American Coastal Insurance Company (AmCoastal) has successfully renewed its core catastrophe reinsurance program for 2025/26 with first event limit now extending to an estimated higher $1.33 billion, as it secured 4% more in coverage for roughly $1.676 billion of occurrence-based limit in the aggregate.First-event limit of $1.33 billion is now 5.4% or $68.4 million higher than a year ago, while total occurrence reinsurance limit rose by $62.4 million at the 2025 renewal season.The core catastrophe program is designed for hurricane coverage in Florida, .Within the first-event hurricane reinsurance tower, AmCoastal has two outstanding catastrophe bonds under its Armor Re II Ltd.

program.Recall that, AmCoastal secured an upsized $200 million Florida named storm cat bond in April 2024, after which it returned to the market in December and sponsored another $200 million cat bond, Armor Re II Ltd.(Series 2024-2).

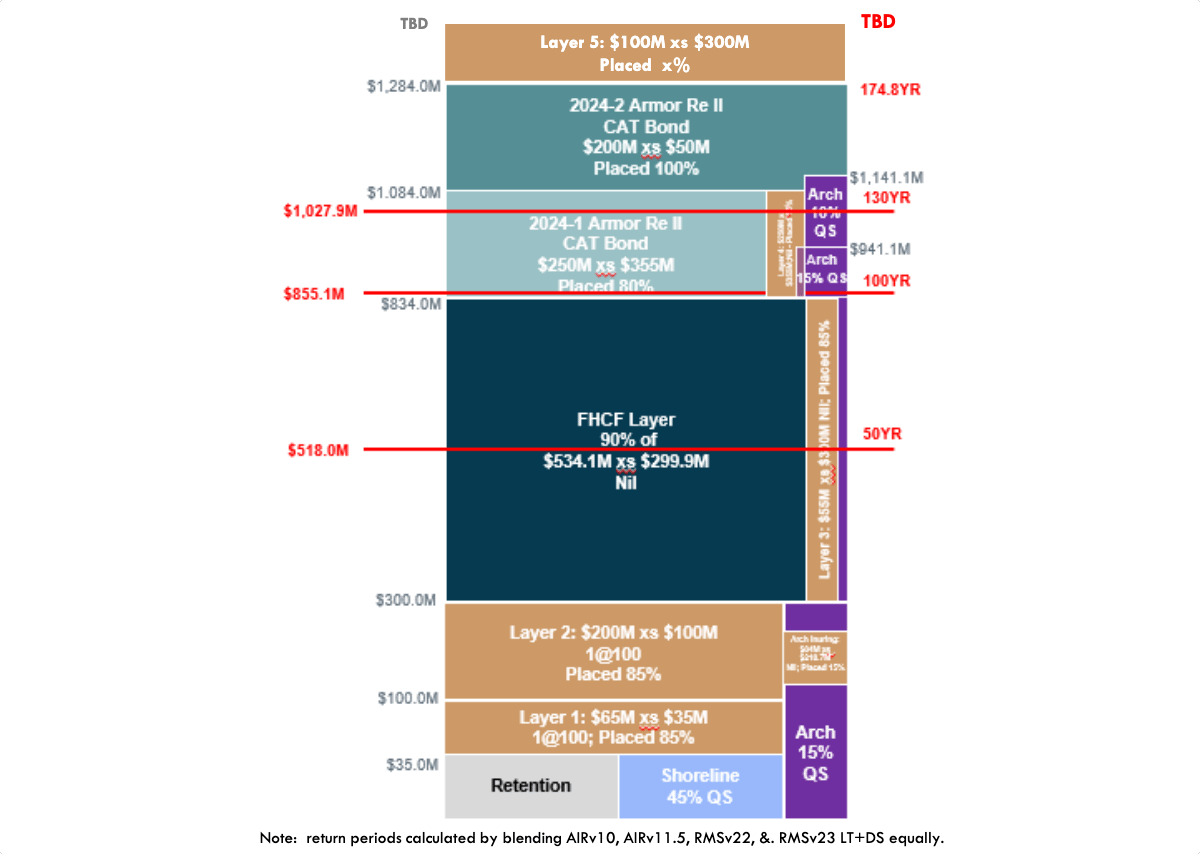

Read about and you can see where the insurer ranks by cat bond risk capital outstanding in our catastrophe bond sponsor leaderboard.With its new reinsurance tower now in place for the coming hurricane season, AmCoastal said it has sufficient coverage for approximately a 1-in-201-year event; and in excess of a 1-in-100-year event followed by a 1-in-50-year event in the same year.Retentions have risen, but the company has continued to use its own reinsurance captive to assist with that, with a first-event retention of $29.75 million, with $14 million retained by AmCoastal and $15.75 million retained by its captive, an increase of $9.25 million from the $20.5 million retention in force a year ago.

Second event retention has also risen, to $18.5 million assuming a 1-in-100-year event followed by a 1-in-50-year event in the same season, up $5.5 million from $13 million a year ago.AmCoastal also placed a 15% quota share coverage, which a recent disclosure of the tower cited as the “Arch Q/S”.The quota share arrangement is with an unaffiliated reinsurer holding an AM Best rating of A+, AmCoastal said, explaining that it covers all catastrophe perils and attritional losses, subject to defined occurrence and aggregate limitations.

The cost of the renewed reinsurance program for 2025/26 was approximately $201.85 million, which AmCoastal said reflects a “risk-adjusted open market rate decrease of (12.2)% from the 2024/25 Core CAT program.” AmCoastal disclosed its reinsurance tower while it was still being constructed earlier in May, with the diagram showing where the catastrophe bonds will attach for this coming hurricane season (see below).As you can see in the diagram above, the Armor Re II catastrophe bonds sit on top of one another, occupying shares of the layers from $834 million up to $1.284 billion.At the time of the disclosure of the tower earlier in May, the reinsurance renewal was still being finalised for AmCoastal, hence the top-layer was not detailed.

But the FHCF coverage has not changed from this diagram to the renewal completion at June 1st and the rest of it seems to remain as projected at that time..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis