The insurance and reinsurance industry loss from the three major European windstorms that struck close together during the month of February 2022 has been lifted to EUR 3.61 billion by data aggregator PERILS AG.The first estimate from PERILS had placed this market loss estimate at EUR 3.289 billion (approx.US $3.67bn), but now the catastrophe data aggregator has raised it by almost 10%.This is the insurance and reinsurance industry loss estimate for the series of storms named Ylenia, Zeynep and Antonia by the Free University of Berlin, and Dudley, Eunice and Franklin by the UK Met Office.

These European windstorms impacted the United Kingdom and continental Europe between February 16th and 21st.Because of the duration of the series of windstorms, across five days, PERILS estimated them together given the challenges in identifying which storm caused certain property damage.It’s no surprise the second loss estimate is higher than the first, as other sources of loss estimate data had originally pegged them higher than PERILS.

At EUR 3.61 billion, that converted to almost US $4.01 billion at the time of the event.PERILS estimate remains towards the lower-end of expectations, given it had been thought the industry loss from these three storms may rise , while RMS had said Eunice alone could be as high as EUR 3.5 billion and when combined with Dudley losses could reach EUR 4.5 billion, and .However, as we noted at the time of the first estimate, PERILS estimate will always undercount the actual insurance and reinsurance industry impact across the entire region, given the company does not collect loss data in certain countries.

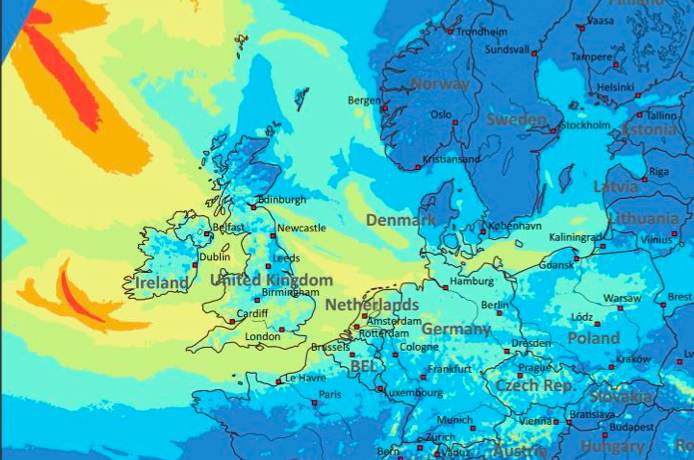

PERILS noted that event definitions for reinsurance purposes in Europe can include meteorological conditions plus loss aggregation periods ranging from 72 hours up to 168 hours.As a result, the company is reporting on these three windstorms as a single event.These extratropical windstorms raced across the Atlantic towards Europe on the back of a strong jet stream that “acted as a conveyor belt for low-pressure systems from the North Atlantic across the British Isles and on into Europe,” PERILS explained.

“This clustering phenomena is not uncommon for European extratropical cyclones but poses a challenge for the insurance sector as it makes it difficult to precisely allocate insurance claims to a specific storm given that the three events occurred within a short space of time and impacted similar areas,” the company also noted...

...

.———————————————————————.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis