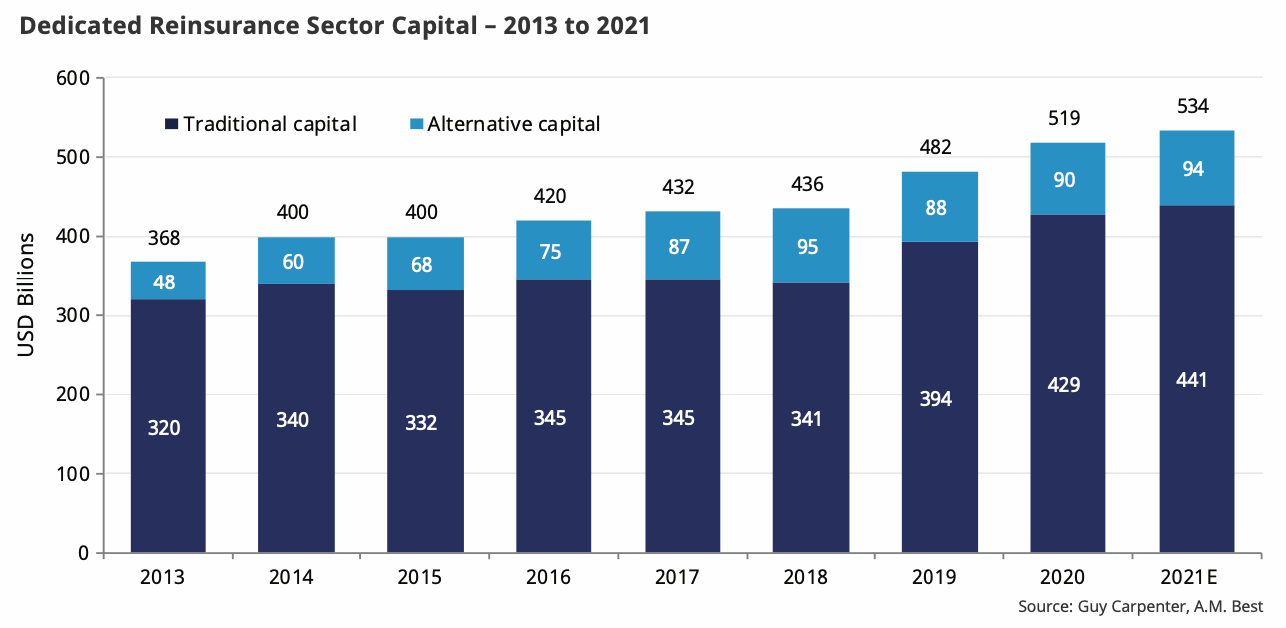

Alternative reinsurance capital levels in the global industry grew 3.7% over the course of 2021, outpacing the 2.7% growth of traditional reinsurance industry capital, according to the latest estimate from broker Guy Carpenter and rating agency AM Best.However, within the overall dedicated reinsurance sector capital estimate of $534 billion at the end of 2021, Guy Carpenter and AM Best note that there is still a significant amount of trapped insurance-linked securities (ILS) collateral included there.The latest data from the reinsurance broker and rating agency can be seen below: As you can see in the above chart, from Guy Carpenter’s latest reinsurance renewals report, overall dedicated reinsurance capital expanded from $519 billion to $534 billion, growth of 2.8%.

Traditional reinsurance capital grew from $429 billion at the end of 2020, to reach $441 billion at the end of 2021, a rise of 2.7%.But, alternative reinsurance capital, which is really insurance-linked securities (ILS) market capital, so collateralized reinsurance, catastrophe bond and sidecar capital, expanded by 3.7%, from just over $90 billion at the end of 2020 to almost an estimated $94 billion.The $94 billion is likely a higher figure than many would have ventured for ILS capital at this time, given the well-documented impacts of catastrophe losses again in 2021.

But it likely reflects .It also doesn’t factor in trapped capital and interestingly, Guy Carpenter explains that it estimates that “trapped capital is less than 5% of overall dedicated reinsurance capital.” 5% of the global dedicated reinsurance market, at the $534 billion size, would be approximately $26.7 billion.It seems sensible therefore to assume that less than this figure is currently trapped after the challenging catastrophe loss year of 2021, as well as prior loss activity.

Guy Carpenter’s estimate does suggest though that, it may be reasonable to assume that around a quarter of ILS capital is trapped following 2021, but this too could be a bit of a high proportion and our sources and research suggest the figure is likely somewhere between $15 billion and $20 billion.Which is still a significant proportion of the ILS market’s available capital and a key driver for dislocation experienced at .Despite all of the significant market losses, which have driven another above-average year of catastrophe losses in 2021, Guy Carpenter said that “dedicated reinsurance capital continues to increase to meet the industry’s needs.” ———————————————————————.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis