Look: Buying life insurance isn’t like buying a shirt or a computer.You’ll likely own your policy and be paying on it for 1o to 30 years (or more), so don’t rush in without reading these critical tips.I’ve been an agent for a long time. These are the tips I’d give my own mother.

Term life insurance is the right choice for most people.It offers low-cost protection for a set period like 10, 20, or 30 years.You can use term life insurance to: replace your income to your family if you passpay off debts like a mortgage or credit card debtget coverage on a non-working spouse… and more! When you hear the radio commercials announcing you can get $500,000 of coverage for $24 per month, they’re quoting you on term life insurance.

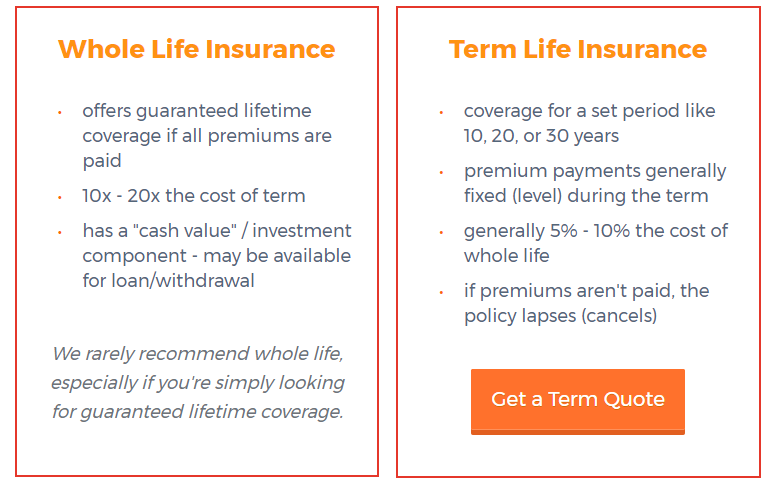

My recommendation? For the absolute lowest price anywhere, get a quote from AIG Direct. (Best rates typically require a medical exam) If you want to skip the exam, get a quote from Bestow.What about Whole Life Insurance? Very few people need coverage for their entire lives (It’s typically only needed for estate planning) and permanent plans cost 10 to 20x as much. So stick with term! Some companies have an ideal clientele and you may not be their ideal client. For example, say you smoke marijuana or smoke cigars or a pipe… Most companies will charge you smoker rates (costs 2-3x as much as non-smoker rates).But not all… That’s where you need an independent agency. They have access to multiple companies and a good agency will place you with the right company and save you a ton of money! You need to talk to an independent agency IF: You are EXTREMELY healthy – As in, you can run a sub-8-minute mile and have zero health concernsYou have medical conditions – Anything from asthma, to diabetes, to heart health history, to obesity, to high blood pressure or cholesterol and so on.You are over 70 years oldYou smoke marijuana or any form of tobaccoYou have a history of family disease such as cancer or heart disease in either parent or siblingYou travel or work outside the U.S.You participate in dangerous activities such as scuba diving, racing, hang gliding, parachuting, mountaineering, etc.If any of these apply to you, you need to be VERY careful what company you buy life insurance from.

You could overpay by 25% to 50% easily if you don’t use an independent agency.The best independent agencies: One of our favorite independent agencies is AIG Direct. Click here to get a guote from AIG Direct. If you’re in excellent health (you eat great or maybe you do yoga or run or cycle), then Health IQ is the specialty company for you. They have special rate life insurance for the health concious.Most agents will tell you the best way to get a the lowest price is to take a medical exam.

Think about it… If the company has your blood and urine, they know quite a bit about your health. It makes you less risky so they can charge you less.The problem? What if you think you’re healthy but something is going on “behind the curtains?” That’s what happened to me the first time I bought life insurance. I had super-high cholesterol (even though I was 27 and felt great). I took an exam and ended up paying 50% more because I took the exam.Taking a medical exam could have the same negative impact on you.

The solution? Get some “no exam” coverage in place first.As long as you’re healthy to the best of your knowledge, you can typically qualify! It costs a bit more (usually 10% to 20% more) but it’s super quick and convenient. You can buy it online from Bestow in minutes.Once you get it in place, there’s nothing stopping you from trying to then replace it with a lower cost policy that requires an exam.

My advice? Unless you have some of the special circumstances I mentioned in #2 above, get a policy from Bestow before you attempt to get a “low-cost” policy that requires an exam.Here’s the way I look at it: You could be paying on your life insurance for 30 years or more. A monthly difference of just 5% could save you hundreds or even thousands of dollars over the life of the policy! The solution is simple… Get more than one quote! Here are our top 3 companies: AIG Direct – Best for the absolute lowest rates or with health conditionsBestow – Best for no-exam plans up to age 55Health IQ – Best for the health conciousI’ve been an agent for over 15 years now. Over that time, I’ve worked with (and reviewed) a LOT of companies. Believe me… you’ll be in great hands with any of the three above.A rider is an additional policy feature you typically have to pay a bit extra for.

In the post-Covid world, some of these are hugely important.A few of my favorites: Guaranteed Insurability Rider – Some plans allow the owner to purchase additional coverage without the need to demonstrate insurability.In other words, no medical underwriting is required. For example, during Covid, people who were sick could add some coverage even if they had the virus! Waiver of Premium – Many people are paying for a waiver of premium rider without even realizing it. If they become disabled or very sick, they can exercise this rider and put a pause on their premium payments. In the event of a lifelong disability, they may never have to pay another life insurance premium.

Child Rider – If you have children, you can typically add coverage on them for up to $10,000 (some companies go higher) without them needing a medical exam. It’s really inexpensive and most of the companies who offer it charge the same amount regardless of how many children you have. So if you have 10 kids, you’ll pay the same as your fruitfully challenged neighbor who only has one! Accelerated Death Benefits for Chronic or Terminal Illness – many companies allow you to take out a portion of your life insurance death benefit while you’re still living (aka, “accelerate” the death benefit) if you have a chronic illness or are confined to nursing home, or require at-home care.I highly recommend searching for policies with these features.When you shop online and just buy the first thing you see, a lot of those companies don’t offer these.

My opinion: It’s worth getting a quote from an agency like AIG Direct so you can speak to an agent about placing you with a company who may have some of the riders above.Good luck! *While we make every effort to keep our site updated, please be aware that "timely" information on this page, such as quote estimates, or pertinent details about companies, may only be accurate as of its last edit day.Huntley Wealth & Insurance Services and its representatives do not give legal or tax advice.

Please consult your own legal or tax adviser.

Publisher: Insurance Blog by Chris