AI and data-driven technologies can help insurers win the hearts and minds of their customers Toronto, ON (Nov.25, 2020) – Traditionally, insurers didn’t need to be overly concerned about how they were perceived by their customers.Whether insurance was mandatory, such as auto or health insurance in many countries, or a basic necessity to secure financial health in case of personal catastrophes, the industry focused more on selling the coverage than providing great customer service afterward.

But times have changed.Due to the proliferation of the internet and social media, customers can easily exchange information about the brands they do business with, their products, and the quality of customer service those brands provide after the deal has closed.Market power has shifted to the consumer.

In essence, insurance has moved away from being a product that is sold to one that is bought, and the right CX drives that purchasing decision.85% of insurers are deploying CX initiatives throughout the customer journey.Today, customers compare and contrast all manner of service providers, and insurers are increasingly seen through the lens of an informed consumer whose last great experience may have been with an online retailer.

Insurers are now being compared against the best CX from other industries—not just other insurers.Under such heightened scrutiny, how do today’s insurers fare in the minds of consumers? And how do insurers see themselves and their progress in customer experience matters? Under such heightened scrutiny, how do today’s insurers fare in the minds of consumers? To better understand the answers to these questions, the IBM Institute for Business Value (IBV) interviewed 1,100 insurance executives in 34 countries regarding their CX initiatives and corresponding key performance indicators (KPIs).We augmented this data with a survey of more than 10,000 consumers across nine countries to hear the customer side of the story.

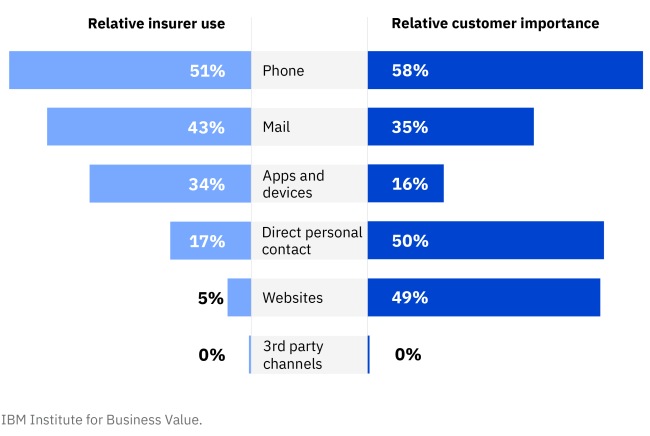

Both surveys were conducted during the COVID-19 pandemic and reflect the specific experiences in these times.The future of the Insurance customer experience If insurers wish to improve on the CX front, realistic assessments of their capabilities are necessary, and they need to meet customers at their preferred contact points.In their engagement with insurers, consumers highly value contact by phone, in person, or digitally via the web.

These channels provide quick interactions and responses, and seamless connections.Yet, instead of pursuing an omnichannel approach, many insurers continue to engage primarily by phone and traditional mail.The latter is relatively expensive and makes seamless integration difficult, requiring several steps to digitize, analyze, and integrate communications.

Investment in digital front office transformation would better align insurers with their customers’ engagement needs and improve cost efficiency.Insurers still rely on old-school communication channels to engage customers Read the full report to learn how a combination of technology investments and strong emotional connections can help insurers build trust, boost satisfaction, and increase retention with their customers.Download the report.

About the study — approach and methodology In cooperation with Oxford Economics, the IBM Institute for Business Value (IBV) surveyed 1,100 business insurance executives in 34 countries globally from May to July 2020.All participants were asked a range of questions specifically both for their organization and the line of business they represent; questions center on KPIs influences by customer experience initiatives and tools, as well as the qualitative measure around customer experience itself.Additionally, and in the same timeframe, we surveyed 10,061 insurance customers in 9 countries, with a minimum of 900 respondents in each country: China (1,800 respondents), India, US (1,800 respondents), Canada, Brazil, UK, France, Germany, and the Netherlands.

Consumers were asked similar questions to the insurance executives, but from the consumer viewpoint.About IBM IBM (NYSE: IBM) is one of the largest technology, services and consulting organizations.We help clients of all sizes and in all industries transform their operations through the use of technology, infusing intelligence into the systems that run our businesses, our society and the world.

Visit www.ibm.ca for more information.Tags: Artificial Intelligence (AI), Big Data, BV, coronavirus, customer experience (CX), epidemic, IBM, satisfaction, survey

Publisher: Insurance Canada