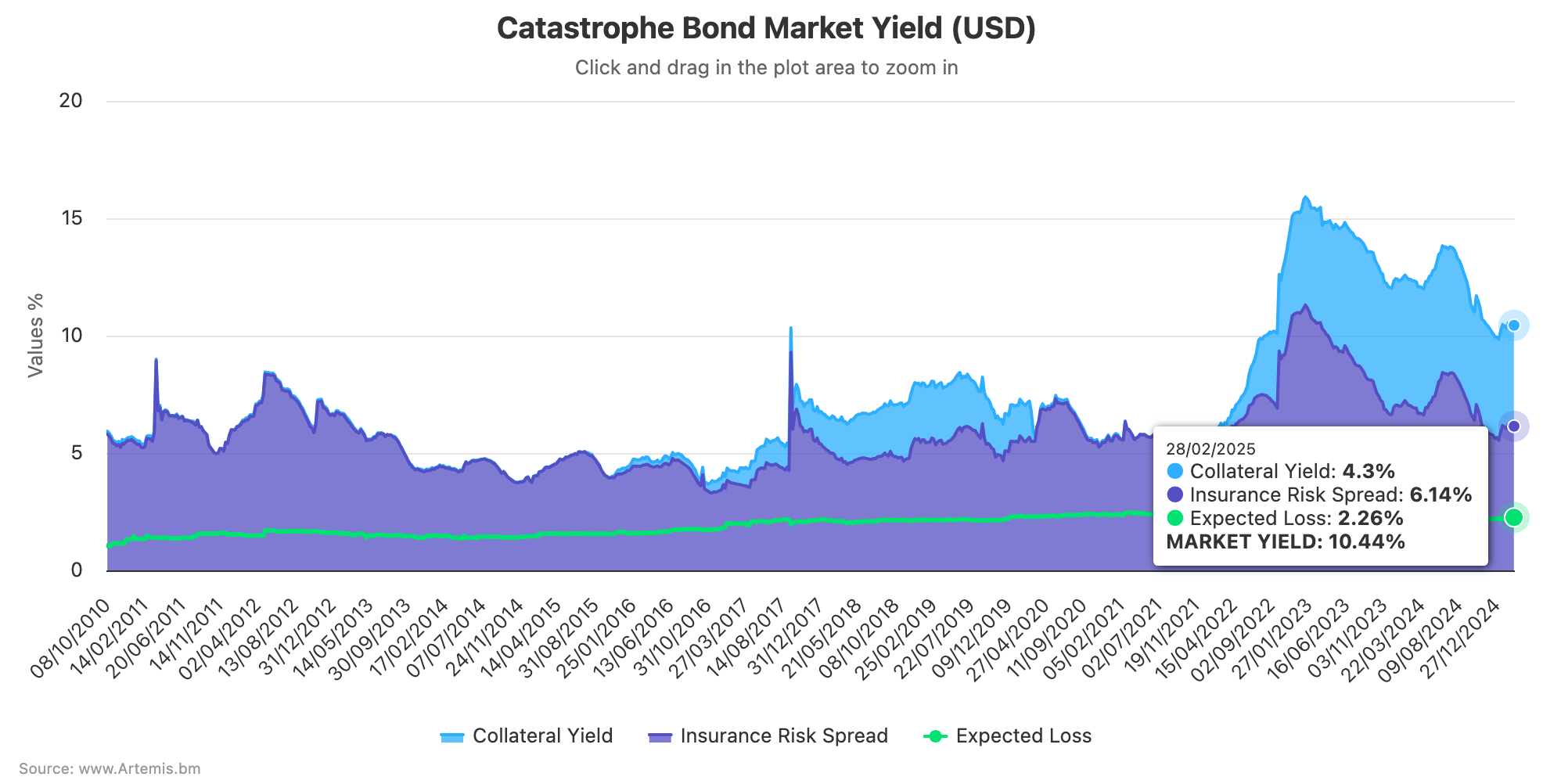

The stood at 10.44% at the end of February 2025 according to data from specialist manager Plenum Investments, with the company explaining that opposing forces are driving the cat bond market yield sideways at this time.In late 2024, high-demand for catastrophe bond investments had compressed risk spreads resulting in the overall yield of the catastrophe bond market falling back into single digits at 9.94% by the end of December 2024.Then, after the impactful California wildfires in January caused price adjustments in the catastrophe bond market, .

Through February, opposing forces were in-play, resulting in the catastrophe bond market yield being relatively flat and ending the month at 10.44% in USD.There were, of course, additional price pressures for some wildfire exposed catastrophe bonds in February, especially aggregate notes, but there were also some price recoveries too, .Which meant the wildfire effect was more muted, as opposing forces drove the yield trajectory for the cat bond market last month.

What were these opposing forces that have been the driver of cat bond market yields in recent weeks and which are set to continue this trend over the coming weeks? Plenum Investments explained that, “Two opposing forces are currently shaping this month’s market yield.On the one hand, the prices of US hurricane bonds fall seasonally.On the other hand, the strong demand for CAT bonds is leading to rising prices.

“For this reason, the market return currently does not show a clear upward direction, as is usually the case in winter.We continue to expect sideways movement.” A 10.44% catastrophe bond market yield, driven by its components of a 6.14% insurance risk spread and 4.3% collateral yield remains very attractive for investors at this time.Compared to almost all other fixed income alternatives, the catastrophe bond market continues to deliver on higher spreads, with the added benefit of the risk-free return on collateral as well.

This should continue to drive investor awareness, interest and demand, which of course could further compress cat bond spreads somewhat over time..All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.

Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis