Twelve Capital has analysed what it can mean for a traditional 60/40 stocks and bonds investment portfolio when catastrophe bonds are added to the mix, finding even a modest cat bond allocation can improve returns and risk metrics.Specialist catastrophe bond, insurance-linked securities (ILS) and re/insurance investment manager Twelve Capital had previously looked at the benefits of incorporating insurance subordinated debt into a traditional 60/40 portfolio, where 60% is allocated to stocks and 40% to global bonds.In that case, the investment manager found the inclusion of insurance subordinated debt was beneficial and enhanced portfolio efficiency, allowing for greater optimisation of portfolios while enhancing return and Sharpe Ratio, all while maintaining the risk level.Now, Twelve Capital has undertaken a similar analysis on the effects of incorporating catastrophe bonds into a 60/40 portfolio.

“Due to their low correlation with traditional financial markets, Cat Bonds provide an efficient tool for optimizing an investor’s risk/return profile,” the investment manager explained.Adding, “Our research indicates that even modest allocations to Cat Bonds can significantly improve both returns and risk metrics.“For example, when looking at publicly available indexes over the past 10 years, a 10% allocation to Cat Bonds has increased the Sharpe Ratio from 0.63 in a traditional 60/40 portfolio to 0.74.

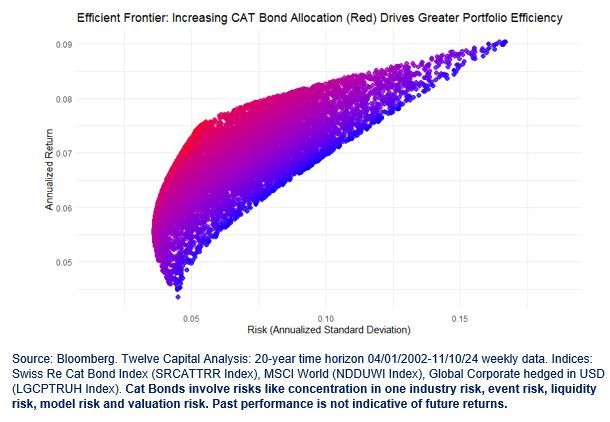

A similar, though more modest, improvement is observed with a 5% allocation to Cat Bonds.” The investment manager continued to explain that, “Furthermore, for similar level of returns, Cat Bonds can contribute to a reduction in overall portfolio risk as highlighted by our analysis, which uses randomly simulated portfolios, and can be observed in the image below.” Twelve Capital also said, “Cat Bonds offer several compelling features that make them an attractive addition to institutional portfolios, including short duration, minimized credit risk, and attractive spreads.These spreads have surged in the wake of recent years’ large-scale catastrophes, now sitting well above those of High Yield Bonds and other alternative asset classes.“While we acknowledge the differing liquidity levels across asset classes, we are encouraged by the rapid growth of the Cat Bond market, which will support progressively larger allocations in institutional portfolios.”.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis