Here are the ten most popular news articles, week ending January 12th 2025, covering catastrophe bonds, ILS, reinsurance capital and related risk transfer topics.To ensure you never miss a thing or get our email alerts for every article we publish.LA wildfires: Over 10k structures destroyed.

Insured losses up to ~$20bn, economic $150bn Details on the scale of the devastation caused by the wildfires burning in the Los Angeles region of California began to emerge, with officials saying 10,000 structures had been destroyed across the two main fires, while estimates of losses continued to rise.Guy Carpenter property catastrophe reinsurance indices all decline at 1/1 2025 renewal Property catastrophe reinsurance rates declined across the globe at the January 1st 2025 reinsurance renewals, with broker Guy Carpenter’s rate-on-line indices for the world, US, Europe and Asia Pacific all falling to start the new year.Mercury says LA wildfire losses to exceed reinsurance retention Insurer Mercury General Corporation has said that it expects the ongoing wildfires in Los Angeles, California will result in losses for the company that will exceed its reinsurance retention of $150 million.

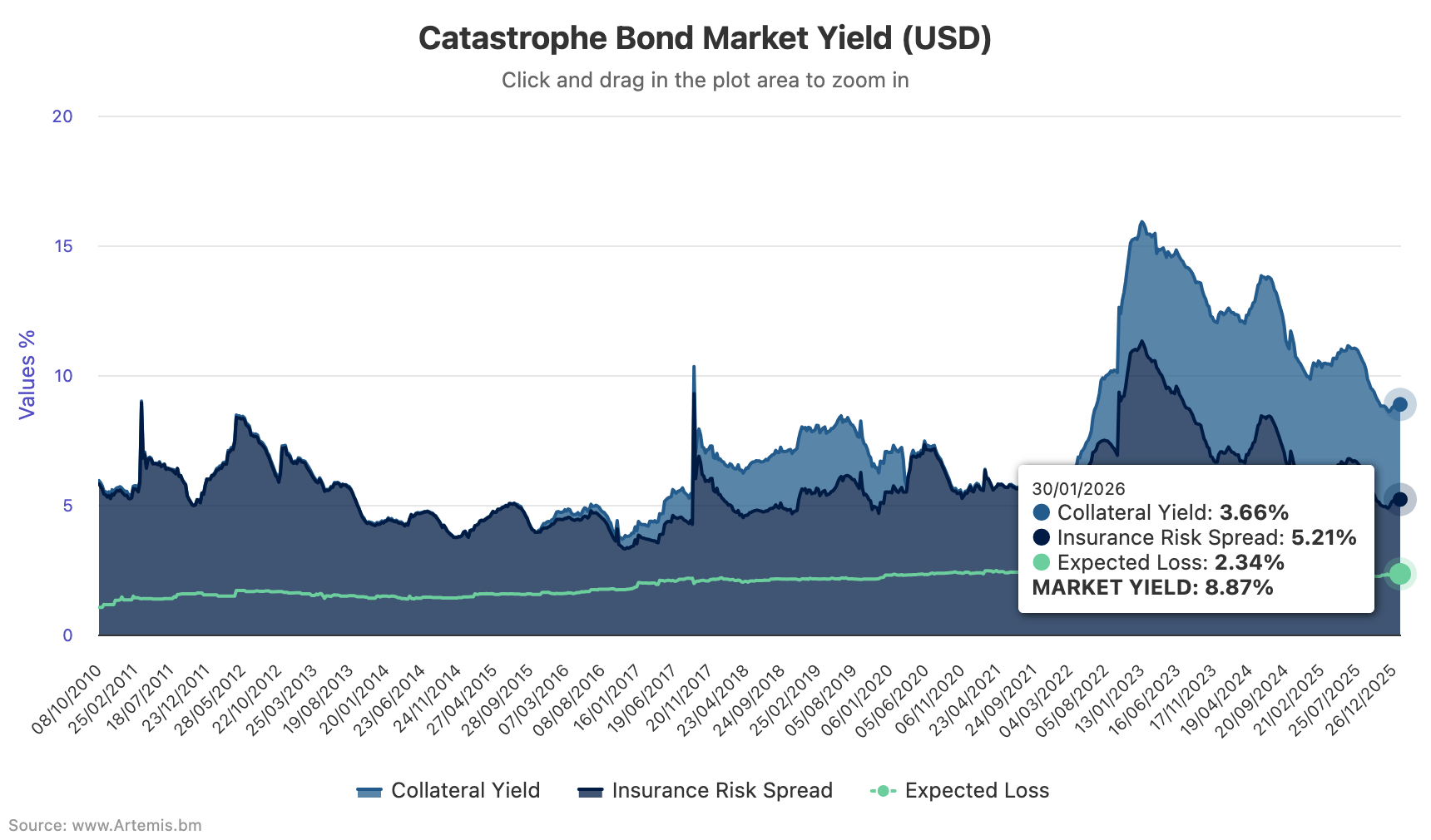

LA wildfires unlikely to cause meaningful catastrophe bond impact: Plenum Investments Specialist manager of catastrophe bond and insurance-linked securities (ILS) funds Plenum Investments has said that it does not believe that the ongoing wildfire situation in Los Angeles will have a meaningful impact on the catastrophe bond market.ILS sector poised to attract substantial capital inflows in 2025: Agecroft Partners Among the hedge fund investment sectors set to benefit from rising institutional investor interest in 2025, Agecroft Partners believes that reinsurance focused insurance-linked securities (ILS) strategies are “poised to attract substantial capital inflows in 2025.” LA fires: “Considerable attachment erosion” likely for some aggregate cat bonds – Steiger, Icosa With loss estimates for the Los Angeles, California wildfires having risen, there is now likely to be “considerable attachment erosion” for some aggregate catastrophe bonds that hold exposure to the wildfire peril, Florian Steiger, CEO of Icosa Investments AG has said.Aetna targets its largest Vitality Re health ILS, $250m Vitality Re XVI 2025 issuance Aetna, the health, medical and benefits insurance unit of CVS Health, is back in the insurance-linked securities (ILS) market and seeking what could become its largest issuance in the long-standing Vitality Re series.

Ryan Specialty to acquire Velocity Risk for $525m.FM to acquire Velocity E&S carrier Ryan Specialty has agreed to acquire managing general underwriter (MGU) Velocity Risk Underwriters, LLC from its current owner, funds managed by Oaktree Capital Management, L.P.for $525 million, while insurer FM is set to acquire the MGU’s excess and surplus (E&S) lines carrier.

Hard market structural changes likely to endure in reinsurance: Howden Even while pricing across the reinsurance market has begun to decline from its historically high levels, broking group Howden believes that the structural changes enacted during the recent hard market are likely to endure.Swiss Re seeks $150m wind / quake retrocession from Matterhorn Re 2025-1 cat bond Swiss Re is back in the catastrophe bond market seeking $150 million or more in North American earthquake and named storm retrocessional protection from capital market investors, through a Matterhorn Re Ltd.(Series 2025-1) transaction.

This is not every article published on Artemis during the last week, just the most popular among our readers over the last seven days..To ensure you always stay up to date with Artemis and never miss a story .

..Get listed in our ..

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance can be accessed online.Our can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Publisher: Artemis