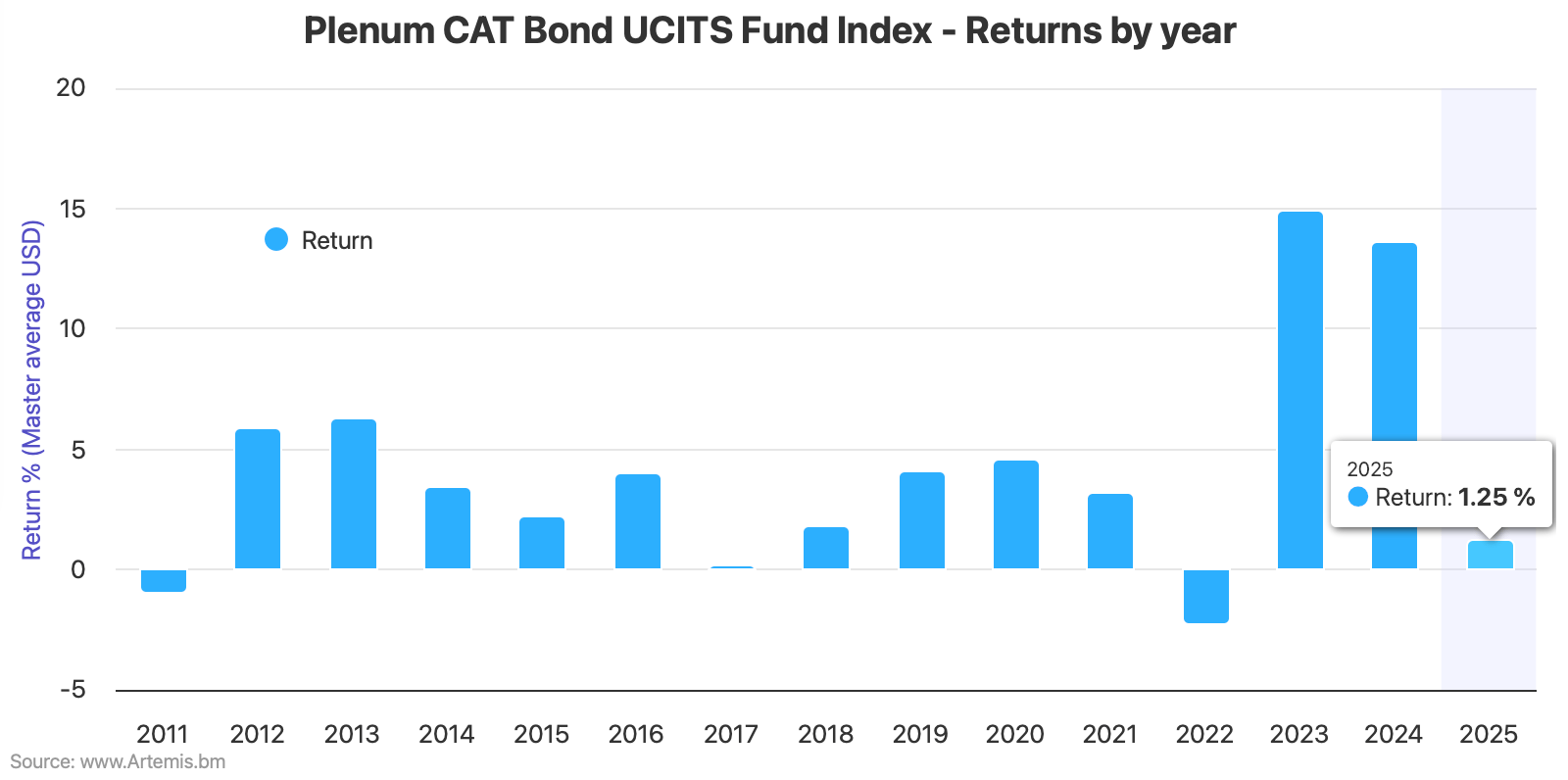

UCITS catastrophe bond fund strategies averaged a -0.28% return for the month of April 2025 as of pricing on May 2nd, according to the , as the impacts of mark-to-market and soon to be realised losses dented performance for the period.After the first-quarter of the year, where effects of the California wildfires and aggregate catastrophe or severe weather losses had affected the catastrophe bond fund sector, the average return of the cohort of UCITS catastrophe bond funds tracked by Plenum Investments had reached .As additional mark-to-market losses and some realised (or soon to be) losses also flowed into catastrophe bonds in April, that has now dented the year-to-date performance of the Index, lowering it to an average UCITS cat bond fund return of 1.25% by the pricing at May 2nd.

2025 started with UCITS cat bond funds as the initial effects of the LA wildfires affected cat bond marks, after which performance dropped to an average 0.32% return for the month of February, as certain positions wildfire related mark-downs accelerated during that month, then .So the month to May 2nd is actually the first negative month of the year for this UCITS cat bond fund Index, as impacts of the wildfires and aggregate losses caught up to certain positions, resulting in the -0.28% average return.Among the reasons for the negative performance for April up to May 2nd, across the UCITS cat bond fund space, are the fact .

In addition, one of , after it became clear the notes would see a reinsurance recovery made from them.There had also been other secondary market price movements during the month, some of which remain mark-to-market at this stage given risk periods running to June for some of the aggregate cat bonds that have seen negative price pressure.It was the final pricing of the month of April 2025 that has dented cat bond fund performance, with the average return of the UCITS strategies being -0.56% for the week to May 2nd.

April’s performance ranged from -0.30% for the higher-risk cohort of UCITS cat bond funds, to -0.27% for the lower-risk cohort.Year-to-date, while the average UCITS cat bond fund return now stands at 1.25%, the lower-risk strategies fared better at 1.30% and the higher-risk delivered a 1.14% return through the first four months to May 2nd pricing.The trailing 12-month return of UCITS catastrophe bond funds remains very attractive still, with the average across the sector running at 10.57% to May 2nd.

The lower-risk cat bond funds averaged 10.23% to that date, while the higher-risk group performed slightly better at 10.79%.As ever, the range of returns across catastrophe bond funds was diverse in April and some strategies delivered still delivered positive returns for the month, largely through their avoidance of wildfire risks or being underweight aggregate cat bond positions in their portfolios.But the effects of the loss activity in the market was sufficient to dent performance for those strategies with more exposure to the affected positions.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis