Global reinsurance market participants are anticipating broad firming at the upcoming January 2022 renewal season, with retrocession and property catastrophe risks seen as areas in need of price improvements.This is according to our latest , undertaken alongside sister publication , which analysed market opinion at a key time of year.We reached out to our combined readership of more than 200,000 per month through September and into October, to get a sense for how the sector is feeling ahead of the upcoming reinsurance renewals.

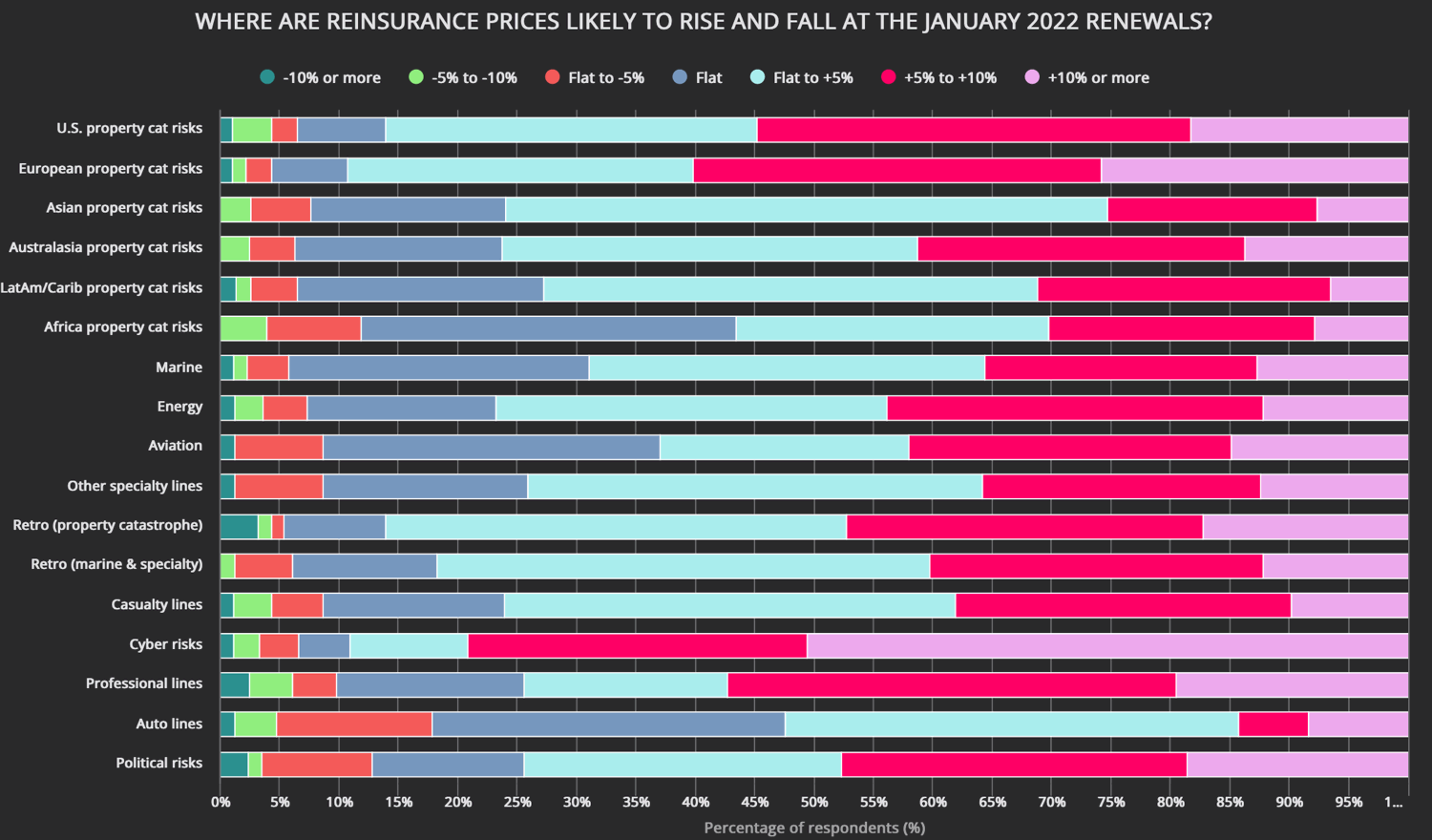

is based on responses from hundreds of identifiable market participants, many in the C-Suite and more than 70% of whom make or provide input into reinsurance buying decisions.We asked our readers for their views on pricing for many of the major reinsurance lines of business and it’s clear the market is anticipating rate increases across retrocession and property catastrophe risks.As you can see in the image above (click the image to ),an astonishing 89% of respondents believe European property catastrophe reinsurance risks will experience rate increases at the January 2022 renewals.

In fact, almost 26% of respondents hope to see 10% or greater rate increases for catastrophe reinsurance renewals in Europe, with another 34% hoping for rate rises of 5% to 10%.US property catastrophe risks are also expected to see increases, with 55% of respondents saying they expect at least 5% rate increases there., with another almost 39% saying retro renewals should see rate increases of up to 5%.

Even in catastrophe regions that have not seen such significant loss activity through 2021, such as Asia, Latin America and Australasia, the majority of our survey respondents feel additional firming is required.Cyber reinsurance is seen as the single line of business in need of the strongest price increases, with more than 50% of survey respondents calling for 10% or higher rate improvements at the January 2022 reinsurance renewals.With the reinsurance renewal process running particularly late, it remains to be seen who holds the power this year.

Larger, global reinsurers will likely moderate pricing somewhat and take advantage of better pricing to continue their expansion, while insurance-linked securities (ILS) capital is expected to be slightly dented at 1/1 after recent loss activity.There seems some confidence that rate gains will be broadly achieved though, as evidenced in our survey results.But whether they are as significant as many are hoping for, remains to be seen.

provide a useful test of the temperature of the industry, offering insight on market sentiment and expectations as we move towards the January 2022 reinsurance renewal season.We hope our readers and other interested parties find the results enlightening and useful in making their strategic decisions for the renewal season ahead.The full results of our latest survey are freely available from today and we’re happy to discuss them with any industry participants.

We’re interested to hear your thoughts.We’ll also be analysing the full reinsurance market survey results over the coming weeks on both Reinsurance News and Artemis.———————————————————————.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis