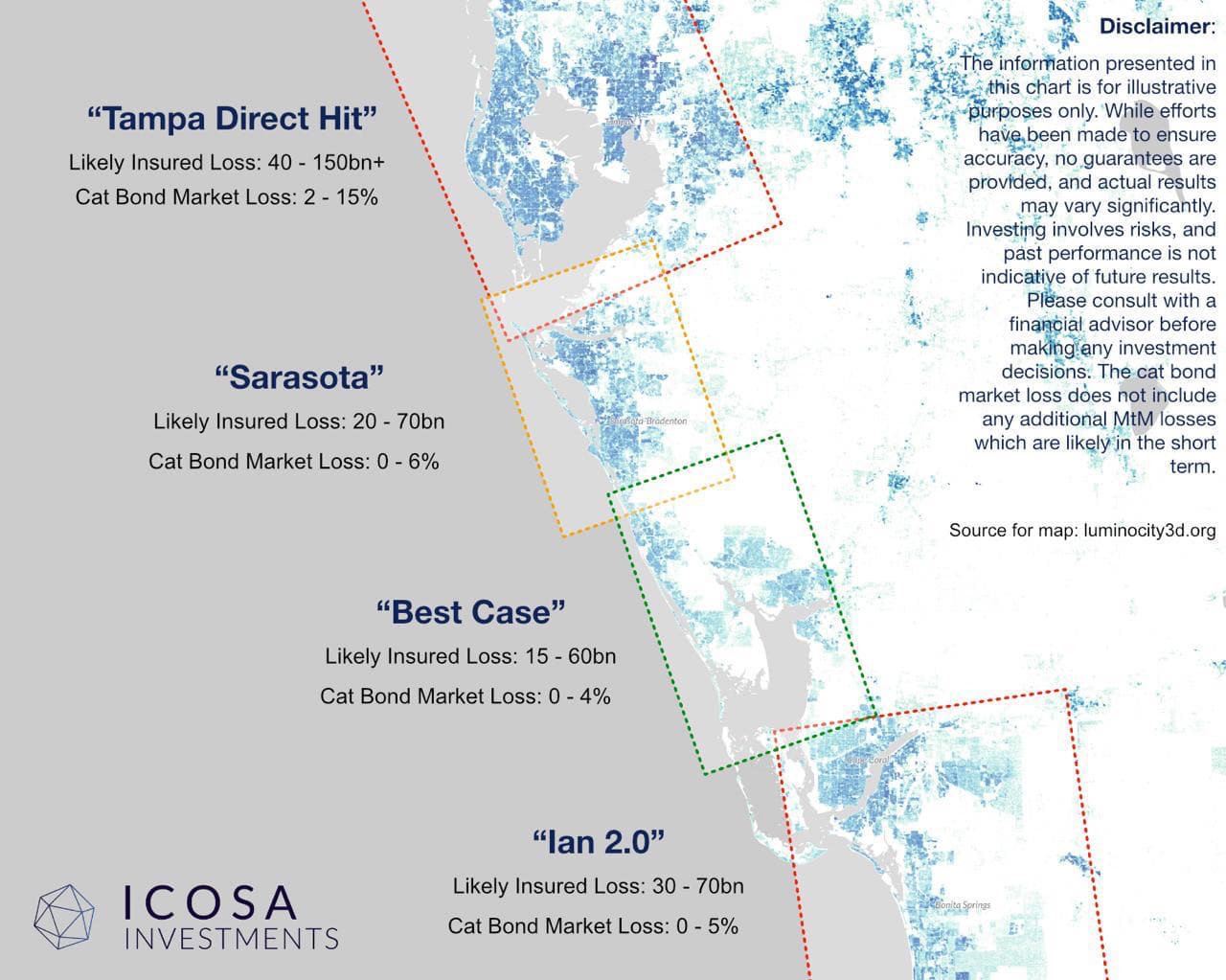

Catastrophe bond fund manager Icosa Investments has published some scenario modelling outputs that show the difference between best and worst case hurricane Milton losses, ranging from industry losses of $15bn to $150bn+, with the hit to the cat bond market anything from zero to as much as 15%.Icosa Investments scenarios range from a hurricane Ian 2.0 to the south, to a direct hit on Tampa further north, with two additional scenarios in between.What’s particularly telling is that the range of expected catastrophe bond market losses begins at zero for three of the scenarios, while it’s only the direct Tampa Bay area landfall where cat bond market losses would start from 2%.

You can see the scenarios in the graphic below: Underscoring the considerable uncertainty that remains and depends on the landfall location, intensity and path of hurricane Milton, the cat bond fund managers’ projections range from an insurance industry loss as low as $15 billion to more than $150 billion, with a corresponding catastrophe bond market hit ranging from 0% to 15%.As we’ve reported already today, if hurricane Milton’s losses end up being around the Ian level or lower, then it feels safe to assume most or all catastrophe bond funds will absorb the losses within their current year returns, with only higher-risk private ILS and collateralized reinsurance strategies seeing their full-year returns eroded by the storm.But, something in the higher end of these scenarios and the more direct Tampa hit would be more impactful to ILS strategies.

Icosa Investments explained, “To assist investors in navigating the potential newsflow around Hurricane Milton’s landfall in the next 24 hours, we’ve outlined several scenarios to illustrate how the insurance and cat bond markets might be impacted.The range of outcomes is broad, from an almost non-event for investors to a major catastrophe with potential losses exceeding $100bn.“Additionally, we’ve observed several cat bonds trading in the secondary market at significantly wider spreads than their previous valuations, suggesting a potential additional mark-to-market impact in Friday’s valuation prices.

For context: Hurricane Ian resulted in around a -10% impact on the Swiss Re Cat Bond Index, while Hurricane Irma, when expected to make landfall in Miami, caused an initial -15% impact before rebounding.” Florian Steiger, CEO of Icosa Investments added, “With less than 24 hours to Hurricane Milton’s landfall, a wide range of outcomes remains possible.From a major, industry-changing event with widespread effects on cat bond investors to a nearly benign scenario with minimal losses (excluding mark-to-market impacts), everything is still on the table.“The uncertainty persists, not only about the exact landfall location but also regarding the storm’s intensity at landfall and the extent of the storm surge.

This makes it impossible to provide any credible point estimate at this stage.Instead, we focus on outlining possible ranges, including scenarios with potentially high impact.” – .– .

– .– .– .

– .– .– .

– .– .– .

– .– .– .

– ..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis