MGIC Investment Corporation has successfully leveraged investor demand to upsize its latest sponsorship of mortgage insurance-linked securities (ILS), securing $330.2 million of reinsurance for its Mortgage Guaranty Insurance Corporation unit through the issuance.Reflecting much-improved conditions for issuance of mortgage insurance-linked securities (ILS), MGIC saw its latest deal upsize from its initial target of $290 million.All four tranches of mortgage insurance-linked notes that were offered have been upsized, demonstrating investor demand across the risk spectrum that was on offer with this deal.

For MGIC, this is the seventh time it has successfully taped capital market investor appetite to secure reinsurance for its Mortgage Guaranty Insurance Corporation unit through a Home Re mortgage ILS issuance..Mortgage ILS issuance has picked up recently, with now four transactions launched in just a few months.

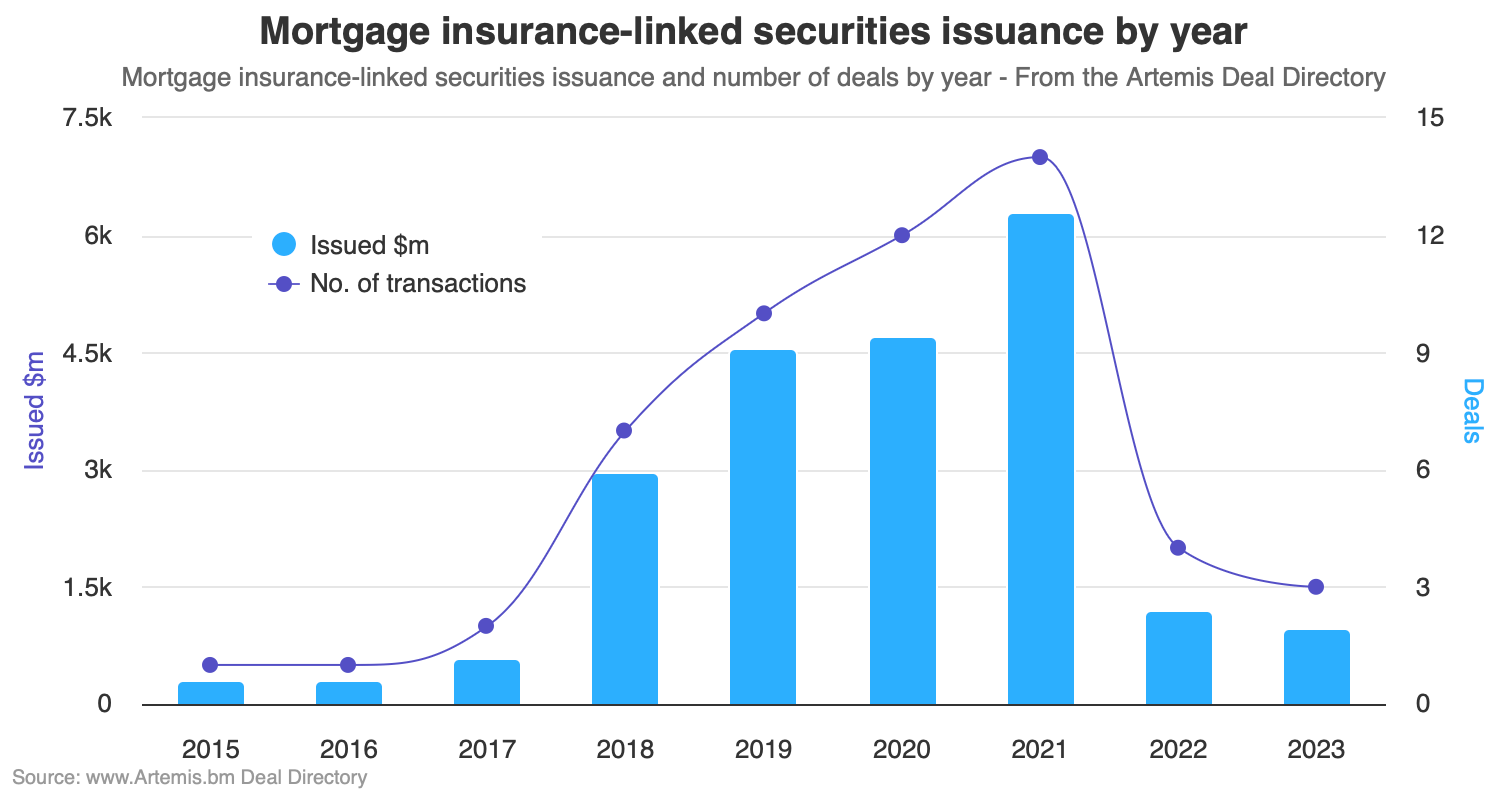

As a result, issuance of mortgage insurance-linked securities (ILS) in 2023 is now catching the annual total from last year.However, as you can see from the chart above (which you can ), issuance of mortgage insurance-linked notes remains far below the levels seen in 2021 and years prior.For MGIC, the completion of its latest Home Re mortgage ILS now means the company has .

With investor appetite for mortgage insurance-linked investments clearly risen in recent months, it will be interesting to see how much activity there is over the coming months.The resurgence of activity in the mortgage ILS space has been driven both by a calming in certain capital markets, after a period of volatility, as well as the fact recent issuances have priced more keenly and upsized, which is now helping interest to build again amongst sponsors, as the spread to pay for capital markets backed mortgage reinsurance is perceived to have fallen somewhat.At the same time, for investors, these offer a floating rate investment opportunity and an alternative fixed income instrument, which at this time is viewed as attractive on a relative basis.

You can read all about the mortgage insurance-linked securities transaction and every other mortgage ILS deal in our specific directory of mortgage ILS deals, as well as in our all-encompassing ..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis