The insurance-linked securities (ILS) fund sector has delivered its highest single month of investment returns on record in September 2025 according to the , as strong premium accrual, coupon earnings and a benign loss environment combined to drive exceptional performance.Investors in the insurance-linked securities (ILS) market have now enjoyed positive returns since February, with only January of 2025 dented by the extreme wildfire losses that affected California.Performance has been building steadily with seasonality as well, with four months in succession now above 1% each, but September has seen ILS fund returns accelerate to a new record high for any month in the ILS Advisers Index’s history.With some 89% of ILS managers having reported their full month returns for September 2025, the average for the months stands at 2.07% so far.

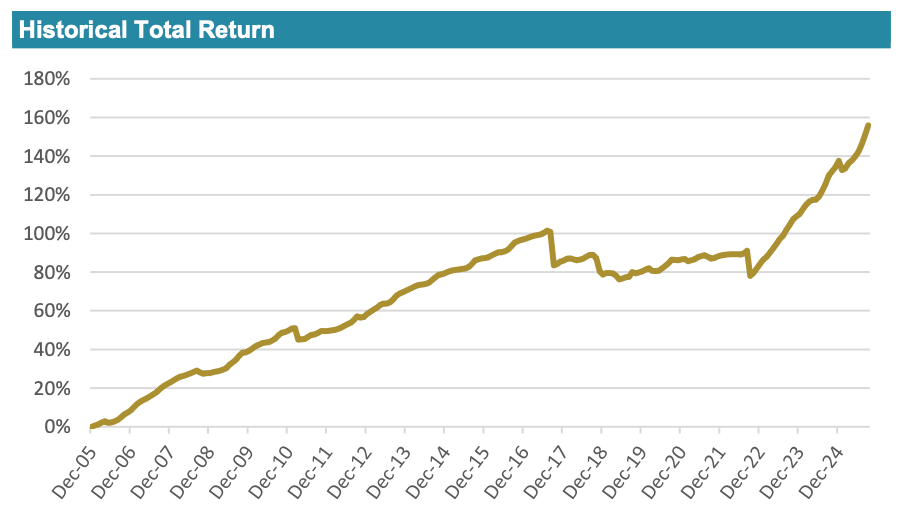

Given it is often the private ILS funds that invest directly into collateralized reinsurance and retrocession opportunities that report latest, there is a chance the figure for the month rises even higher once all performance reports are in.Currently, the average year-to-date return across this Index stands at 7.71% and with October likely to see another stellar performance across the ILS fund’s tracked there is a chance it elevates 2025 to become one of the three to five years ever once the next month’s data is available.Commenting on September’s very strong ILS fund returns, ILS Advisers said, “With no major insured events occurring during the month, ILS funds posted their strongest monthly performance in the nearly 20-year history of the ILS Advisers Fund Index.

“This result surpassed the previous record set in September 2024.” The catastrophe bond market delivered stellar performance for September, with this group averaging a 1.84% return for the month.The ILS funds that also invest in private insurance-linked securities and reinsurance opportunities performed even better, averaging 2.36% as a group.With 32 ILS funds reported so far, all of them were positive for the month.

Across those ILS funds the range of performance was from 1.20% to as high as 4.01% for September 2025, again underscoring not just the return potential of the ILS asset class, but also the diversity in strategies and risk-return levels available to investors.Impressively, for the first nine months of 2025, this year is now tracking at the third-highest return after September of any year in the Index history, only running behind 2024 and 2023.Year to the end of September, pure cat bond funds as a group are still slightly outpacing ILS funds that allocate to private reinsurance opportunities, but only due to the dent January’s wildfires made and we expect the private ILS investment strategies grouping will overtake cat bond funds before the end of this year, perhaps as soon as once October’s results are in.

Finally, it’s worth looking at broader hedge fund industry benchmarks for September to see how ILS funds compared.The compare favourably, given hedge fund benchmarks ranged from 1.3% to around 2.4% for the month, showing ILS funds looking particularly attractive when you consider the diversification they offer to investors.You can track the .

It comprises an equally weighted index of 36 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis