With having sprung back to life as the US wind season passes its meteorological peak, cat bond fund manager Icosa Investments AG has analysed the issuance trend and sees it still running at a record pace.As Artemis readers will be aware, there are currently four new catastrophe bond issuances in the market, with the potential to bring as much as $950 million in new risk capital to cat bond investors once they settle.Broker-dealers continue to anticipate a busy end to the year for cat bond issuance, although with some uncertainty over whether planned deals could fall into this year or 2025 for their settlement.Another factor that can affect cat bond issuance is of course reinsurance market pricing and the competition that can be experienced as the January renewal season gets properly underway.

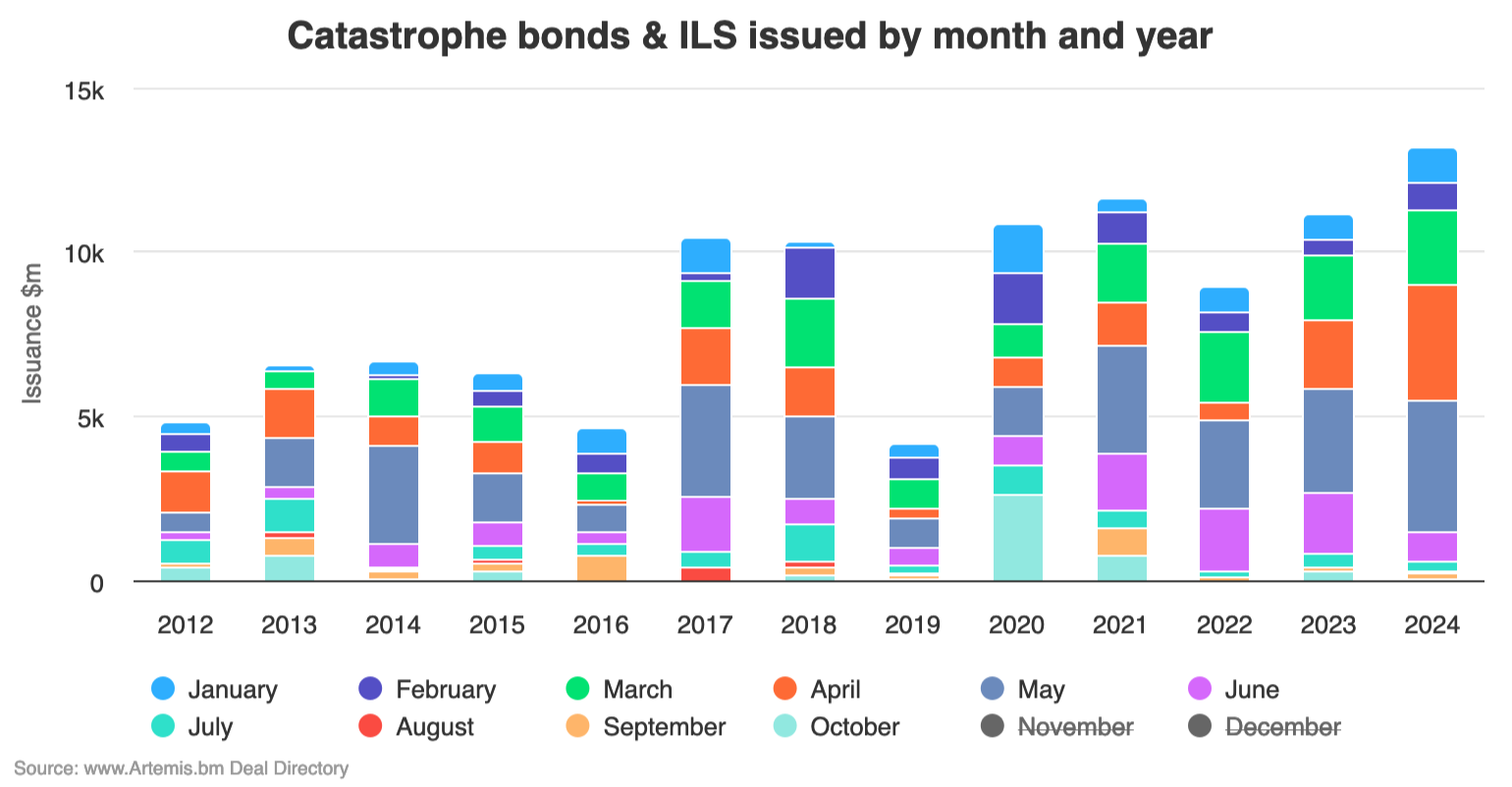

But, after the significant hurricane losses experienced in recent weeks, most are now , which alongside the fact increasing numbers of sponsors are turning to cat bonds, could serve to buoy issuance through the coming months.Analysis undertaken by cat bond fund manager Icosa Investments shows that primary catastrophe bond issuance continues to run at a record pace in 2024.“After the typical seasonal pause from July through early October, the cat bond primary market is finally showing signs of renewed activity.

Several transactions have already been announced, and we expect a robust pipeline of additional issuances before year-end, with combined nominal amounts likely exceeding USD 3 billion,” Icosa Investments explained.Continuing to say, “As anticipated, the secondary market has also become more dynamic, with investors reallocating capital in preparation for the upcoming new issuances.Our internal models indicate that if this trend continues, FY 2024 could set a new record for issuance, though this depends on volumes reaching the higher end of our projections.

“For investors, this resurgence in both primary and secondary markets offers a timely opportunity.With the hurricane season drawing to a close and seasonal risks at their lowest, portfolio managers now have a broad range of instruments to deploy fresh capital effectively.” Florian Steiger, the CEO of Icoas Investments also commented, “If you’re considering an allocation into cat bonds, now is the time.The Atlantic hurricane season is nearly over, significantly reducing the risk of major events in the near future.

Additionally, recent medium-sized events like Helene and Milton are supporting spreads, and yields remain in the double digits, well above historical averages.“With access to both primary and secondary markets, portfolio managers now have the flexibility to allocate capital efficiently, benefiting from a wide selection of instruments available at this time of year.And as always, cat bonds offer excellent portfolio diversification due to their low correlation with traditional asset classes, while also delivering high yields in the current market environment.” Artemis tracks .

, to remove them from the data in real-time, which will then redraw the chart to show you that issuance so far (not including the yet-to-settle pipeline deals) continues to run at a record-setting pace..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis