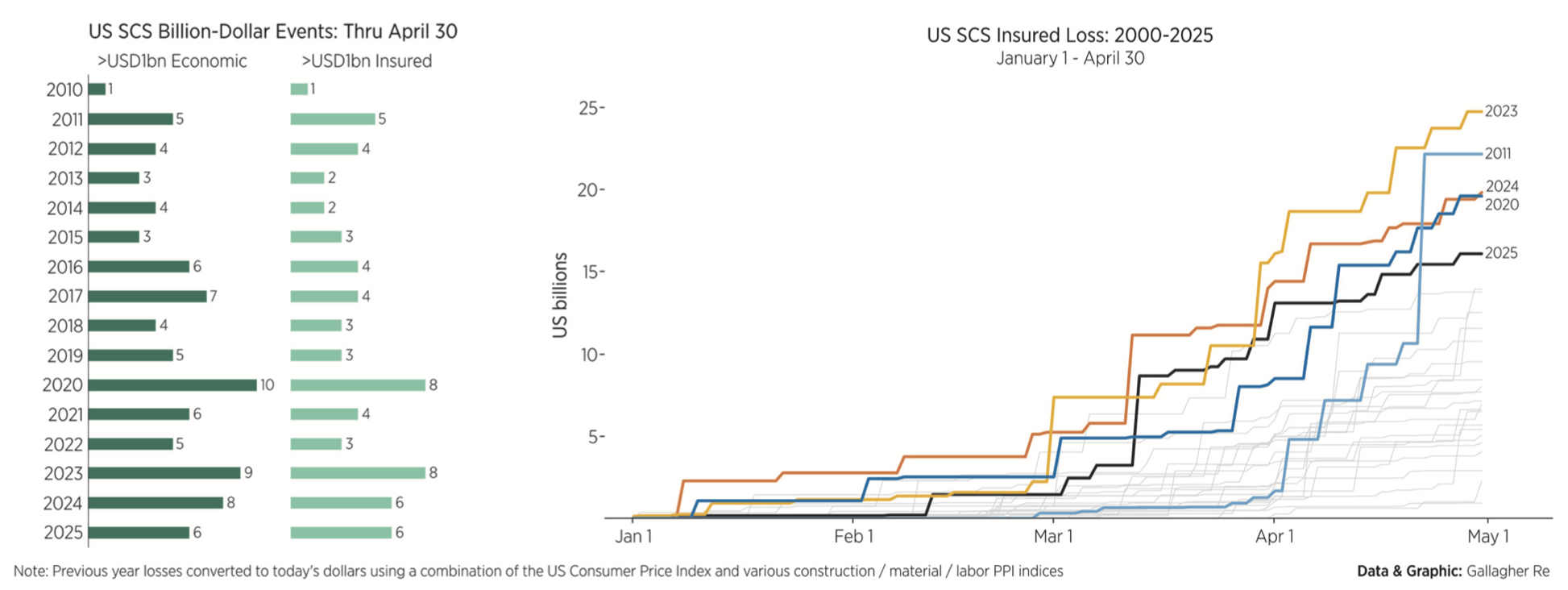

Severe convective storm (SCS) activity across the United States has now cost the insurance and reinsurance industry more than $20 billion in 2025, broker Gallagher Re estimates, with its Chief Science Officer Steve Bowen highlighting that the May 14th to 20th outbreak could drive insured losses of up to $7 billion.2025 becomes the eighth year out of the last nine where severe convective storm (SCS) insured losses in the US have topped $20 billion, with the recent outbreak having accelerated the aggregation of losses from this peril considerably.Steve Bowen, Chief Science Officer and Meteorologist at reinsurance broker Gallagher Re explained, “We now report that there have been eight individual billion-dollar US SCS insured loss events thus far in 2025 through May 20.This compares to recent year totals through the end of May in 2024 (13), 2023 (11), 2022 (6), 2021 (6), and 2020 (12).

“The recent stretch of US thunderstorm activity has sadly left a considerable path of destruction across many states and communities.“Today we release our latest event commentary that includes our preliminary insured loss estimate of $4 billion to $7 billion for the entire May 14-20 timeframe.This is subject to change.

Uninsured damage is expected to drive the overall direct economic cost higher by at least another billion.” Tornadoes have driven a meaningful proportion of damages so far this year, Bowen said, with “35 tornadoes rated either EF3 (30) or EF4 (5).” “Since the Enhanced Fujita (EF) Scale went operational in 2007, the 35 EF3+ tornadoes thus far in 2025 sits behind only 2011 (74) and 2008 (50) for totals through May,” he further explained.Large and damaging hail from these severe thunderstorms has been a further driver of insured losses, with 2025 now one of the most prevalent years on record for that peril as well.Bowen said that, “From a large hail (2.0+ inches) perspective, the US has recorded 415 such local storm reports through May 20.

When compared to previous years over the same period, 2025 ranks only behind 2024 (493), 2023 (465), and 2005 (425) dating to at least 1950.” As a result, “The US heads toward the start of the with insurance industry losses already beyond $60 billion for the year,” Bowen further stated.Saying, “We’ve long passed the point of justifying any semantic categorization that considers SCS to be a “secondary” peril for the US insurance market.This has proven itself to be perennial major loss driver for many insurance carriers.

“Reinsurers, however, remain very well capitalized and in position to absorb sizeable natural catastrophe losses should they arise in the months to come.” The year-to-date 5-year average for US severe thunderstorm insured losses stands at $25 billion, while the YTD 10-year average is $19 billion, so the latter has already been exceeded in 2025.With primary insurance carriers estimated to face between $4 billion and $7 billion of losses from the May 14th to 20th outbreak of severe weather, tornadoes, hail, damaging winds and flooding rains, it suggests further erosion of aggregate reinsurance deductibles and some additional aggregation to reinsurance arrangements that have already attached.This could include some further erosion for a number of aggregate catastrophe bonds that have faced erosion of their aggregate retention or attached, with the potential to drive losses higher for some of those already on the hook for losses in the still-running annual risk period.

The aggregation of losses through the year so far from the SCS peril, “Further shows how convective storms are continuing to drive greater aggregate losses for the industry.The combination of much more population and housing unit exposure in high-risk areas, plus more consistent impacts from large hail, straight-line winds, and tornadic activity, are the primary factors of why SCS losses continue to accelerate,” Gallagher Re explained in its event report.– .

– Severe weather & tornado outbreak could drive $5bn+ insured losses: BMS’ Siffert..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis