Performance, diversification, attractive relative value support ILS demand: Ruoff, Schroders Capital

As the insurance-linked securities (ILS) sector expands, investors are being drawn to the market by its strong performance over the past several years, its diversification benefits, and the attractive relative value currently offered by catastrophe bond spreads compared with those of other asset classes, according to Schroders Capital’s Stephan Ruoff.As the ILS sector moves into 2026, we spoke with Ruoff, who serves as Co-Head of Private Debt & Credit Alternatives, Chairman ILS at Schroders Capital, who provided an outlook for both the ILS and catastrophe bond sector for the year.To begin, Ruoff explained what he believes is drawing investors into the ILS market.“First, the performance of the last three years has caused ILS to receive a lot of publicity. Second, the fundamentals of diversification from, and lack of correlation to, other investment classes has proven beneficial in the current more volatile times, and third, the spread tightening seen in asset classes with broadly similar levels of risk to those in, most specifically, the cat bond market has been relatively more severe. In the absence of losses, and should these conditions persist without further spread tightening in ILS, we expect investor interest to remain strong,” the executive told Artemis.

Importantly, Ruoff also stressed that not all types of investors exhibit the same behaviours.Providing an example, the Chairman of ILS explained that hedge fund-type investors may choose to act with greater opportunism than investors such as pension funds which stereotypically take a longer-term view.“The more opportunistic money may find the reduced spread environment less to their liking than the past three years,” Ruoff said.

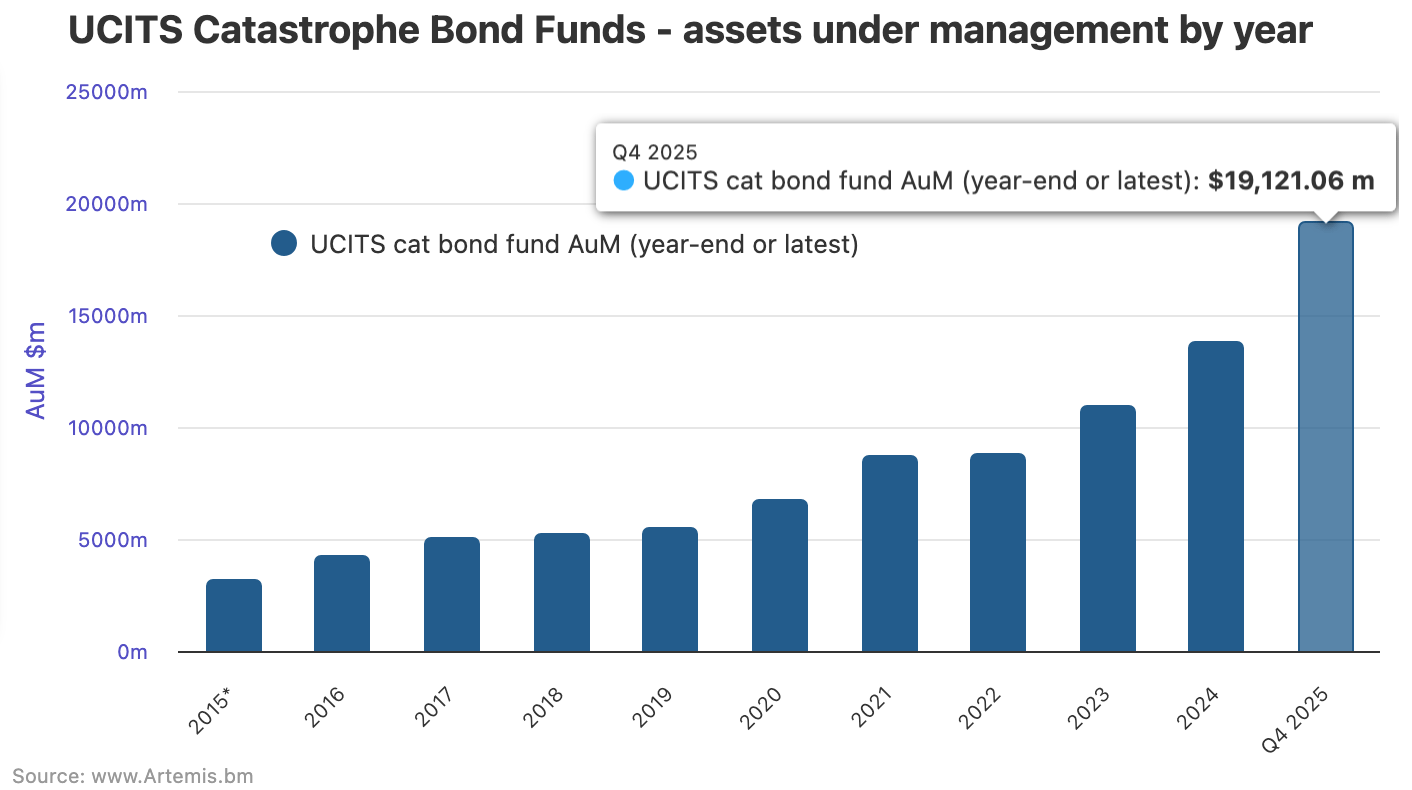

Turning to the catastrophe bond market, Ruoff emphasised that it’s hard to forecast what’s going to happen in the future because many different factors are at play.“A large catastrophe could occur at any time, or not, and that’s going to be a major driver of the direction of travel in the ILS market,” he explained.“The very strong performance of the last three years, together with the fundamental attractions of ILS as an investment, have resulted in ILS manager AUMs increasing materially. Note that this increase comes from a combination of retained performance and new inflows.

“There is no doubt that the current demand from investors has created a very strong bid, and we are seeing spread multiples reduce due to the resulting competition for paper. Cat bond sponsors, repeat and new, are aware of the situation and the pipeline of primary issuance is larger than the volume of maturities. This helps to use up some of the investor demand.” Ruoff continued: “As a result of constant dialogue with brokers, and given our position as a leading catastrophe bond manager, we have the best knowledge available about the primary issuance pipeline.That being said there is still scope for deviations away from expectations, so there could be either more or less issuance in Q1 2026 than currently anticipated.The current market dynamics may lead more sponsors to bring transactions to the market.

This would be good for all parties if it results in a more balanced market i.e.one in which the available capital overhang is reduced.” With the catastrophe bond market currently experiencing lower spreads in comparison to the peaks observed in 2023, we asked Ruoff whether he considers the current lower spread environment to be sustainable.On top of this, we also asked the executive whether he anticipates a return to levels that lie between the current situation and the peak, as excess capital is absorbed in the forthcoming months? “Capacity management at manager level needs to bear in mind the points covered in the answer to Q1 above.

Across the market there are different approaches.We take a prudent approach to capacity management, possibly more so than others in the market.We apply soft- and hard-closes and limit the marketing of funds when we consider it necessary,” Ruoff explained to Artemis.

“We note that there are new funds and new managers entering the market.Based upon activity that we have seen in the primary market in the last few weeks, we are concerned that spread multiples have been driven lower as a result of the application of what might be called systematic investing.Even that term may be an over-statement of the skill being applied in some cases.” As noted by Ruoff, a broader debate exists regarding the differences between an investment strategy that’s founded on a sophisticated approach to risk analysis at one end, and one that is centered on market purchasing at the other.

Nevertheless, although the results are often comparable, the Chairman of ILS at Schroders Capital emphasised that due to the characteristics of the return distribution in a cat bond portfolio, when losses arise, both the actual outcome and the outcome in relation to expectations will differ.“The riskiness of a cat bond, as presented in its offering documents, typically needs to be adjusted for several, sometimes quite basic, reasons,” Ruoff added.Concluding: “In the current market we are seeing bonds closing at spreads that are less than 1x the adjusted expected loss.

So our view is that the current spread environment is not sustainable for parts of the ILS universe.” ..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis