As catastrophe risk models for assessing wildfires continue to advance, and as the industry experiences ongoing refinements in pricing and coverage through lessons learned from each new fire season, are anticipated to persist as a permanent and growing feature of the cat bond market, according to Acrisure Re.In a recent report released by firm, analysts note that California’s growing wildfire exposure, combined with investor demand for diversification and advances in risk modelling, has driven the rapid maturation of the wildfire cat bond market.“Since the inaugural USD 200 million issuance in 2018, the segment has expanded significantly—by 2025, wildfire-linked cat bonds represent record issuance volumes and have become a mainstream component of insurance-linked securities (ILS) portfolios,” Acrisure Re explains.Recall that 2025 began with the devastating wildfires that struck the Los Angeles region of California, which went on to become the most costly wildfire event ever to hit the global insurance and reinsurance industry, with the estimated $40 billion of market losses also having an impact on some insurance-linked securities (ILS) funds.

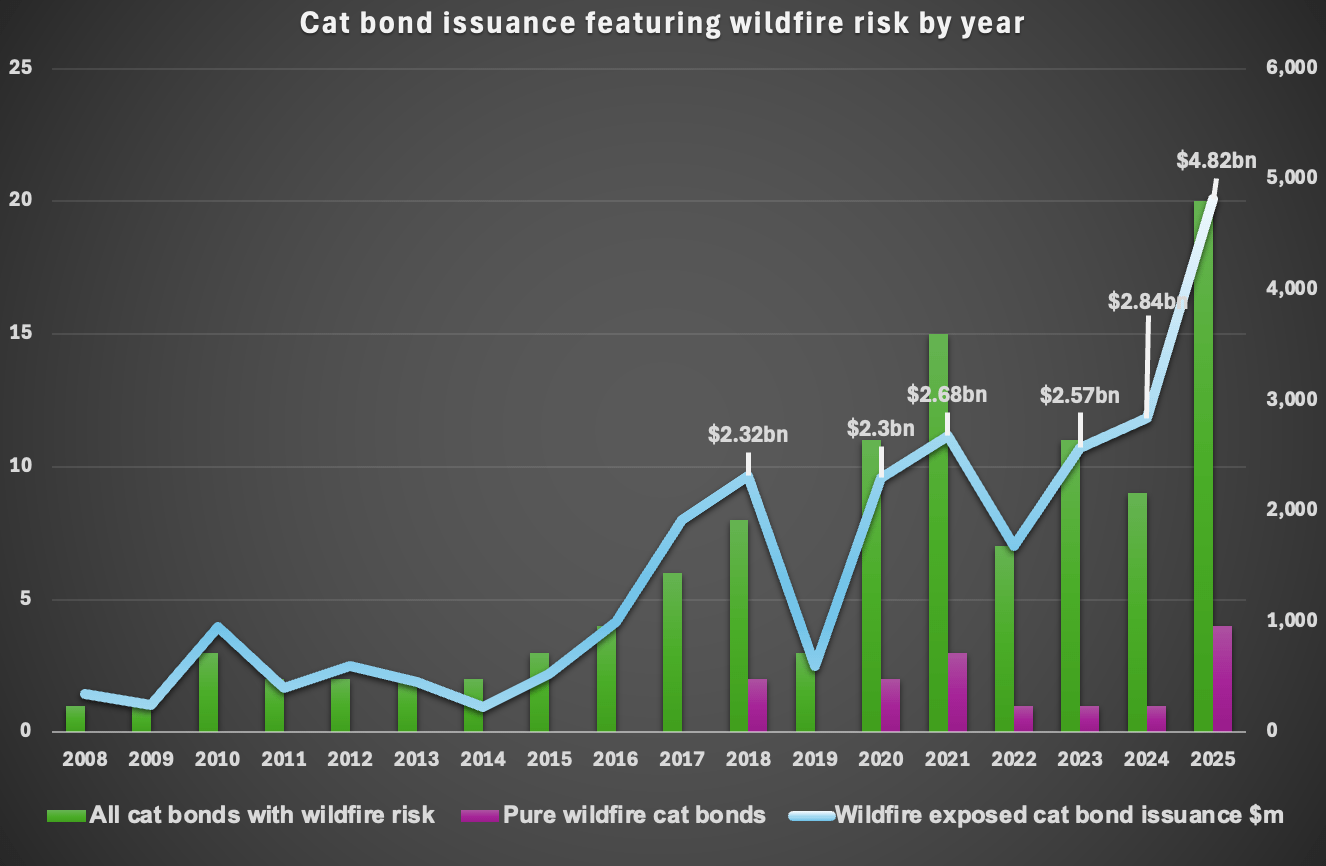

However, the event clearly exposed the challenges that California’s property insurance market has faced in recent years and particularly drove home the need for efficient reinsurance risk capital to support underwriting operations there.Year-to-date, we’ve tracked and analysed some $4.82 billion of new catastrophe bond issuance that has an exposure to wildfire risk, which beats the previous highest full-year total of $2.84 billion of wildfire exposed cat bonds tracked by Artemis in 2024.The chart below shows how wildfire exposure has come to the cat bond market over the years.

As you can see from the chart below, currently we have analysed and tracked 20 catastrophe bonds that cover the wildfire peril in 2025.While four pure wildfire cat bonds have been issued so far this year, a record number, which includes the California FAIR Plan Association’s current $250 million deal that has yet to be priced and could still upsize.Moreover, Acrisure Re states that “the evolution of California wildfire cat bonds illustrates how the ILS market can adapt to emerging risks.” “What began as an experimental structure has matured into a vital risk-transfer mechanism that strengthens the resilience of both the insurance sector and local communities.

With continued modelling improvements and structural refinements, wildfire cat bonds are poised to remain a permanent and expanding feature of the global catastrophe bond landscape.” Analysts highlighted that for a number of years, wildfire risk was considered to be poorly modeled, with particular events throughout 2017 to 2020 critically exposing gaps in the older models that were being used within the industry, as they had underpredicted the frequency of extreme urban conflagrations fueled by climate change.“In response, the major modeling firms (AIR Worldwide, now part of Verisk, and RMS, now Moody’s) have significantly upgraded their U.S.wildfire models in recent releases.

These advancements have given both (re)insurers and ILS investors greater confidence in quantifying wildfire risk, which directly supports more cat bond activity,” Acrisure Re said.The firm continued: “From an ILS perspective, the impact of better modeling is profound.Cat bond investors rely on modelled expected loss and probability metrics to price the bonds.

If the models systematically underestimated wildfire risk in the past (which some sources acknowledge they did, especially regarding climate change effects), investors would either avoid the risk or demand a huge cushion.” However, now with updated models incorporating recent climate trends and fire data, the risk estimates are much more realistic.Advancements in wildfire cat models also means that investors can size positions with greater certainty, while cat bond sponsors can also structure triggers/attachments with more confidence, and pricing can tighten as fewer unknowns remain.“Indeed, the growing acceptance of wildfire cat bonds in 2025 is attributed in large part to enhanced modeling giving investors clarity on the peril,” Acrisure Re added.

Going back to the 2025 LA wildfires, while they were a particularly significant loss event, they also demonstrated how risk-sharing between different constituents in and tiers of the insurance, reinsurance and ILS sector has been adjusted in recent years.“Each major wildfire catastrophe since 2017 has influenced the cat bond sector’s approach to this peril: higher pricing after losses, refined structures (higher attachment points, parametric triggers) after surprises, and increased utilization as necessity grew.The most recent fires in 2025 – though devastating in economic terms – demonstrated that the cat bond mechanisms can withstand even the worst-case wildfire on record with minimal principal impairment to investors,” Acrisure Re noted.

To conclude, Acrisure Re said: “The evolution of California wildfire cat bonds is a case study in how the ILS market adapts to emerging risks.What began as a tentative experiment has, through hard-earned experience and data-driven innovation, grown into a dynamic segment that is helping to stabilize an otherwise fragile insurance market.” “If current trends continue, we can expect wildfire risk to be a fixture in catastrophe bond portfolios, with ongoing refinements in pricing and coverage as the industry learns from each new fire season.In the face of a warming climate and more extreme wildfires, such capital markets solutions will be an indispensable tool for spreading risk and bolstering the resilience of California’s insurers and communities.” ..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis