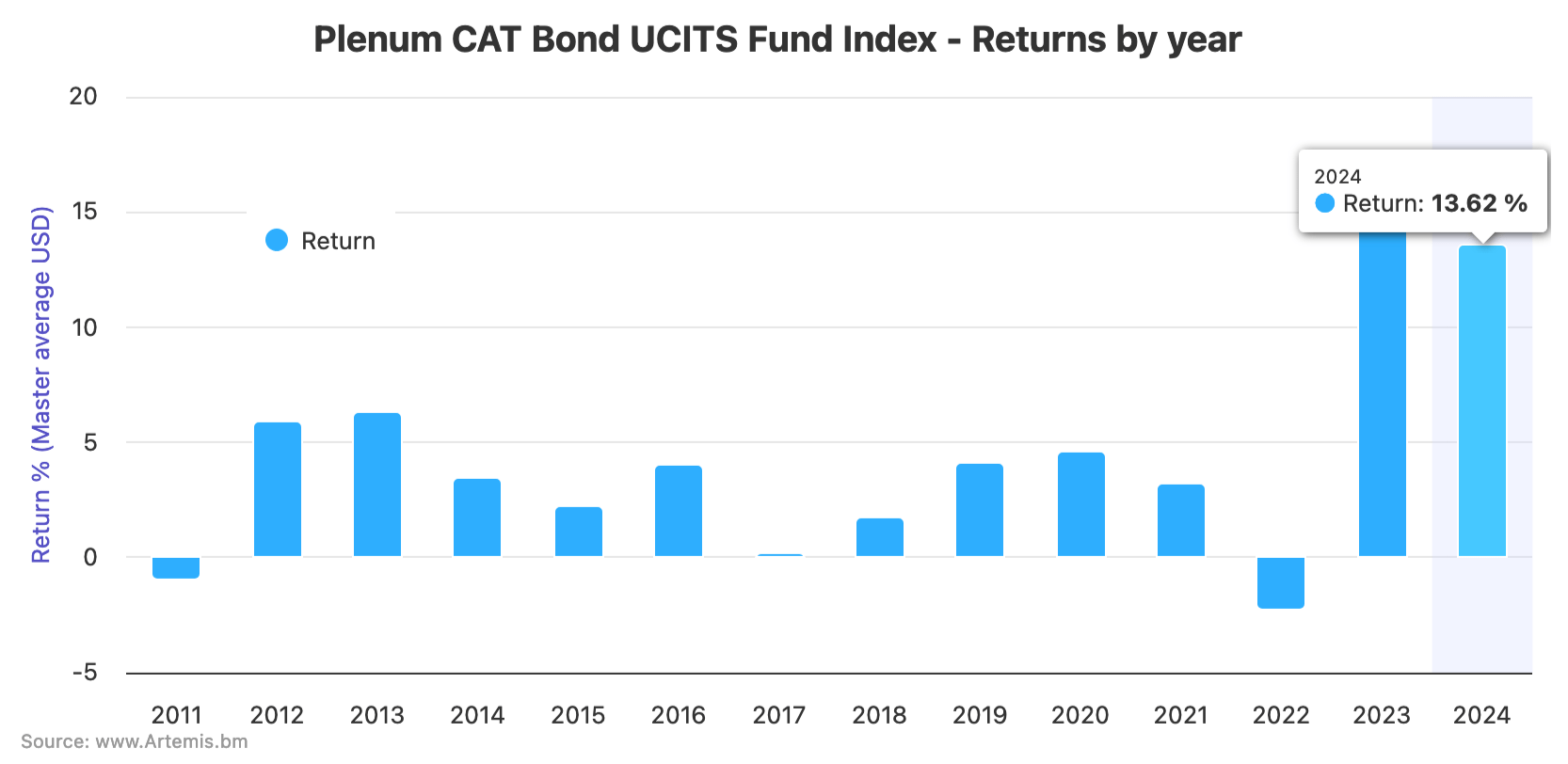

Catastrophe bond fund strategies in the UCITS format have averaged a 13.62% return for full-year 2024, according to the latest data from the .While this is behind the record returns achieved in 2023, it remains historically very high and more than double the previous annual high of 6.28% in 2013.Catastrophe bond funds continued to benefit from significant coupon returns generated from their investments and the fact the majority of global natural catastrophe loss events did not trouble any cat bond backed reinsurance or retrocession arrangements in 2024.

While there were some mark-to-market impacts to certain cat bonds from hurricanes Helene and Milton, the realised losses are likely to be minimal, to non-existent, for the majority of cat bond fund strategies.While 2023 had seen the UCITS catastrophe bond fund segment deliver a higher 14.88% return for the year, it’s important to remember that mark-to-market recoveries of certain cat bond positions after hurricane Ian from September 2022 drove more than a percentage point of benefit to the majority of cat bond fund strategies that year.As a result, the 13.62% annual return for the closest data points to full-year 2024, so running from December 30th 2023 to December 27th 2024, was very impressive and underscores the attractive returns possible in catastrophe bond fund investments at this time.

The 13.62% annual return is the figure for the Master Average index calculated by Plenum Investments.The Master Capital weighted index return was 14.01% for the same period.The Low-Risk average return, for UCITS catastrophe bond funds with a lower expected loss, was 13.11%, while the High-Risk UCITS cat bond fund index average return for 2024 was 14%.

From data seen by Artemis, there were some UCITS catastrophe bond fund strategies that achieved a return of more than 15% for 2024, but the majority of these UCITS cat bond fund strategies appeared to range between 11% and 14% returns for the year.The funds ended 2024 with a strong performance for December, generating an average return of 0.93% across the segment, but with the higher-risk group of UCITS cat bond funds averaging 1.12% for the period.As 2025 begins it will be interesting to see how these catastrophe bond fund indices perform, as with spreads still historically elevated for the majority of the outstanding market there is another chance that returns are attractive by historical standards for the cat bond asset class.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis