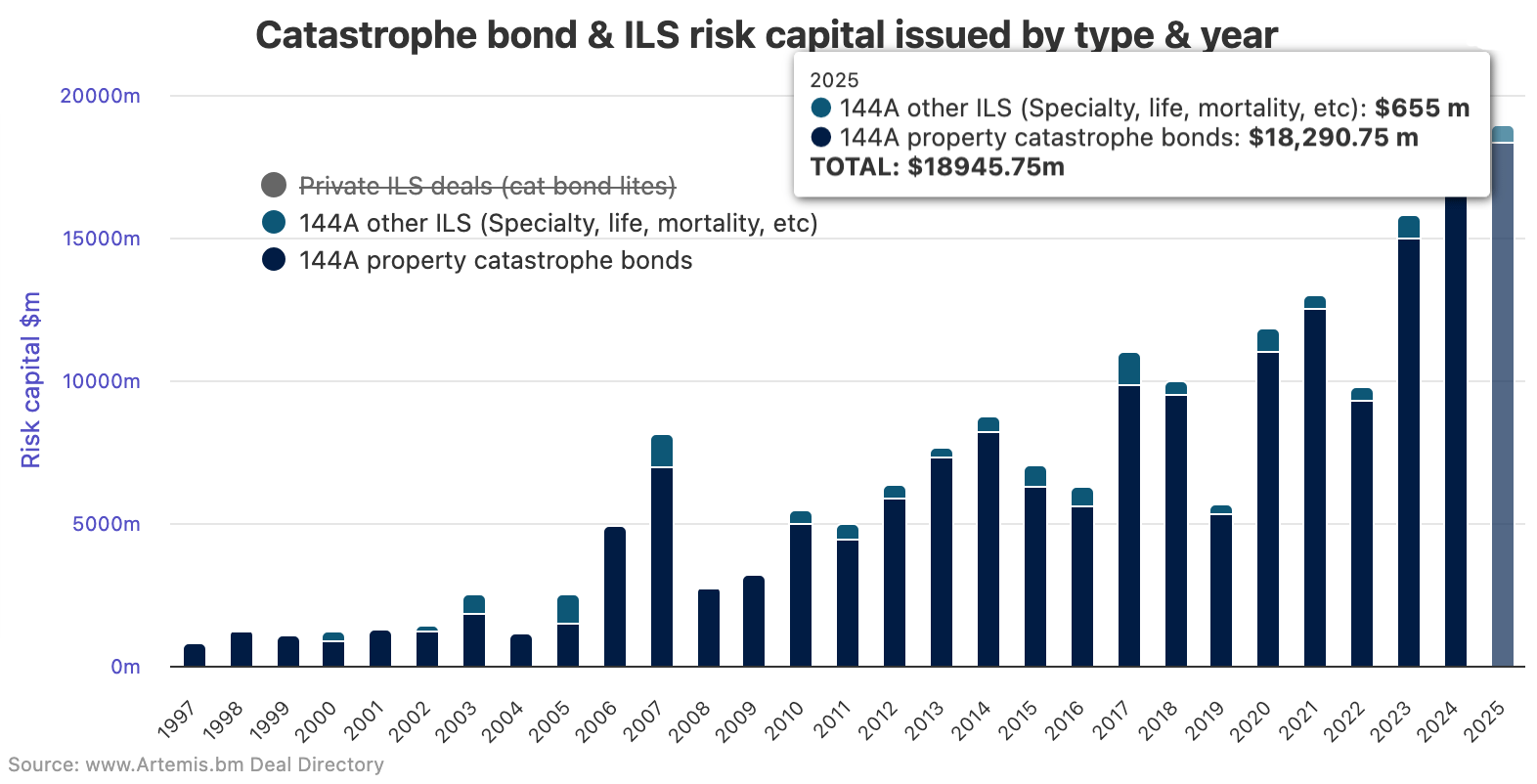

With the pipeline of new 144A catastrophe bonds growing as new deals are launched, the market is now officially on track for the first $20 billion plus calendar year of issuance in 2025.Recall that, calendar year issuance of 144A catastrophe bonds, across property cat and non-cat deals, had already beaten the previous annual record by the end of the first-half of 2025 in reaching over $17.4 billion, .The third-quarter of the year saw some more 144A cat bonds issued, which .

Now, with additional transactions settled in the fourth-quarter so far, the total for 144A cat bond issuance in 2025 has reached almost $18.95 billion at this time.The pipeline continues to build steadily and now stands at $1.36 billion, including all the 144A cat bond transactions that are yet to settle but are actively being marketed at this time.Which takes Artemis’ projection for full-year 2025 144A catastrophe bond issuance to just over $20.3 billion, so the milestone looks set to be beaten within just a matter of weeks.

: In our catastrophe bond issued and outstanding by year chart, you can , all of which are 144A property catastrophe bonds at this time.Settled issuance of 144A catastrophe bonds in 2025 so far consists of $18.29 billion of property cat bonds and a further $655 million covering non-property risks.The pipeline, as we said, currently consists of $1.36 billion of targeted new 144A catastrophe bond issuance, all expected to settle before the end of the year.

That breaks down into $1.16 billion of property cat bonds and a $200 million cyber cat bond issue that .With further deals expected to be launched, some that are also anticipated to be scheduled for settlement in 2025, there is a strong chance annual 144A catastrophe bond issuance for this calendar year rises even higher.In fact, given the pace of activity in the market still, there is now a chance we could even see the 144A property catastrophe bond issuance total exceeding $20 billion on its own.

It’s a meaningful new milestone for the catastrophe bond market, with new and repeat sponsors increasingly looking to the cat bond market for efficient reinsurance and retrocession.At the same time investor appetite remains very strong, which is driving attractive execution for sponsors that venture into the 144A catastrophe bond market..

We track , the most prolific sponsors in the market, most active , which risk modellers feature in cat bonds most frequently, plus much ., or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.All of these are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis