Have you ever heard of Knights of Columbus Life Insurance? If not, I wouldn’t be surprised… In a world rife with stories of secret societies, the Knights of Columbus fits right in! Well, in actuality they aren’t really a secret, but I would say they most definitely fly under the radar.So, are their products worth your consideration? They sure are – put your feet up and check out this Knights of Columbus Insurance Review, ’cause I have some GREAT insider information for you.Knights of Columbus, the largest Catholic fraternal society in the world, was founded in 1882.

They are a philanthropic organization that provides several services to their community.One of those offerings includes access to a complete portfolio of top-quality insurance products for their members and eligible family.Cool! But as you can see, this is an exclusive offer that you can only access if you’re a member of the KOC.

Additionally, these products are only offered by captive agents, but what’s more interesting is that all agents are members of the Knights of Columbus as well.So, without further ado, let’s review the KOFC insurance coverage offered by the Knights of Columbus Insurance Agents.Fraternal organizations are groups that are formed based on a common bond, as with social or academic interests.

Examples of fraternal organizations include college fraternities which are based on religion, previous members or just common interests.Sometimes these organizations provide great networking opportunities which allow graduates a smoother transition into the workforce.Fraternal Organization, Investopedia Compare Quotes Now! Knights Insurance offers: Life Insurance (Permanent and Term) Long Term Care Insurance Annuities Disability Insurance Which means that they don’t spread themselves too thin.

KOFC Insurance has set a goal to provide comprehensive insurance products with fantastic customer service – something that’s very attainable with such a limited number of offerings.Knight of Columbus insurance is specifically designed to give members the best care possible.Kinda makes you want to join right? Knights of Columbus Whole Life Insurance As the name suggests, these policies cover you for your entire life.

There’s also a cash-value component included in these policies.Their permanent products include: Single Premium Knights of Columbus Whole Life – Secure protection with one single payment.10-Pay Life – Pay premiums in just ten years, and your death benefit is guaranteed for life.

20-Pay Life – Pay premiums in just twenty years, and your death benefit is guaranteed for life.Life Paid-Up at 65 – Pay premiums until 65, so that you don’t have to worry about additional expenses in retirement.Life Paid-Up at 100 – Pay level, guaranteed premiums until your 100th birthday.

Graded Premium Whole Life – Enjoy lower premiums for your first few years to help you get started.Premiums will then gradually increase before leveling off.Discoverer – a unique blend of the best features of both permanent and term insurance.

Graded Death Benefit – a guaranteed issue final expenses product.Survivorship Universal Life – a second-to-die policy for couples, families, or business partners.Knights of Columbus Term Life Insurance Unlike permanent life insurance, KOFC term lasts for a predetermined period of time (such as 10, 15, or 20 years).

These policies have significantly cheaper premiums, but they don’t include the cash-value component.Here are the KOFC term life insurance products offered by the Knights of Columbus: 10 Year Term – 10 years of coverage, with the Accelerator Term Insurance series, which includes a unique opportunity to increase your coverage amount by 25%, to keep up with inflation and salary increases, for an extremely low cost.15 Year Term – 15 years of coverage, with the Accelerator Term Insurance series, which includes a unique opportunity to increase your coverage amount by 25%, to keep up with inflation and salary increases, for an extremely low cost.

20 Year Term – 20 years of coverage, with the Accelerator Term Insurance series, which includes a unique opportunity to increase your coverage amount by 25%, to keep up with inflation and salary increases, for an extremely low cost.Annual Renewable Term – Review and renew coverage annually, with adjusted premiums and a level death benefit.Youth Insurance – Ages 18 – 29 Knights of Columbus Annuities This is a retirement savings product where you make contributions, and, after a specified amount of time, the annuity pays you a regular income.

Knights of Columbus Annuity Products Available: Single Premium Knights of Columbus Annuity – A single, lump-sum payment that accrues interest until you elect to begin withdrawals.Flexible Premium KOFC Annuity – Premium payments can be made on a regular or irregular basis.Single Premium Immediate Annuity – Purchased with a single payment, it begins to pay out immediately.

Plan Types in the United States Non-Qualified Knights of Columbus Annuity Traditional Individual Retirement Annuity Roth Individual Retirement KOFC Annuity Long Term Care Insurance Reviews Provides financial assistance for costs and expenses related to long-term medical conditions.If you have major medical problems that will require long stays in hospitals or rehabilitation centers then this may be something you should consider.Knights of Columbus long term care insurance is very comprehensive and offered at an affordable price.

It is good to compare long term care insurance side by side because so many policies offer different coverages.Disability Insurance Provides financial assistance when a policyholder can no longer work due to injury or illness.In addition to these standard products, Knights of Columbus Disability Insurance offers several extended services to their policyholders.

Family Fraternal Benefits help policyholders with unique needs.Some of these benefits include: Guaranteed life insurance benefits for uninsurable children Death benefits available for stillborn or miscarried children Orphan benefits Member/spouse accidental death benefits Knight of Columbus Insurance agents provide support to members and their families to help them in the aftermath of the loss of a loved one.When you buy a policy from Knights of Columbus you get a Comprehensive, Complimentary Financial Analysis Knights Insurance Agents use “Profiles & Forecaster,” a proven industry analytical tool to identify risks and goals.

KOFC Insurance Agents also offer End-of-Life Planning.Compare Quotes Now! Because Knight of Columbus Insurance Agents belong to the Order, policyholders know they’ll receive great customer service.In fact, the Knights of Columbus website states that their agents are “brother Knights first and foremost”! It’s like being related to your insurance agent! Quick Pros: Excellent life insurance coverage and affordable rates Received A.M.

Best’s highest rating in terms of financial strength (A++) ‘Fraternal benefits’, Survivor Benefits & Personalized Service offered.Excellent Insurance Coverage & Affordable Rates Well, frustratingly, it’s tough to get solid information about how much coverage Knights of Columbus offers.That being said, their website states that their Knights of Columbus term life insurance is designed to provide you with a maximum amount of coverage at affordable and competitive rates.

This leads me to believe that their face values are substantial and rates more than fair.Received AM Best’s Highest Rating A company that’s financially solid, is a company you can trust.…and you’d be hard-pressed to find an insurer that can compete with Knights of Columbus in this category! Financial strength indicates how stable the company is, how successful, and how likely they are to stick around.

Knights of Columbus has an excellent track record: A.M.Best has given KOC their highest rating (A++) for over 40 years straight Standard and Poor’s gives Knights of Columbus an ‘AA+’ rating KOC ranked #900 on the Fortune 1,000 list of U.S.corporations In a nutshell, A.M.

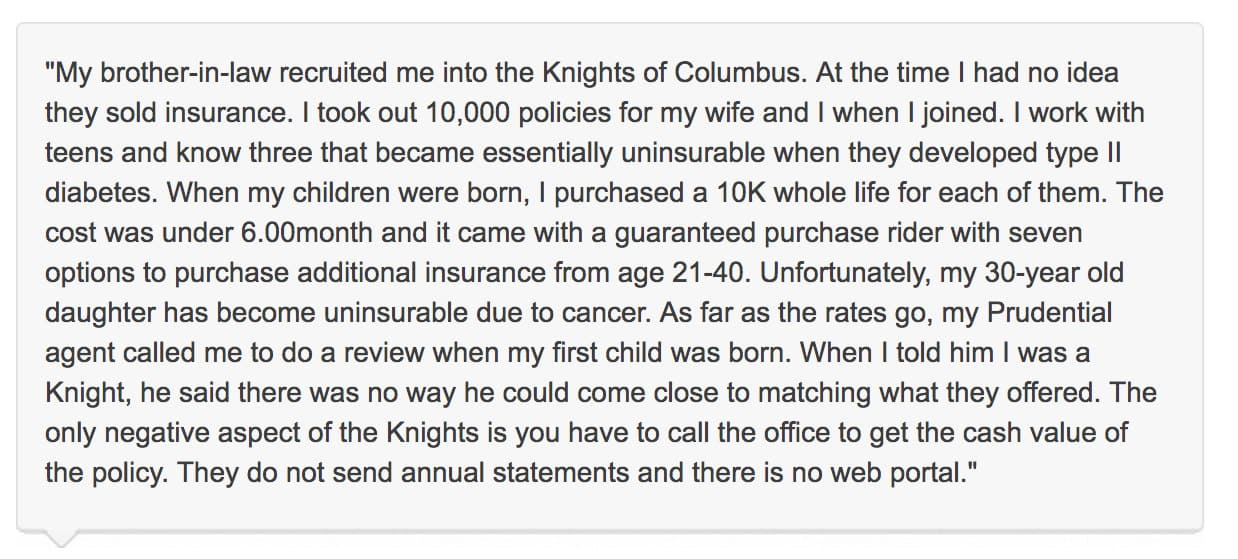

Best is one of the most reliable insurance rating agencies out there.They don’t give A++ ratings lightly, which means that they believe KOC is exceptionally stable and trustworthy.You can read more online reviews like the one below in order to gather more information on what it’s like to be a policyholder: All signs indicate that Knights of Columbus is one of the most financially stable insurance providers out there.

As of 2014, KOC has $21 billion in assets.This society has been around for over 135 years, and they continue to expand.As I mentioned above Knights of Columbus offer Fraternal Benefits, Survivor Benefits and Personalized Financial Services.

Now that’s something, isn’t it? When the chips are down, not only will you receive your standard death benefits, but you’ll have a supportive group of fellow members to lean on.These benefits remind policyholders that their insurance is set up with their best interests in mind.Knights of Columbus Insurance surely takes customer service to the next level! What customers think is true.

Unfortunately, it may not be supported by the facts.Understand that they will hold on to this truth and do not fight to change their mind.Apologize and then try to come up with a satisfactory solution. The 10 Keys of Excellent Customer Service, Forbes There’s no such thing as perfection! Let’s face it, there’s always some downside to the upside – and Knight of Columbus Insurance is no different.

So let’s see what their weaknesses are now! Quick Cons: They offer a relatively limited line of products You have to be a member of the Knights of Columbus to enjoy their insurance products Some families may not receive the same fraternal benefits Compare Quotes Now! If you’re looking for any other type of insurance, you’ll need to look further.That being said since Knight of Columbus Insurance focuses only on a few types of insurance products, they offer some of the best coverage in North America in these categories.KOFC Insurance Isn’t Offered to the General Public Another downside to Knights of Columbus is that their insurance isn’t open to the public.

You must be a member of the Order to qualify for coverage.While members of the Order benefit from the exclusivity of Knights of Columbus insurance, nonmembers are out of luck.Fraternal Benefits May Not Be Distributed Equitably Finally, not everyone enjoys the fruits of a fraternal organization.

In fact, several reviews have complained about the social drama and pressure that they experienced with Knights of Columbus Life insurance.Check out an example of one these reviews below: The question is, do you really want your insurance to be tied up in a social group that you’re a member of? Personally, this is the main drawback that keeps me from shouting “Knights of Columbus Life Insurance” from the rooftops! Since Knight of Columbus insurance isn’t offered to the public, it’s difficult to know how they match up to other insurance companies.No quick quotes are offered which means you’ll need to contact a local Knight of Columbus agent to get a personalized quote.

…even if you’re a member.It really is simple.KOFC Life Insurance is designed to take care of their valued members.

The Knights of Columbus website does offer an insurance calculator that you can use to determine how much life insurance you need to protect your family.Because I’m such an advocate of shopping around before you select an insurance company, this is a bit of an obstacle for me.Check it out.

Cut and dried.Simply go to the Huntley Wealth site and generate a free quote with just a few bits of information.Because we’re independent agents and have access to dozens of the best life insurance companies in the US, we’ll find the least expensive premiums for YOUR personal circumstances in no time at all.

Gotta love transparency! Compare Quotes Now! Yeah, yeah, I know… I can only make an educated guess here.Sorry everyone — it’s difficult to find specific information on how Knights of Columbus insurance rates compare to other companies.***NOTE: A Knights of Columbus membership costs $30 annually.

HOWEVER… I have reason to believe that Knights of Columbus Life Insurance Policies are likely quite affordable! Let me explain.KOFC Life Insurance is specifically designed to take care of their valued members, rather than make money off them.Plus, the agents are members themselves, which means that they are more likely to look after policyholders.

…not to mention the fact that I snooped around a bit online and word on the street is that the other carriers can’t compete.But hey, that’s just hearsay.You never really know until you see the numbers in black and white.

If you happen to be a member or are interested in becoming a member, give them a call.Remember, comparing quotes is the ticket to finding the most affordable policy, and research is the best way to make sure you get a company that works for you.Hey, since you’re reading this review, you’re already halfway there! Compare Quotes Now! I’ve gotta say, it’s a shame that the public can’t benefit from Knights Insurance.

They offer some of the highest-quality life insurance out there and rank high on my list of life insurance providers.To summarize, Knights of Columbus Insurance… They Offer: Life Insurance, Retirement Annuities, Disability Insurance & Long Term Care Insurance Yep! A solid offering of affordable and comprehensive insurance to meet your personal needs.All of that with a smattering of AWESOME customer service to top it off.

I will, however, say, that their products are limited so if you’re looking for a homeowner’s policy or auto insurance, you need to look elsewhere.All Representative are Knights of Columbus Insurance Agents You deal with fellow members of Knights of Columbus, rather than an agent you may never see again.There is something to be said for those personal connections.

Fraternal Benefits Are Provided The Knights of Columbus don’t just sell a policy and forget about you.There are Fraternal Perks, Survivor Benefits, and Personal Financial Advice.BUT – this can also be a drawback.

Not everyone enjoys belonging to a fraternal organization.In fact, several reviews have complained about the social drama and pressure that they experienced with Knights Insurance.It depends on what you are looking for.

Obtaining Quotes Is Tough! THIS is frustrating.I like to know what I’m dealing with and KOC doesn’t give you any indication of how much your premiums may be.I did do my homework though, which brings me to affordability… KOC Insurance Offers Affordable Products Yep! All indications are – the Knights of Columbus sell insurance as a service to their community members, not necessarily as a way to make a lot of money.

…and from what I read their prices are tough to beat.Extraordinarily Financially Stable Last but NOT least – if you’re looking for a safe company to buy insurance from – there is nothing better in the market.The Knights of Columbus is a VERY solid company.

You can sleep well knowing that your family won’t have a hard time getting them to pay their claims.Sure, Knights of Columbus is a great life insurance provider.But, let’s be honest here.

Most of you aren’t going to become a member just to have access to their life insurance — nor should you.Give us a call! You won’t be pressured into buying a policy, but we can help you weigh your options.The most important thing to know when you are shopping for life insurance is that NOT all companies are created equal.

Knowing the ins and outs of the underwriting process is key to finding the cheapest rates and our agents are ROCK stars.*While we make every effort to keep our site updated, please be aware that "timely" information on this page, such as quote estimates, or pertinent details about companies, may only be accurate as of its last edit day.Huntley Wealth & Insurance Services and its representatives do not give legal or tax advice.

Please consult your own legal or tax adviser.

Publisher: Insurance Blog by Chris