Insurance-linked securities (ILS) funds reported a narrower range of performance in November 2021, as a quieter month led to an average positive return of 0.25% for the ILS fund market, according to the .November did not see any major new catastrophe loss activity, so ILS fund returns held up better as a result.In fact, the majority of the ILS funds tracked by ILS Advisers for the Index were positive for the month, but still a handful experienced further impacts that dented returns, likely from prior month loss events, and 5 ILS funds reported negative performance.We’d , as losses from the European flooding in July and hurricane Ida in late August and early September flowed through the reinsurance market.

That has turned out to be the case and it’s borne out in ILS Advisers figures again for November 2021.According to the measurement of ILS fund performance, the average ILS fund was up by 0.25% for November 2021.That’s slightly down on October’s 0.27% average ILS fund return.

Catastrophe bond focused investment funds led the way, with an average return of 0.28% in November.The group of ILS funds that also invest in private contracts, such as collateralised reinsurance arrangements, fared slightly worse, being on average up by 0.23% for the month.Overall in November 2021, 22 of the ILS funds tracked by ILS Advisers were positive for the month, with 5 reporting negative returns.

The performance gap was relatively tight, which suggests losses were developing more slowly in the ILS market in November, at least.The best performing ILS fund was up by 1.1% in November 2021, while the worst performing was down by -0.8% for the month.After November, the average ILS fund return for the first eleven months of 2021 stood at 0.65%.

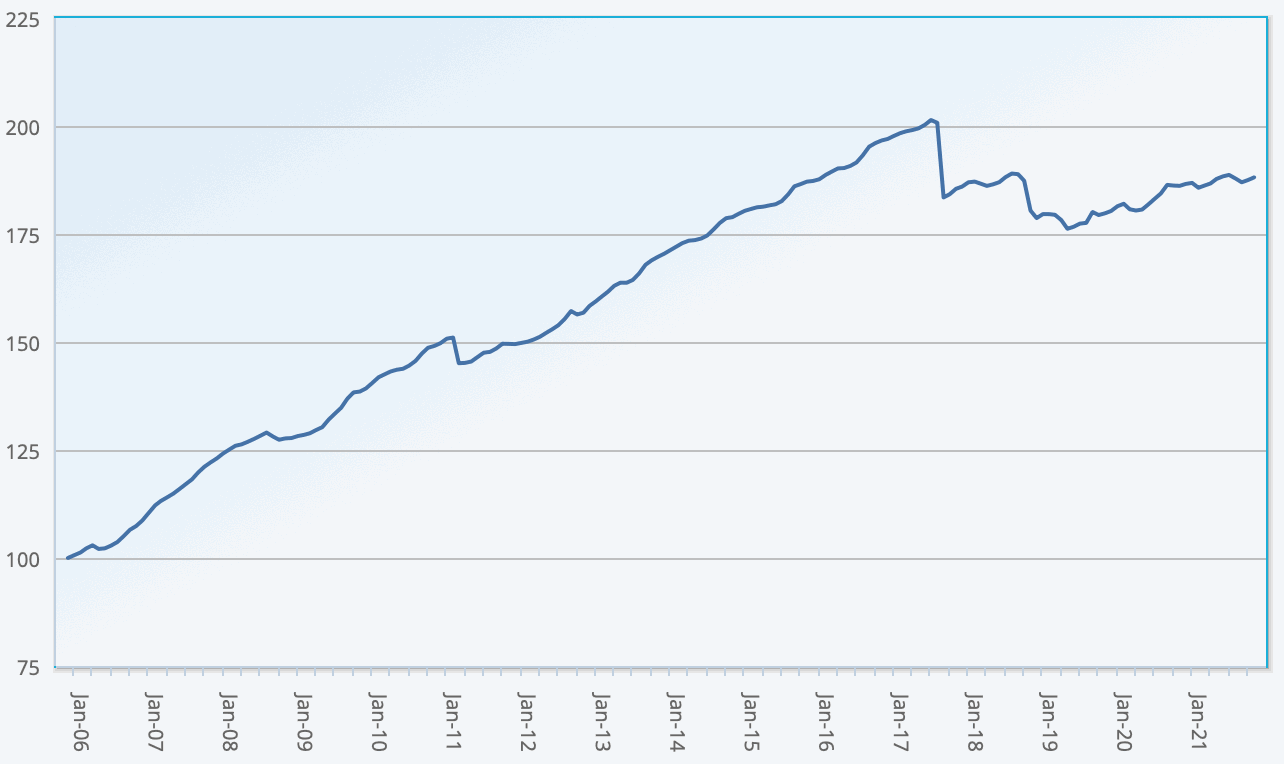

Depending on the impact of tornadoes and severe weather in December, it seems 2021 could at least be a positive year for this Index, despite the heavy catastrophe losses experienced.You can track the , including the USD hedged version of the index.It comprises an equally weighted index of 28 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.———————————————————————.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis