Allstate has started the 2025 annual risk period for the aggregate reinsurance provided by some of its catastrophe bonds with a $594 million pre-tax catastrophe loss burden, driven by 11 severe weather events during the month of April.Recall that US primary insurance giant , which ended March 31st 2025.After a particularly costly March that added more than $1 billion to expensive catastrophe losses from the last annual aggregate risk period, including the California wildfires, Allstate said that it “surpassed the retention level of the annual aggregate reinsurance cover for the annual risk period ending March 31, 2025, with expected recoveries of approximately $123 million.” With that risk period having ended on March 31st, the aggregate reinsurance begins accumulating qualifying losses again over the year from April 1st.For the first month of the new risk period, Allstate has reported $594 million of pre-tax catastrophe losses, that translate to $469 million after-tax.

Allstate said that its catastrophe losses for April 2025 came from 11 distinct events, classified as cats for the insurer.The insurer also said that losses largely came from two events, with 60% of the catastrophe impact related to two geographically widespread wind and hail events during April.When we , we highlighted that the attachment for the aggregate catastrophe bond backed reinsurance has now risen in the insurer’s tower.

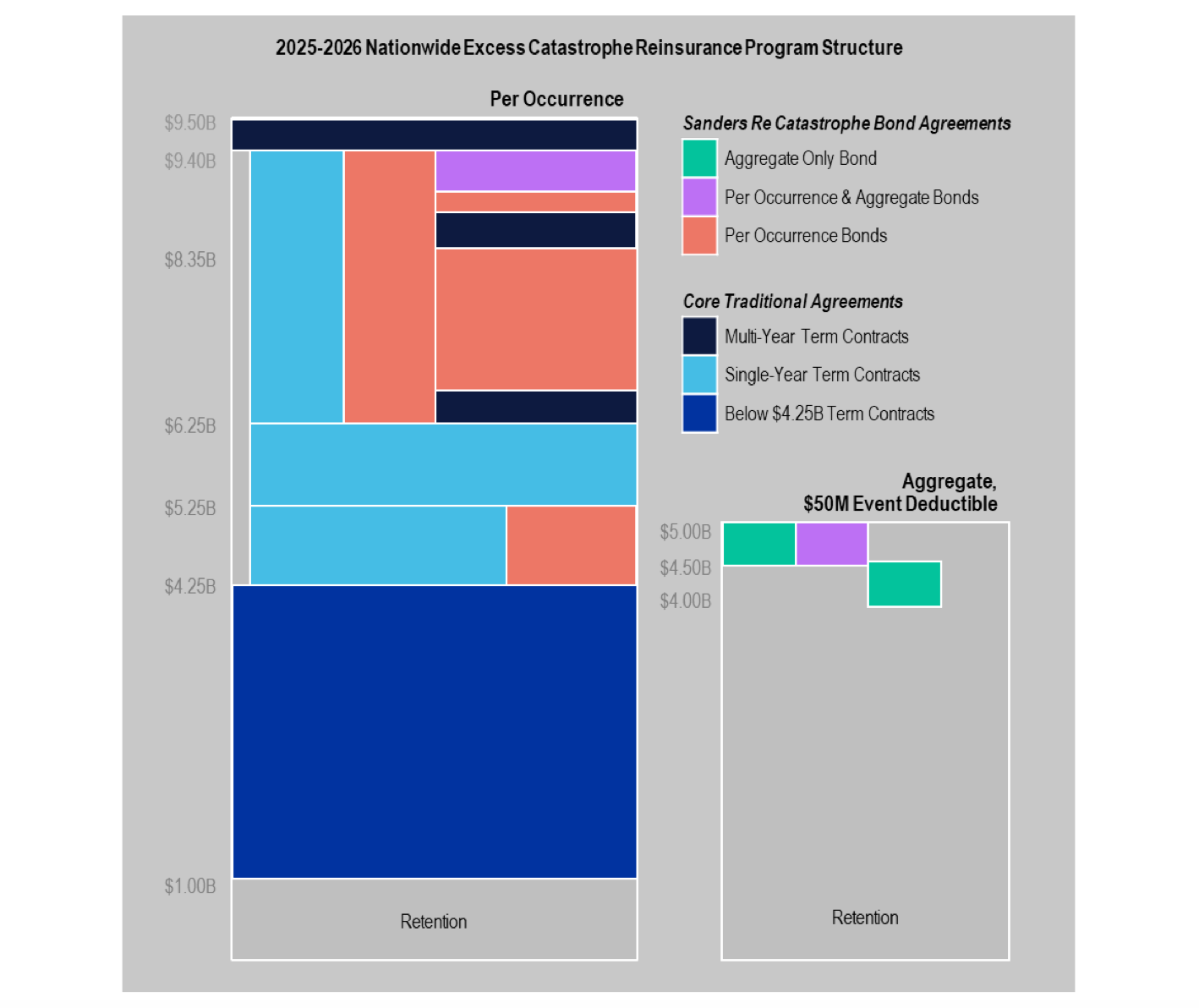

In 2024, the aggregate cat bonds, which are the only aggregate reinsurance Allstate has in place, sat above a $3.6 billion attachment level.But, after the 2025 reinsurance renewal which is completed in time for April 1st for the insurer, the aggregate Sanders Re cat bonds now sit above an attachment level of $4 billion for the new risk period., including the aggregate cat bond coverage.

It’s worth noting that the aggregate cat bond that sits lowest down, at that $4 billion attachment, is already expected to be eroded by a $66 million recovery from the prior risk period, according to Allstate.The April 20225 catastrophe losses of $594 million pre-tax is a higher figure than last year, but lower than April 2023’s $872 million.As ever, it’s important to also note that the aggregate Sanders Re catastrophe bonds all feature a $50 million per-event deductible, meaning only loss events that cost the insurer more than that can qualify.

As a result, it’s unlikely the full $594 million from April 2025 will accumulate under the terms of qualifying aggregating losses for the cat bonds..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis