New Novarica study of 70+ insurers looks at STP rates in underwriting, claims, and payments Boston, MA (Feb.23, 2021) – As insurers work to create fully digital processes, improve core systems capabilities, and make use of third-party data and artificial intelligence modules, straight-through processing is becoming more common.For simpler products and program-business-style targeted offerings, faster turnaround times will become the expectation.

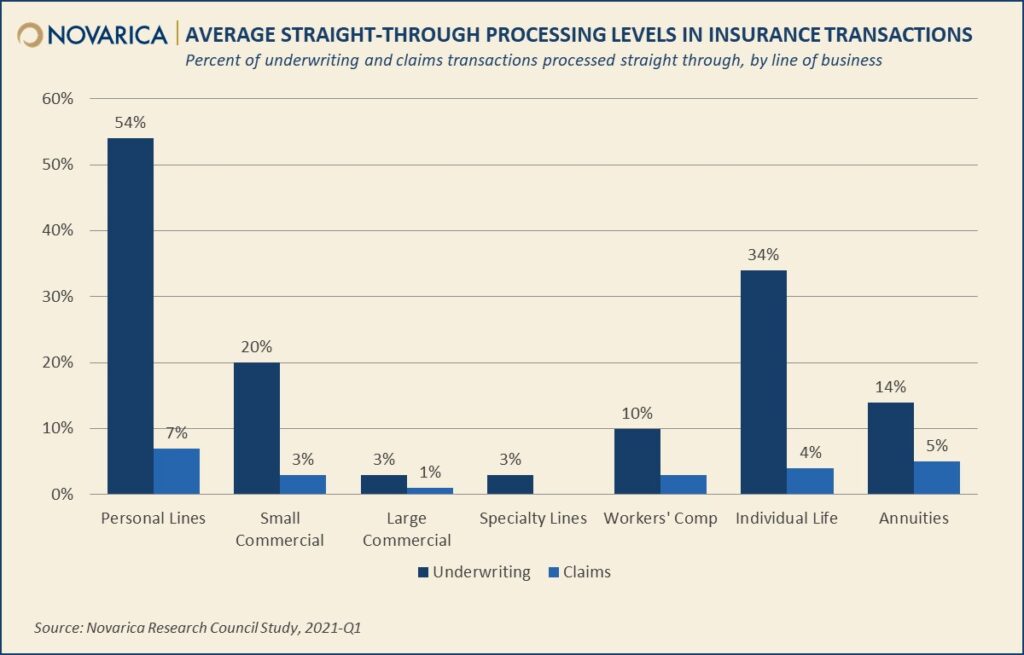

In Straight-Through Processing in Underwriting and Claims, research and advisory firm Novarica analyzes a study of more than 70 insurer CIO members of the Novarica Research Council, representing a cross-section of property/casualty and life/annuity insurers of all sizes, writing most lines of business.“Most insurance will never be 100% straight through, as complex applications and claims will inevitably arise that require human intervention,” said Matthew Josefowicz, President and CEO of Novarica, and lead author of the report.“But letting a computer handle the easy processes means skilled underwriters have more time to focus on complex risks and nurture producer relationships.” Key points and findings: Straight-through processing is strongly associated with lines sold directly. Insurers have achieved the highest levels of automation in personal lines and individual life products.

Few insurers have automated claims processes. For some lines of business, complexity of claims processing has inhibited automation; for others, this is an opportunity for innovation.Digital claims payment automation is highly variable. Digital payments can be customer experience differentiators, but many insurers still rely on paper checks for most transactions.Click here for the table of contents or to access the report.

Report Summary Straight-through processing (STP) is becoming more common in insurance underwriting and payment processes.Particularly in personal lines, individual life, and small commercial—lines which are under cost pressures and are increasingly sold directly—many insurers have enabled some level of STP.Adoption rates in more complex lines and in claims processes remain relatively low.

This report tracks STP in underwriting, claims, and digital payment transactions across seven major insurance business lines.Click here for the table of contents or to access the report.About Novarica Novarica helps more than 100 insurers make better decisions about technology projects and strategy.

Its research covers trends, best practices, and vendors, leveraging relationships with more than 300 insurer CIO members of its Research Council.Its advisory services provide enterprise phone and email consultations on any topic for a fixed annual fee.Consulting services range from assessments and strategic roadmaps to vendor evaluations.

For more information, visit www.novarica.com.Tags: Novarica

Publisher: Insurance Canada