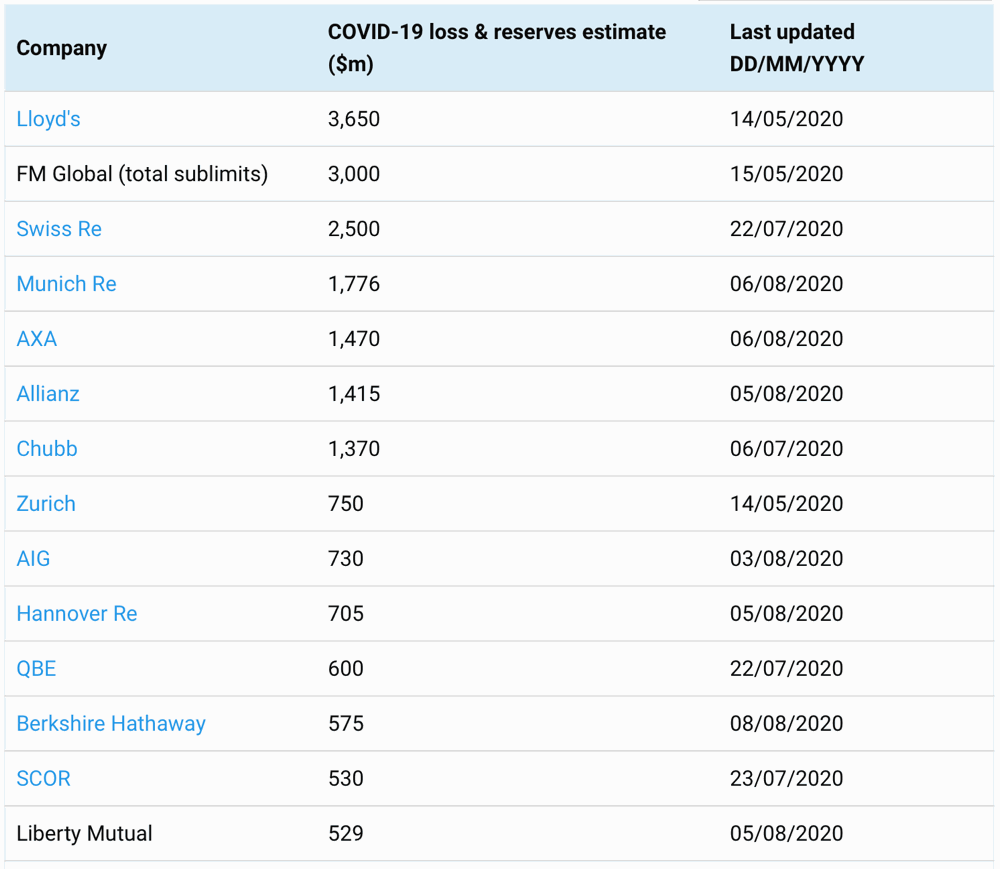

P&C insurance and reinsurance company reported losses and IBNR reserves related to the COVID-19 coronavirus pandemic have now reached almost $25 billion, according to data collected by advisory PeriStrat LLC and augmented by our own research.The second-quarter earnings season has added almost $4.5 billion to the total .Zurich-based PeriStrat LLC, operated by Hans-Joachim Guenther, aggregates publicly available loss reports from insurance and reinsurance companies to give a picture of how the Covid-19 industry loss impact is developing.

We’ve been augmenting that as well, alongside our reporting on re/insurer results and feeding that back to Guenther, giving us a picture of Covid-19 loss and reserve development for the property and casualty re/insurance market.Re/insurers have been embracing different strategies in how the report their losses from Covid-19.Some have taken to analysing their books and trying to forecast their expected total losses from the pandemic as incurred but not reported (IBNR) reserves, while others are only reporting actual claims filed so far.

It means some re/insurance companies haven’t updated their Covid-19 loss estimates at the second-quarter results season, while others are set to continue drip-feeding Covid losses in the coming two quarters as well.While the total of almost $25 billion is still far below the industry loss estimate mid-point of around $50bn-60bn, it is expected that further increases will come in time.Also, it’s unlikely any re/insurers have tried to factor in potential exposure in casualty lines of business (thinking areas like employers liability) and so far estimates tend to be based on all of the business interruption litigation being won by the industry.

Those are two factors that could elevate the P&C sectors Covid-19 loss burden over time, in addition to which we understand that trade credit insurance and also reinsurance, particularly in Europe, remains an area of potential additional losses.So there remains a significant amount of uncertainty over how high the total could be once all claims are realised.In addition, second waves of the coronavirus pandemic also have the potential to drive more losses and this could also .

So we’re unlikely to have a clearer picture of the size of the industries loss burden due to the Covid-19 pandemic at least until after the full-year 2020 results are reported, perhaps much longer if the pandemic develops a sting in its tail.END.———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis