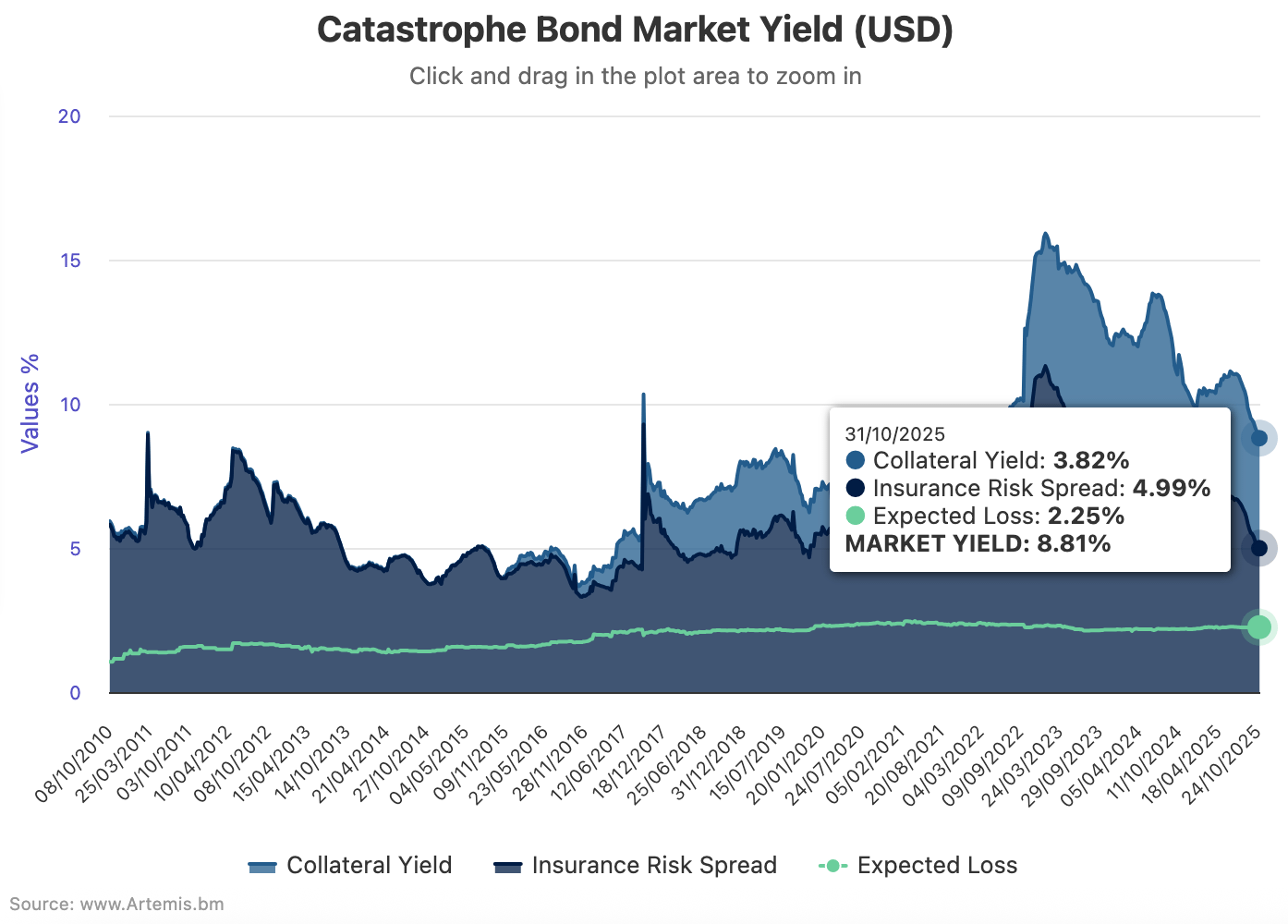

The declined to 8.81% as of October 31st 2025, falling back to levels last seen in June 2022, while the insurance risk spread, or discount margin, has now declined to its lowest point since November 2019, the latest data from Plenum Investments shows.Seasonal spread tightening continued to be a contributing factor, but so too was high investor demand for catastrophe bond investments, specialist cat bond manager Plenum explained.Hurricane-related seasonal effects have been the main pressure on catastrophe bond market yields since early July.Seasonality continued to lower the overall yield of the cat bond market through to late September, .

But supply-demand factors in a cat bond market with evidently high supply of capital at this time is also further pressuring yields it seems.The cat bond primary issuance market’s pricing has softened considerably over the last year, in-line with (or perhaps running somewhat ahead of), traditional catastrophe reinsurance rates-on-line.The had sat at 11.03% at the end of June 2025, then declined to 10.81% by August 1st, then 10.22% as of August 29th and further still to 9.43% as of September 26th.

By the end of October the decline had proved to be very persistent, with yields dropping to 8.81%.You can , which uses data kindly shared by Plenum Investments.While the tightening of cat bond market spreads and related reduction in yield has perhaps been more dramatic this year given other supply-demand dynamics, it is also resulting in very high catastrophe bond fund returns over recent months.

In fact, , which was particularly strong performance.October looks set to potentially see that figure beaten, at this stage.But notably, the overall cat bond market yield of 8.81% as of October 31st 2025, is now the lowest level in the data set since June 2022.

It is the insurance risk spread, or discount margin, of the catastrophe bond market that has been the main driver of the decline.Having declined to 5.48% at September 26th 2025, the insurance risk spread component of the catastrophe bond market yield fell further to 4.99% at October 31st 2025.It’s the first time the cat bond discount margin has dropped below 5% since November 2019.

We’ve remarked in recent articles on new catastrophe bond issues that pricing multiples of expected loss have in some cases declined to levels seen as long ago as 2019 in certain recent deals.The question is what happens next? At this time of the year we’d typically expect spread tightening to ease off, with the US wind season nearly over at which stage cat bond market yields would at the least become more stable.But amid 2024’s strong issuance activity risk spreads continued to compress into the end of the year and if that trend continues then we could see yields decline further, especially if the supply-demand of the catastrophe bond market remains imbalanced.

Which means issuance levels could be the determining factor, as unless it picks up (the final quarter of the year is not typically busy yet) there could be further spread compression ahead.Plenum Investments stated, “We expect demand to remain high, as the attractiveness of CAT bonds relative to interest rate markets persists.” If demand is to remain high, the market will need a meaningful increase in supply to become more balanced, it seems.Finally, the cat bond market yield has now fallen by around 21% since the same time last year, by Plenum’s data.

As we reported last week, , another sign of the tightening of the market environment..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis