Based on comments made by some of the largest reinsurance firms in the world, it appears this could be a relatively concentrated loss event, with major global players.Which is understandable, as for regions like the Caribbean, both in reinsurance and in larger, more complex insurance risks, the major re/insurers are typically anticipated to take meaningful shares of significant natural catastrophe events, with their capital supporting reconstruction and recovery.Today, Munich Re’s CFO said that his company expects a mid-triple-digit million Euro impact from major hurricane Melissa.

Christoph Jurecka explained, “I’m happy to mention an order of magnitude, although I have to say it’s really early days.So these are very rough estimates at this point in time.Melissa, our current assumption is that it would be a mid-triple digit million euro number for our loss.” Yesterday, Hannover Re’s executives also discussed the potential losses the reinsurer will experience due to hurricane Melissa.

CFO Christian Hermelingmeier said, “The combined ratio of 86% is well within the target range below 88% the impact from large losses was 459 million euro below budget, which has nevertheless been booked in full as usual.The unused budget should be sufficient to cover the expected losses from Hurricane Melissa, meaning that full Q4 budget is available for other losses in the fourth quarter.” Hannover Re’s Sven Althoff further stated, “I don’t have a number for you yet, it’s still early days, so we are still gathering all the information.But to narrow the range a little bit for you, if you look at the EUR 450 million unutilised budget for Q3 we are not expecting Melissa to use all of this EUR 450 million, on the other hand, we expect this to be a three digit loss for our share, and Jamaica, from a territory point of view, is where we have a slightly above average market share.

We don’t expect that the EUR 450 million unutilised budget is fully used for Melissa.” So Hannover Re is expecting a loss greater than EUR 100 million, but lower than EUR 450 million at this time from Melissa.Finally, French reinsurer SCOR had also commented during its recent earnings call.CEO Thierry Léger had explained, “On, Melissa, it’s fair to say that it has been a devastating event for the people and population.

There have been winds with speed levels close to 300 kilometres an hour, and even strong buildings have been down.So a very, very difficult event for for the people in Jamaica.For us, it’s too early to tell where the real losses will be for us, so we prefer not to comment at this point in time.

But it’s fair to say that it will be an event in which we will participate at our fair share, but again, too early to say.” So no specific guidance, in terms of quantum of the hurricane Melissa loss from SCOR, but something commensurate with its market share is to be expected.Natural catastrophe losses in the hundreds of millions of Euros experienced by the major reinsurance firms can sometimes result in some retrocession recoveries for these companies.The higher the eventual quantum of loss, the greater chance there is that retro partners will take a share.

Quota share arrangements, such as the reinsurance sidecars these firms operate, could experience some attrition due to hurricane Melissa first it would seem, while excess of loss retrocession arrangements would be anticipated to require the losses eventually reported by these reinsurer to prove more meaningful, we expect..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis