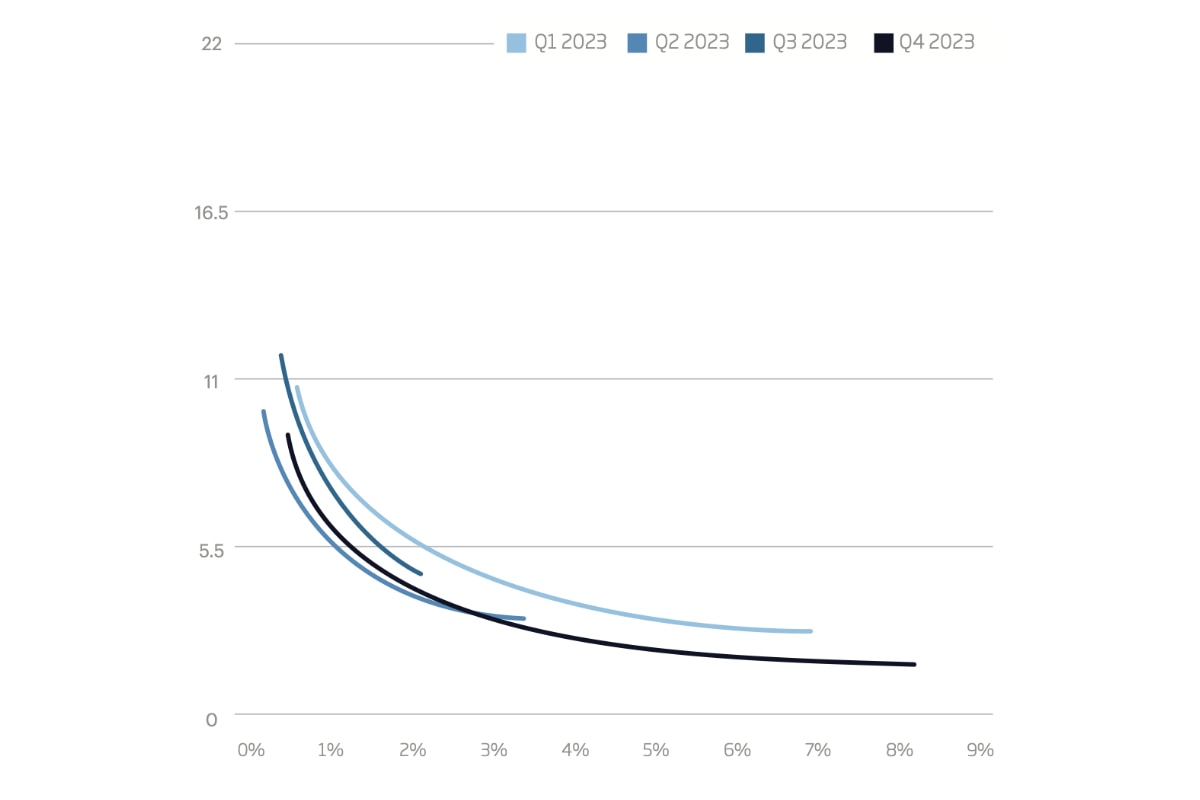

While the pricing of cat bond notes stabilised somewhat in the final quarter of 2023, persistently firm reinsurance and retrocession rates saw investors achieve higher risk-adjusted pricing throughout the year, according to .Excluding a peak in the third quarter, throughout 2023, the average multiple (spread divided by expected loss) of quarterly issuance exhibited a downward trend, suggesting price stabilisation after some significant adjustments early in the year.In Q1 2023, the average multiple was 5.52, but fell to 4.82 in Q2 before peaking at 6.87 in Q3 and falling further to 3.68 in Q4 2023.

Regardless of price stabilisation, the trend of investors demanding higher risk-adjusted returns in a hard market environment was consistent throughout the year.In fact, despite a decline in the average multiple in the final quarter of the year, Artemis’ data shows that for the full year 2023, an average multiple of 4.54 is still the highest in more than 20 years, and the first time it’s been above 4 in any year since 2012.The chart above, taken from the , plots the expected loss and multiple of the tranches of notes issued throughout the year, revealing a clear trend of investors achieving a higher multiple the lower the expected loss.

We will keep you updated on all catastrophe bond and related ILS transaction issuance as 2024 progresses, and we’ll report on the evolving trends in the cat bond, insurance-linked securities (ILS) and collateralised reinsurance market.For full details of fourth-quarter 2023 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year. For copies of all our catastrophe bond market reports, ..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis