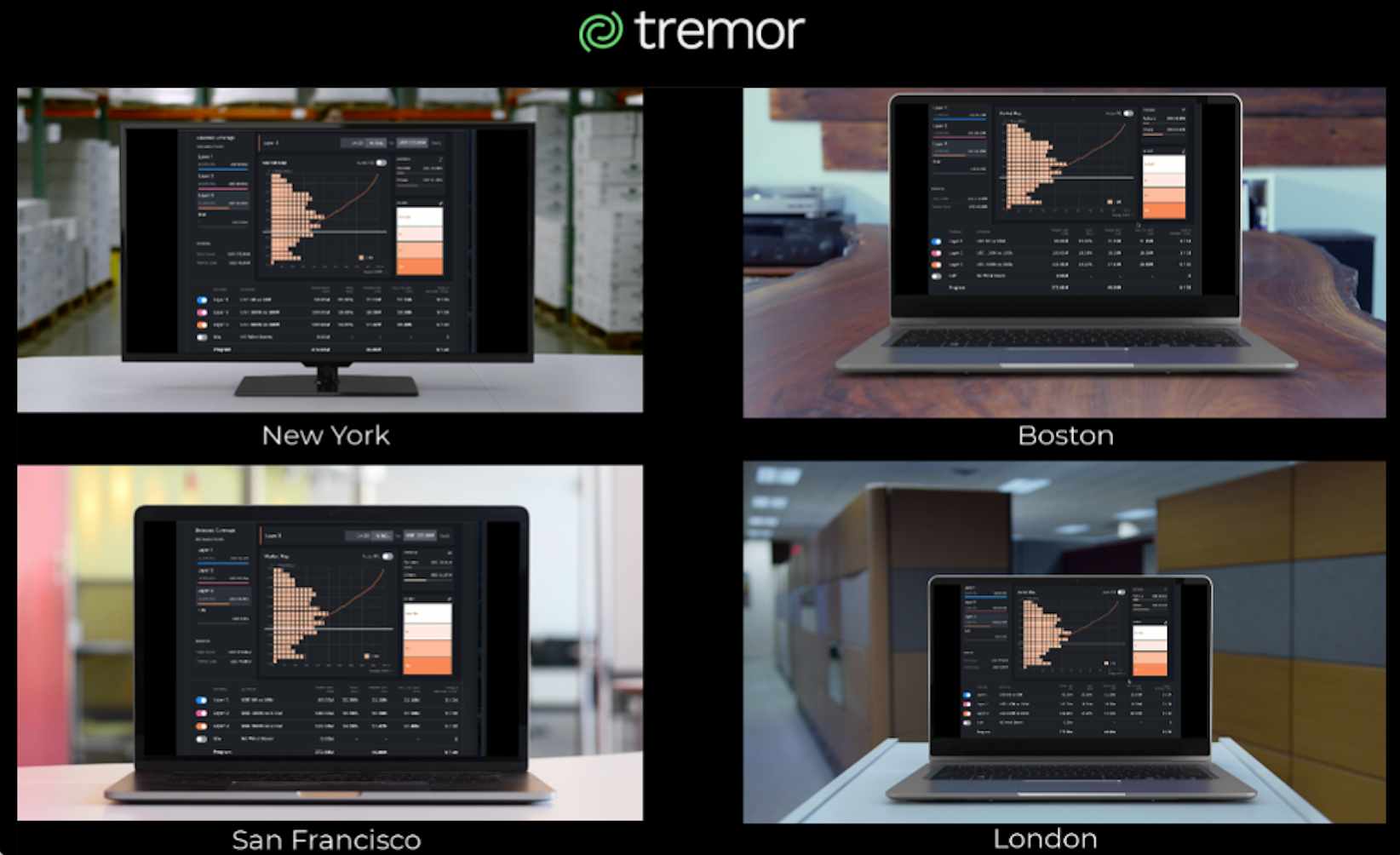

Tremor Technologies, the insurtech with a technology-based programmatic insurance and reinsurance risk transfer marketplace, has added another innovative feature to its software, now launching Tremor Blackboard a real-time collaboration tool so remote and global teams can work together on their reinsurance placements.Tremor Blackboard makes it possible for ceded reinsurance teams to collaborate on their placements no matter where they are in the world, something which is even more important in the post-peak pandemic world, where remote-working has become more widely accepted and physical markets and locations less important to getting the job of insurance, reinsurance and risk transfer done.This new collaboration functionality is available to users of Tremor’s risk transfer and reinsurance placement Marketplace 2.0 platform with no additional software required and at no additional cost.

It’s designed to provide another value-added tool to ceded reinsurance teams who often find themselves working across systems such as spreadsheets, email and faxes, as well as across time-zones, meaning they can collaborate in real-time to organise their placements.Using the Blackboard collaboration tool, cedents still have access to all of the pricing and allocation functionality of Tremor’s advanced marketplace software and access to all of the , but can now review various price, limit and terms scenarios no matter where the team is distributed to.It means that cedents staff can work on placements, tweaking options, limits and terms, together and live in Tremor’s application.

As a result teams can now test their assumptions, save scenarios, work together as a team to reach agreement on an optimal reinsurance or risk transfer placement.Impressively, given the real-time collaboration focus, the new feature means when one user makes a change in their account the entire team can see them live, instantly on their screens.Tremor calls this “A modern approach to reinsurance program management that saves time and effort while logging progress every step of the way with a complete audit trail.” The company sums up the benefits to cedents of this functionality as follows, “For insurance companies and their brokers spending weeks and weeks of time trading emails with spreadsheets trying to keep a single source of truth maintained, Tremor Blackboard is for you – no more email, no more spreadsheets and certainly no more faxes.

No more clunky Zoom screen sharing.No need to add even more software to your placement process.Error prone double entry of data is also eliminated.

“Put modern trading technology to work for you and use modern collaboration tools to review, discuss and finalize your reinsurance programs wherever you are in the world whenever you like.Your reinsurance program is at your entire team’s fingertips and always up to date, 24/7, 7 days a week.” This is just the latest enhancement to Tremor’s risk transfer and reinsurance marketplace, as the insurtech continues to deliver additional value to users.Collaboration is absolutely key in the post-peak pandemic world we find ourselves in and Tremor is and responding appropriately, delivering functionality that can essentially make a reinsurance buying team’s job easier and ultimately reduce the friction around reinsurance placements, as well as some of the effort and even costs.———————————————————————.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis