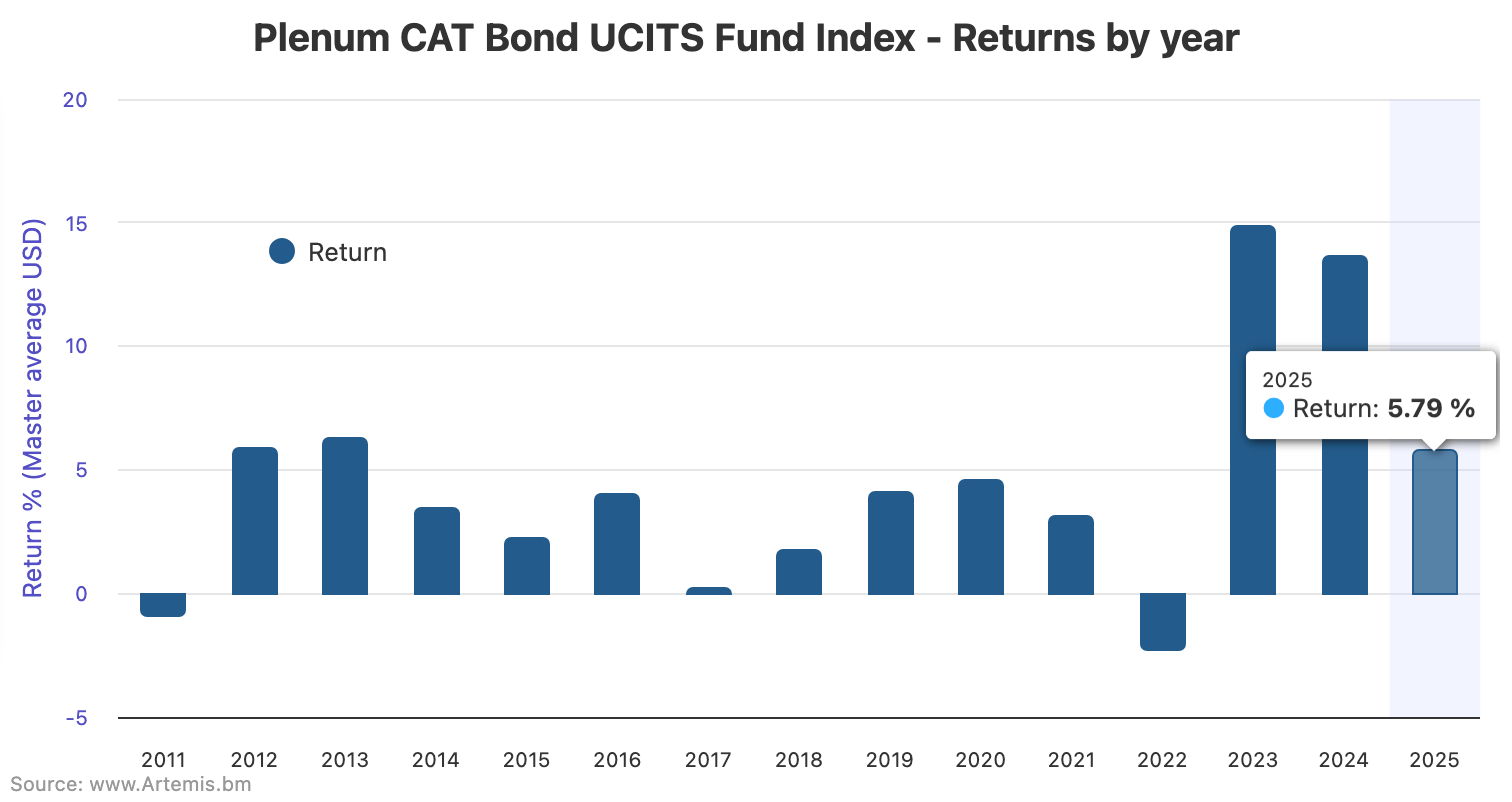

Seasonality related to the Atlantic hurricane season, alongside still strong baseline risk spreads and collateral return all helped to boost the average performance for the to a 5.79% return year-to-date, as of August 29th 2025.The latest data for the shows that August 2025 saw the average return across the cohort of UCITS catastrophe bond funds rising to 1.34% for the month, setting another monthly high performance for the year so far.Looking back at the rest of 2025 to-date, the Plenum CAT Bond UCITS Fund Indices had delivered a 0.40% return for January, 0.32% for February, 0.56% for March, 0.28% for April, 0.52% for May, 0.58% for June and 1.09% for July as seasonality effects began.

Now August has seen cat bond fund returns lifted higher still and accelerating helped by the effects on the discount margin from the US wind perils seasonality.At 5.79%, on average after the majority of August, the performance of the UCITS catastrophe bond fund segment remains very attractive, even accounting for some losses to bonds driven by California wildfires and aggregated events that affected certain positions.2025 is now well on-track to become the third best performance for the Index on record and depending on whether any catastrophe events occur over the rest of September, the Index return may enter this territory by the end of the month.

The higher-risk group of UCITS cat bond funds outperformed in August, with a 1.44% average return that helped raise the year-to-date performance for these cat bond funds to 5.73% The lower-risk cohort of UCITS cat bond funds averaged a 1.30% return for August 2025, taking their YTD return to 5.90% as of August 29th.As a result, the lower-risk cohort continue to lead in 2025 so far, having avoided more of the losses seen this year largely due to being underweight aggregate and wildfire deals, but the gap to the higher-risk cohort of cat bond funds is closing now.On a capital-weighted basis, the Plenum CAT Bond Fund Indices delivered a .143% return for the last month and now stands at 5.53% year-to-date.

On a trailing twelve-month basis, the average return for the entire Index of UCITS catastrophe bond funds stood at 11.16% as of August 29th 2025, with 11.05% for the lower-risk cohort, 11.29% for the higher-risk cat bond funds and capital-weighted at 11.18%.That trailing twelve-month return has declined slightly from the prior month, but September may see that recover somewhat and it may remain in the 11%+ range depending on any loss activity occurring.Through the peak of the US hurricane season the performance of these catastrophe bond funds will see seasonality continuing to be the main driver alongside still attractive risk spreads and risk-free collateral returns of more than 4%, while any storm activity of note would be the main detractor from potential continued higher performance.

.All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis